Asset Management

Discretionary/Non-Discretionary Trusts

We offer comprehensive asset management solutions to meet customers' investment needs. Asset management utilizing trust functions is an optimal way of asset management for those who have a broad range of assets but little time to care for them.

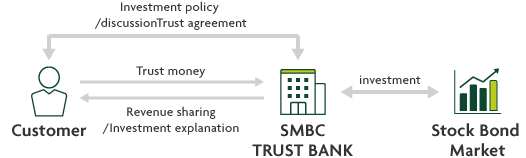

Structure of Discretionary Trusts

Asset Succession, Business Succession

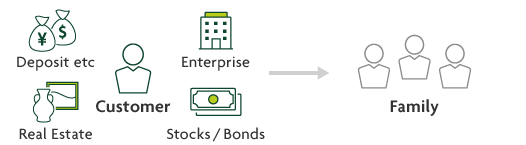

Living trusts / Successive beneficiary trusts

We will support smooth succession of assets or businesses by offering solutions that best suit customers'needs that a will cannot meet.

Asset Administration & Protection

Securities Administration Trusts

We are committed to the secure administration and long-term protection of customers’ valuable assets in accordance with their goals and requirements. The use of trusts for these purposes could be the optimal option for those who have a broad range of assets but little time to care for them. Assets in our trust are administered in our name and, thus, their privacy is protected. In addition, trust assets are kept separate from the corporate assets of SMBC Trust Bank, and a statement describing the state of their assets and account activities is sent to them regularly.

Asset Purchases

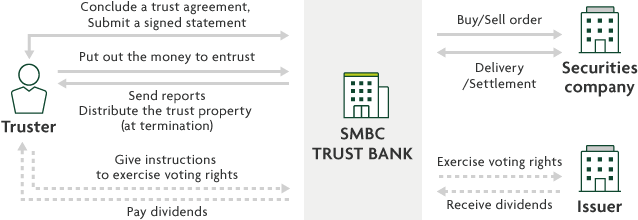

Securities Administration Trust

We have a wide range of asset purchase solutions that can assist our customers with asset administration and succession planning at various stages of their lifecycle. For example, if you or a member of your family owns a publicly-traded company, the shares of the company are an important component of your assets. When purchasing such shares, however, you should be aware that your transaction may be scrutinized for or arouse suspicion about a possible violation of insider trading or market manipulation regulations. To mitigate these risks, we would advise you to use a securities purchase trust and let us buy such shares at our own discretion for you.

Asset Sales

Securities Disposal Trusts

We have a wide range of asset disposal solutions that can assist our customers with asset administration or succession planning at various stages of their lifecycle. For example, if you or a member of your family owns a publicly-traded company, the shares of the company are an important component of your assets. When selling such shares, however, you should be aware that your transaction may be scrutinized for or arouse suspicion about a possible violation of insider trading or market manipulation regulations. To reduce these risks, we would advise you to use a securities disposal trust and let us sell such shares at our own discretion for you.

Asset Administration and Protection

Securities Administration Trusts

We administer in our name securities such as stocks and bonds that corporate customers own. We receive dividends and principals/interests on their behalf and distribute them to the corresponding customers. We also exercise their voting rights in accordance with their instructions.

Securities Investment Trusts

A securities investment trust is a financial product where investors' moneys are pooled together and invested primarily in marketable securities by the professional fund manager of an investment trust management company. Earnings and other payouts from the investments are distributed to the investors.

Clearing Trusts

We administer the margin money for foreign-exchange margin trading, etc. deposited with the settlor by its customers, as the trust assets for the protection of the money and the customers as well as for the legal compliance.

Asset Purchases

Securities Acquisition Trusts

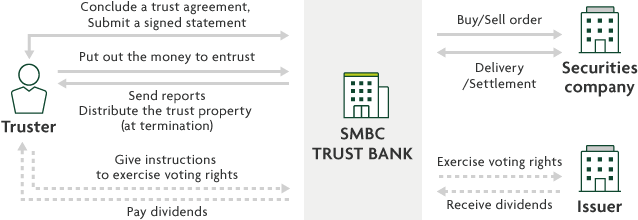

We offer various asset purchase solutions to meet customers' needs. For example, when a publicly-traded company buys back its own stock in the marketplace, they should pay close attention to the risk of infringing insider trading and market manipulation regulations or of causing such doubts. As a way to reduce such risks, we would propose to use a securities acquisition trust and let us buy the shares at our own discretion.

Asset Sales

Securities Disposal Trusts

We offer various asset disposal solutions to meet customers' needs. For example, when selling a publiclytraded stock in the market place, extra attention should be paid to the risk of infringing insider trading and market manipulation regulations or of causing such doubts. As a method to mitigate such risks, we would propose to use a securities disposal trust and let us sell the shares at our own discretion.

Monetary Claims Trusts, etc.

We provide solutions for corporate financing and collateral management.

Trust & Debt Assumption

We provide solutions for corporate financial improvement.

Japanese

Japanese English

English