Housing Loan

- Check other loans

- Investment Property Loan

We provide distinctive preferential rate programs to selected customers.

We offer special interest rate plans for PRESTIA GOLD customers, PRESTIA GOLD PREMIUM customers, and customers who meet certain conditions, such as loan contract amount.

For floating rate loan (1 year renewal) and fixed rate loan (10 years fixed), we offer A Plan "Interest Rate Focused Plan" ideal for customers who value lower interest rates over initial costs, and B Plan "Initial Cost Focused Plan" ideal for customers who value lower initial costs over interest rates.

You can borrow up to 500 million yen to live out your big dream.

- Please make sure to read the Notes and the Housing loans Information Memorandum below.

Housing Loan Features

- Borrow up to 500 million yen

-

Credit guarantee fees

or surety fees ¥0 -

Partial early payments

¥0

Reduced period type

only by phone - No need to pay stamp duty when you choose digital contracting ¥0

-

Group credit life insurance

Prescribed Cancer

Coverage coverage rider up to

100 million yen

*Applied to those insurance applications with notification date of on or after April 1, 2024

- Notes:

- The borrower bears the cost of mortgage execution fees and stamp duties/registration fees.

- The extension of the housing loan, as well as the financeable amount, will be determined based on the screening criteria specified by the bank.

- Please click here to see the Housing Loan Interest Rate Plans.

Housing Loan Programs

A Plan "Interest Rate Focused Plan"

For customers who value lower interest rates over initial costs

Recommended for people who want to keep their monthly payments low, and envision repaying the loan over a relatively long period.

- Administrative fee: 2.2% of total loan amount (including tax)

Floating rate loan (1 year renewal)

- Initial interest rate

- % p.a. ~ % p.a.

- Housing loan base interest rate

- % p.a.

- Discount on the base interest rate

- -% p.a. ~ -% p.a.

- (generally -% p.a.)

Fixed rate loan (10 years fixed)

- Initial interest rate

- % p.a. ~ % p.a.

- Housing loan base interest rate

- % p.a.

- Discount on the base interest rate

- -% p.a. ~ -% p.a.

- (generally -% p.a.)

- The discount on the base interest rates of this plan is determined by loan contract amount, the customer's status, etc. For details, please refer to the “Housing Loan Interest Rate Plans”.

B Plan "Initial Cost Focused Plan"

For customers who value lower initial costs over interest rates

Recommended for customers who plan to make frequent early repayments and envision paying off the loan in as short a time as possible.

- Administrative fee: 22,000 yen (including tax)

Floating rate loan (1 year renewal)

- Initial interest rate

- % p.a. ~ % p.a.

- Housing loan base interest rate

- % p.a.

- Discount on the base interest rate

- -% p.a. ~ -% p.a.

- (generally -% p.a.)

Fixed rate loan (10 years fixed)

- Initial interest rate

- % p.a. ~ % p.a.

- Housing loan base interest rate

- % p.a.

- Discount on the base interest rate

- -% p.a. ~ -% p.a.

- (generally -% p.a.)

- The discount on the base interest rates of this plan is determined by loan contract amount, the customer's status, etc. For details, please refer to the “Housing Loan Interest Rate Plans”.

- Notes:

- The above loan interest rates are shown for reference purposes only, as the initial interest rates assuming that you signed a contract on , (contract date) and took out a loan by the end of , . Base interest rates are reviewed every month after , and your loan interest rate will also be revised in accordance with the review of the base interest rates.

- The discount on the base interest rates will be determined based on screening of applications.

- Different loan interest rates and administrative fees are applied for A Plan "Interest Rate Focused Plan" and B Plan "Initial Cost Focused Plan". For details, please refer to the Information Memorandum.

- For floating rate loans (1 year renewal), discounts on the base interest rates will be applied throughout the loan period (until you complete repayment), except in cases where you switch to a fixed rate plan*. The discount range differs between A Plan "Interest Rate Focused Plan" and B Plan "Initial Cost Focused Plan". For details, please refer to the Housing Loan Interest Rate Plans.

- Please note that for fixed rate loans, discounts on the base interest rates will be applied only during the initial applicable interest rate period.

- If you switch from a floating rate loan (1 year renewal) to a fixed rate loan during the loan contract period, the application of the interest rate plan under the floating rate loan (1 year renewal) will be suspended and conditions under the fixed rate loan plan will be applied instead. For details, please check the Housing Loan Interest Rate Plans. This document is available at our branches.

