What is the Total Average Monthly Relationship Balance?

'Total Average Monthly Relationship Balance' is the sum of the average monthly balances of each product in your SMBC Trust Bank PRESTIA accounts, and is the standard used to determine eligibility for a waiver of the account maintenance fee or for discount fee services. Your Total Average Monthly Relationship Balance is included in your Bank Statement.

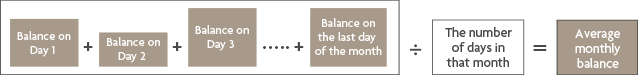

Basic Formula

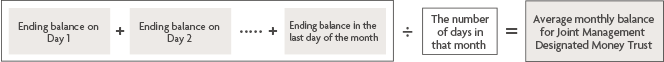

1. Add up the end-of-day balances for each product and divide by the number of days in that month to calculate the 'average monthly balance'

Note: This is not the same as the balance as of the end of the month.

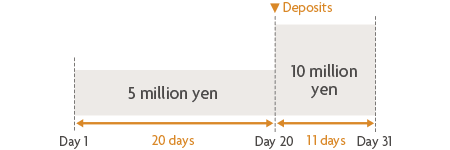

e.g.) During the month (transaction on the 21st) you deposit 5 million yen in addition to existing 5 million yen balance.

Sum of daily balance: (5 million yen × 20 days) + (10 million yen × 11 days) = 210 million yen

Number of days in the month = 31 days

Average Monthly Balance: 210 million yen ÷ 31 days

= approx. 6.77 million yen

2. Calculate the 'Average Monthly Balance' for each product to calculate the Total Average Monthly Relationship Balance

- *1For insurance products, the Total Average Monthly Relationship Balance is calculated based on the balance as of the last business day of every month. The balance of insurance product will not be reflected in your Total Average Monthly Relationship Balance within about a year after the end of the contract.

Average Monthly Balance Calculation Method by Product

A list of products included in the "Total Average Monthly Relationship Balance" and their specific calculation methods follow below.

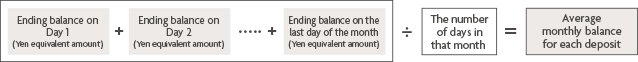

Deposits (Yen Deposits/Foreign Currency Deposits/Structured Deposits)

- *For foreign currency deposits and foreign currency-denominated structured deposits, the yen equivalent amount is calculated for each currency using the bank's TTB rate from the last business day of the previous month.

Loans (Housing loans, PRESTIA MultiMoney Credit, etc.)

- *For loan products, 25% of the loan balance is calculated.

- *For foreign currency-denominated loan products, the yen equivalent amount is calculated for each currency using the bank's TTB rate from the last business day of the previous month.

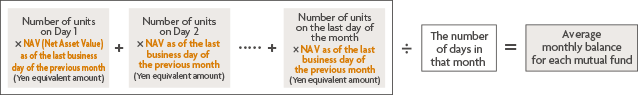

Mutual funds

- *In order to calculate the balance of a mutual fund on any given date, the net asset value as of the last business day of the previous month is multiplied by the number of units owned on that day.

- *For foreign currency-denominated mutual fund, the yen equivalent amount is calculated for each currency using the bank's TTB rate from the last business day of the previous month.

- *When purchasing a mutual fund, the purchase amount (including fees and consumption taxes) is used as the daily balance from the application date to the day prior to the contract date. From the date of the contract onward, the balance is calculated using the net asset value on the last business day of the previous month multiplied by the number of units owned on the applicable day.

- *When selling a mutual fund, the settlement amount (an after-tax amount when the sell transaction occurred in a special account and there is a withholding tax) is used as the balance from the transaction date to the day prior to the settlement date.

- *If you make a purchase using online banking at 15:00 or later, the purchase amount will be withdrawn from your settlement account, but it will not be recorded in the average monthly balance until the following business day.

Securities Intermediary Products

- *1If the end of the month is either a holiday or a weekend, this is the number of days until the last business day.

- *For foreign currency-denominated bonds/notes, the yen equivalent amount is calculated for each currency using the bank's TTB rate from the last business day of the previous month.

- *Securities Intermediary Products balance is calculated based on information received from the securities company. As a result, when you make a purchase, the balance for the Securities Intermediary Product (equivalent amount) will not be included in your Total Average Monthly Relationship Balance during the period between when you send the delivery amount and when the bank receives transaction data from the securities company after the delivery is complete.

Joint Management Designated Money Trust

- *For Joint Management Designated Money Trust products, after the application, it will be included as your Total Average Monthly Relationship Balance from the day when the withdrawal is completed.

- *The principal amount of Joint Management Designated Money Trust products up to the day before the redemption date is included in your Total Average Monthly Relationship Balance.

Insurance

Total Average Monthly Relationship Balance is calculated based on the method defined by SMBC Trust Bank after the contract status is received from the insurance company. The calculation method varies depending on product type, the payment method of insurance premiums, and contract status, among other factors; And there might even be cases for not considering a product for calculation altogether. As a general rule, the total amount of the single premium is included for single-premium insurance products, while an amount obtained by multiplying the number of years elapsed by the annual premium is included for level-premium insurance products.

- *For insurance products, the Total Average Monthly Relationship Balance is calculated based on the balance as of the last business day of every month.

- *An amount obtained by multiplying the number of years elapsed by the annual premium is likewise included in cases where the premiums of a level-premium insurance product are paid in advance; this means that the total amount of insurance premiums paid at the time of application will be different from the insurance product balance.

- *Foreign currency-denominated insurance products are converted from each currency into yen by using the bank's TTB rate from the last business day of the preceding month.

- *When you apply for insurance, the balance for the insurance product will not be included in your Total Average Monthly Relationship Balance from the date on which the premium is sent to the date on which the bank receives the transaction data from the insurance company after contract conclusion.

- *The balance of insurance product will not be reflected in your Total Average Monthly Relationship Balance within about a year after the end of the contract.

Important Notes

- Please note that the bank will not be able to revise transaction balances.

- Calculation methods, etc. may change in certain cases, so please contact your branch or PRESTIA Phone Banking for more details.

Japanese

Japanese English

English