FAQ

Status

Q If my status is changed, does my current cash card/GLOBAL PASS become invalid? ID 001

A No. You can still use your cash card / GLOBAL PASS after the status change.

The benefits and privileges will be offered according to your new status, regardless of the type of card you have.

- *Please note that the privileges of GLOBAL PASS will be changed without notice if the status is terminated or changed. If you have a cash card other than GLOBAL PASS, you can switch to GLOBAL PASS via online banking. See here for details

Q Where can I check my status? ID 002

A You can check your status via online banking.

- *A status is shown only for PRESTIA DIGITAL GOLD/PRESTIA GOLD/PRESTIA GOLD PREMIUM customers.

See here for how to check your status

See here for when new status applies

Q Do I get notified when I got automatically upgraded to PRESTIA DIGITAL GOLD? ID 003

A No. Basically you do not get notified but some of you may be notified individually.

Q How much more do I need to deposit/invest to be upgraded? ID 004

A For how much more you need to deposit/invest to be upgraded, please contact the phone number below.

0120-110-330 Within Japan (toll-free)

81-46-401-2100 From Overseas (charges apply)

Q When does PRESTIA DIGITAL GOLD status initially be applied? ID 005

A The initial status change to PRESTIA DIGITAL GOLD status is scheduled to be 8:00 am (JST) on April 14, 2023.

Q When does the termination or change of a status take place? Do I get notified? ID 006

A If you fail to meet eligibility conditions for each status for a certain period of time, we may terminate or change your status. In such a case, we will notify you separately in writing.

Please note that the status termination/change of 2023 is scheduled to take place in October 2023. For customers who may be subject to status termination/change, we will send a letter individually from mid-April to the end of May 2023.

Q If I cannot maintain my status, will a monthly account maintenance fee be withdrawn? ID 007

A Despite the status change, the monthly account maintenance fee will be waived if you meet of any of the following conditions.

| Transactions eligible for a fee waiver | Conditions | |

|---|---|---|

| 1 | Total Average Monthly Relationship Balance | The balance for the previous month is equivalent to 500,000 yen or more. |

| 2 | Total Average Monthly Relationship Balance (foreign currency portion) | The balance in foreign currency for the previous month is equivalent to 200,000 yen or more. |

| 3 | Loans | Having a loan balance as of the end of the previous month (excluding PRESTIA MultiMoney Credit). |

| 4 | PRESTIA MultiMoney Credit | Having a PRESTIA MultiMoney Credit loan balance as of the specific time on the final business day of the previous month designated by SMBC Trust Bank. |

| 5 | Affiliated credit card of SMBC Trust Bank | Being the credit card holder as of the 25th of the previous month (or if the 25th falls on Sat/Sun/national holiday, as of the previous business day). |

| 6 | Foreign Currency Deposit Service | Having applied for Foreign Currency Deposit Service and deposited certain times after the initial withdrawal. |

- *If the previous month is the month you opened your account, or the month after you opened your account, there is no fee, regardless of the above conditions.

Q Where can I check my Total Average Monthly Relationship Balance and Total Average Monthly Wealth Management Balance? ID 008

A You can check your Total Average Monthly Relationship Balance via online banking. See here for details.

- *The balance is calculated based on the information as of the previous business day, and is for reference only.

Please contact the bank to check your Total Average Monthly Wealth Management Balance.

0120-110-330 Within Japan (toll-free)

81-46-401-2100 From Overseas (charges apply)

Q If I make a deposit, will it be immediately included in my Total Average Monthly Relationship Balance? ID 009

A If you make a deposit in the middle of a month, the deposited amount will be included in the calculation for your Total Average Monthly Relationship Balance. The Total Average Monthly Relationship Balance is not the same as the balance as of the end of the month.

e.g.) During the month (transaction on the 21st) you deposit 5 million yen in addition to existing 5 million yen balance.

Sum of daily balance: (5 million yen × 20 days) + ( 10 million yen × 11 days) = 210 million yen

Number of days in the month = 31 days

Average Monthly Balance: 210 million yen ÷ 31 days

= approx. 6.77 million yen

See here for details.

Q Tried to make a foreign currency transaction via online banking, but did not see the discounted foreign exchange commission. ID 010

A On "Input Transaction Details" page, you see foreign exchange rates before the discount. Proceed to "Review Transaction Details" page then a message "Discount for foreign exchange commission will be applied to this transaction" and the discounted exchange rate will be displayed.

Q Can I have the foreign exchange commission discount and add-on interest, such as ENJOY PLUS, applied in one transaction? ID 011

A Yes.

Note that PRESTIAL DIGITAL GOLD customers receive a discount on foreign exchange commissions only when making a transaction via online banking.

Q Who can apply for the Family Premium Service? ID 012

A One family member within the second degree of kinship can use the service. Contact us for details.