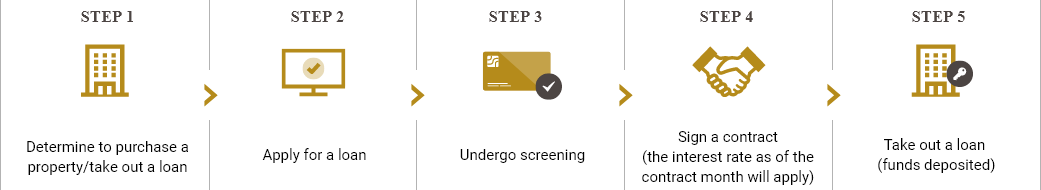

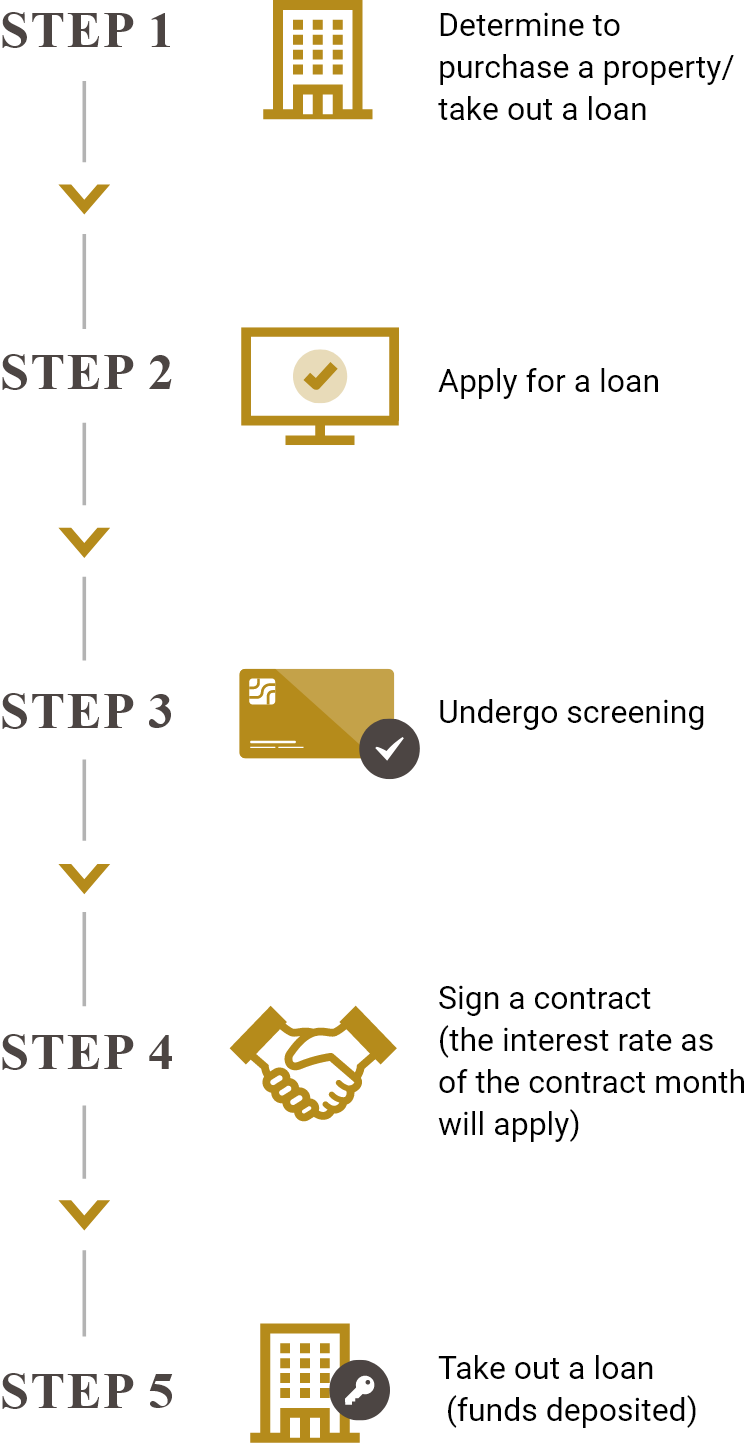

Steps to Borrow

- Support Documentation

- Please read the following documents for more details about the housing loan.

- Housing Loan Interest Rate Plans

- Housing Loan (Floating rate, 1 year renewal) Information Memorandum

- Housing Loan (Fixed rate) Information Memorandum