Dear Customers,

Effective October 1, 2025 (Wed), we are planning to make some changes to the way we handle new applications for Housing Loans.

For details, please refer to "Regarding the Criteria for New Applications for Housing Loans"

Our loan products for your various needs

Housing Loan (up to 500 million yen)

Choose Housing Loans with perfect interest rate plan to fit your lifestyle.

% p.a.- (As of , )

Investment Property Loan (up to 100 million yen)

For people thinking of investing in real estate

% p.a.- (As of , )

Second House Loan (up to 200 million yen)

For people considering a weekend or holiday real estate.

% p.a.- (As of , )

Home Equity Loan (up to 20 million yen)

For people who want to use multi-purpose loans for home renovations, car purchases, education, etc.

% p.a.- (As of , )

PRESTIA MultiMoney Credit

Don't let your savings lie dormant, wake them up!

Unlock the collateral in your savings for immediate borrowing power.

Special features of SMBC Trust Bank PRESTIA Loans*

- *Except for PRESTIA MultiMoney Credit

- 1Apply smoothly on PC / Tablet

You can apply for screening and submit documents on PC or tablet. Please contact us first by telephone or at our branch. (Smartphones cannot be used for loan application)

- 2Choose to sign the contract either digitally or in writing

* We request you to sign the contract in person even in the case of digital contracts. For mortgage procedures, etc., a signature and seal on the document are required.

- 3Group credit life insurance also covers cancer.

Maximum amount covered up to 200 million yen; up to 100 million yen for cancer*.

- *Applied to those insurance applications with notification date of on or after April 1, 2024.

- 4No credit guarantee fees or surety fees

Initial borrowing costs can be reduced.

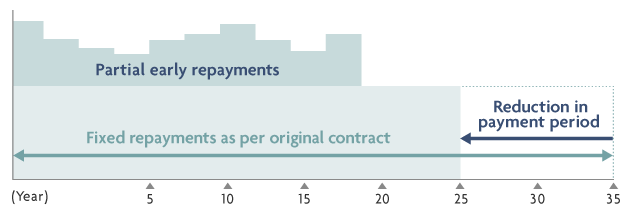

- 5Partial early repayments can be made free of charge by phone (Reduced period only).

Use it as part of your repayment plan.

With an SMBC Trust Bank loan, you can repay any extra amount with your choice. Furthermore, partial early repayments will be free of charge for transactions made by phone (Reduced period only). By making partial early repayments whenever your financial situation allows, you can reduce the overall repayment period of your loan, and in addition, the total amount of interest on the principal. In this way, you may reduce the total amount to be repaid.

- *Partial early repayments at an SMBC Trust Bank branch each incur a charge of 5,500 yen (including tax). (Both reduced period and reduced repayment amount).

Contact Us

Before contacting us

Please refer to our FAQ for helpful tips

Please contact SMBC Trust Bank branch or phone below to discuss your loan application needs.

Telephone

0120-004-847(toll-free)

Service HoursWeekdays 9:00 - 17:00 (excluding holidays)*

- *SMBC Trust Bank recommends that you make an appointment for consultations in advance.

Japanese

Japanese English

English