Priority Issues (Materiality)

| Environment |

|

An irreplaceable asset shared between generations, and is the foundation of the society we aim to achieve. |

|---|---|---|

| Community |

|

A social safety net that fills the gap between the public sector and the private sector, based on "trust" and "mutual assistance" created by the connections among people, in order to realize the society we aim to achieve. |

| Next Generation |

|

Intelligent people who create the better society and pass it on to future generations in order to realize the society we aim to achieve. |

Specifically, we have adopted a policy on sustainability, which requires us to pursue "customer oriented business conduct" and the "enhancement of employee engagement & employee experience (EX)" to contribute to the realization of sustainable society while growing sustainably as a trust bank through businesses conducted from a long-term perspective. In accordance with the policy, we will advance business and social contribution activities expected of us.

Main activities

Environment

![]()

![]()

![]()

Renewable energy business

We receive entrustment of the right to use solar power generation facilities and land (ownership, leasehold or surface rights), manage the trust property, and distribute the proceeds from the sale of power to beneficiaries.

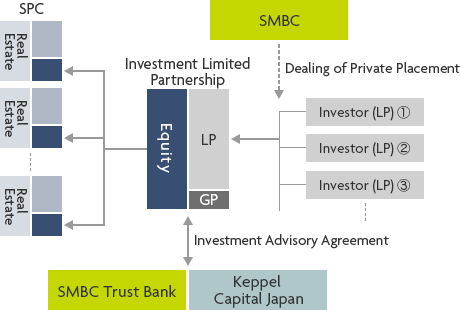

Sustainable Value-Added Funds

In collaboration with SMBC, we launched "Sustainable Value-Added Fund No. 1 Investment LLP" in February 2021. This partnership invests in some aged properties and renovate them by such measures as making the air conditioning facility up to date for energy conservation. Through such investments, we contribute to the enhancement of the quality of the fund’s domestic real estate portfolio and reduce the environmental burden that the real estate carries.

ESG-Minded Financing Policies

SMBC Group has disclosed financing policies for businesses and sectors with a high risk of significantly impacting the environment or society. We are introducing these policies according to their business.

Going forward, we will continue to consider the need to revise our financing policies as necessitated by the operating environment.

*For more information, please refer to Sumitomo Mitsui Financial Group’s corporate website.

Businesses and Sectors for Which Policies Have Been Disclosed

- Coal-fired power generation

- Hydroelectric generation

- Oil and gas

- Coal mining

- Tobacco manufacturing

- Natural conservation areas

- Palm oil plantation development

- Deforestation

- Manufacturing of cluster bombs and other weapons of destruction

Donation for forest conservation activities

SMBC Trust Bank promotes the paperless movement and donates to a forest conservation activity a part of the profits generated by paperless cost savings.

Please see here for more details.

SMBC Trust Bank is a corporate supporter of "more trees".

Community

![]()

![]()

![]()

Family Baton (support for gift-tax exemption)

For those who consider asset succession, we offer "Family Baton", a service to support your asset transfer to your family, using an annual gift-tax exemption system. In addition to Japanese yen, this service is offered for five foreign currencies (US dollars, Australian dollars, New Zealand dollars, British pounds, and Euro).

Smart Inheritance Account

We provide "Smart Inheritance Account", a pay on death (POD) account that allows you, when you pass away, to transfer the assets in your deposit/mutual fund accounts with us to your family members designated in advance smoothly. Under the arrangement, you maintain full control over the account balances while you are alive.

This is the first product in Japan that meets the diversified asset succession needs of those who:

- do not want to bother their family with inheritance procedures

- think that writing a will is troublesome

- want to hold down the cost of inheritance

- still want to spend their money freely after taking care of inheritance

| POINT 1Smooth inheritance - no need to prepare complicated documentation |

|

|---|---|

| POINT 2Quick procedure enabled by electronic contracts |

|

| POINT 3Deposit, withdrawal, and switching assets possible even after the contract |

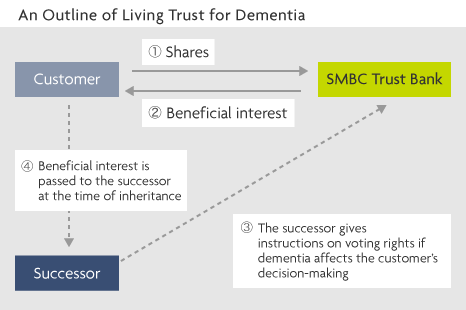

A Trust for Business Succession in Preparation for Dementia

With the advancement of the aging society, we have had more opportunities to hear our customers say about their need to set the course to pass their company shares to the next generation or to manage the risk of not being able to exercise their voting rights due to dementia, etc.

As a financial solution to address social issues expected in a 100-year-old life, we offer Living Trust for Dementia.

Supporting sports for the disabled

As part of supporting sports for the disabled, we serve as a supporter of the Japan Goalball Association.

We encourage the spread and development of sports for people with handicaps through holding experience sessions and dispatching employee volunteers to competitions.

Regional Revitalization

Shikoku Aquarium (Utazu-cho, Kagawa Prefecture) opened in April 2020 as a regional revitalization project.

We have been entrusted with the land of the aquarium, building, as the property of trust and support the aquarium asset management. We will continue to promote initiatives for regional revitalization.

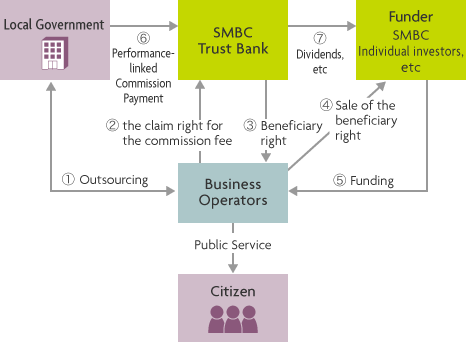

Social Impact Bonds

In cooperation with Sumitomo Mitsui Banking Corporation, we are promoting the "Social Impact Bond" (SIB), a public-private structure aimed at solving social issues.

In July 2017, in Kobe City, we have arranged SIB for the "Program for the Prevention of aggravation of Diabetic Nephropathy" and in September 2019, in Toyonaka City, we have also arranged SIB for "smoking cessation business", both of them are the first social impact bond initiative in Japan.

Next Generation

![]()

![]()

Quality Education for the Next Generation

We co-sponsor economic education program "Shinagawa Student City" for fifth graders, which is co-managed by economic education group Junior Achievement and Shinagawa Ward. Student City created using empty classrooms in a junior high school in Shinagawa Ward, Tokyo, is a fictional town where banks, convenience stores, newspaper companies, and other companies from various industries have booths that mimic actual stores.

We dispatch employees as volunteer staff and support children who will lead the next generation. In addition, we have the financial education class for Kyoto Women's University and we entered into an agreement with Shiga University for collaboration in the field of education and research related to data science for Society 5.0. As such, we are engaged in support for education for the next generation through industry- collaboration academia.

* Lecture at Shiga University

Supporting young artists

As part of our support activities for young artists, we support students who aspire to the arts by exhibiting works from Joshibi University of Art and Design and Osaka University of Arts at our Head Office and Osaka Office.

Japanese

Japanese English

English