See here for contact information.

Q I want to know the preferential interest rates for each status for loan products. ID 013

A For loan products, please see below.

Q Does my bank representative remain the same? ID 014

A Please kindly contact your PRESTIA GOLD Executive or Relationship Manager for details.

Statement

Q How can I check e-statements? ID 015

A To check e-statements, see here for instructions.

Q I want to know if I currently receive Statement/Torihikizandaka-hokokusho by post. ID 016

A You can check via online banking. When you are receiving statements by post, you see "Unsubscribe via Post".

-

Online banking

Menu > Services -

SMBC Trust Bank App

Menu > User Information

See here for details.

Q I want to stop the statements to be issued. ID 017

A We do not stop issuing statements. You can stop receiving statements by post and view e-statements via online banking. For details, please check here.

Q Do I need to pay a fee for paper statements even if I have an affiliated credit card? ID 018

A Yes. You need to pay a fee for paper statements even if you have an affiliated credit card.

If you fall under any of the followings, the fee will be waived.

- PRESTIA GOLD/PRESTIA GOLD PREMIUM customers

- Customers with a mutual fund account

- Customers who are 75 years old or older (Fee waiver will begin starting with the statement for April of the fiscal year when the customer turns 75 years old.)

- Corporate account holders

Q How can I check if I have any mutual fund account? ID 019

A You can check via online banking.

- PRESTIA Online

Accounts > Balance Summary - App

Menu > Balance Summary

If you see the amount in "Current Value of Mutual Funds" under "Mutual Funds" towards the bottom of Balance Summary, you have mutual fund account(s).

If you see "-" in "Current Value of Mutual Funds", you do not have any mutual fund account.

Online banking

Q What is User ID? ID 020

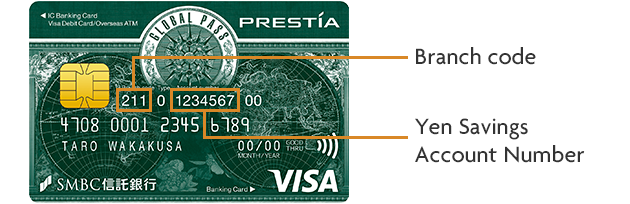

A User ID is an ID necessary to Sign On to online banking. To create your User ID, branch code (or branch name), Yen Savings Account Number, T-PIN, and Date of Birth are required. For details, refer to User Registration

If you have forgotten your User ID, press here.

Q How do I start using online banking? ID 021

A Press here to create your User ID.

A Press here to create your User ID.

- *To use our App, download the App from here after you complete First Time User Registration.

Q What kind of services are available on online banking? (PRESTIA Online/PRESTIA Mobile/SMBC Trust Bank App) ID 022

A You can view your account balance and transaction history, make domestic transfer and overseas remittance, and make other transactions.

For details, see here.

Q When using online banking, I see an error message. ID 023

A See here for common error codes, their cause, and how to solve them.

Q I forgot my User ID/Password. ID 024

A From online banking Sign On screen, you can retrieve User ID by pressing "Forgot User ID" and reset password from "Forgot Password".

Q Does SMBC Trust Bank have an App? ID 025

A Yes. For details on SMBC Trust Bank App, press here.

Other

Q Is there any change to the overseas ATM usage fees? ID 026

A No. GLOBAL PASS transaction fee is still free when withdrawing from overseas ATMs.

- *Local ATM owners may separately charge ATM usage fees.

See Service Charges for details.

Q How can I check my branch code and Yen Savings Account Number to use online banking? ID 027

A To use online banking for the first time or forgot User ID and/or Password, you can check your branch code and Yen Savings Account number on your GLOBAL PASS / Banking Card.

- GLOBAL PASS

- Banking Card

- *Depending on when you opened the account with us, the branch code may not be embossed on the card. If so, see top right on the first page of statement.

To check branch code from branch name, see here.

Q I forgot my T-PIN. ID 028

A Please download the T-PIN Application from here, fill it out, and mail it to us using Address Label. We will set a randomly generated T-PIN and have it sent to your registered address.

Q How do I close my account? ID 029

A To close your account, see here for details.

Related Information

Inquiry about service renewal

We are experiencing high call volumes, and it may take a while to reach an operator.

Please check FAQ focused on Service Renewal in advance.

In Japan

0120-104-189 (9:00 - 17:00, weekdays / toll-free)

From overseas

81-46-401-2122 (9:00 - 17:00 (Japan time) , weekdays / charges apply)

- *This number is for inquiries only. We do not accept transactions or other requests.

Other Inquiries / Transactions and Procedures

Please check here for details.

The information about Family Premium Service and PRESTIA GOLD PREMIUM privileges for "Transfer funds from overseas" program, please see the link below. If you have further questions, contact us.

Japanese

Japanese English

English