GLOBALPASS® (Multi Currencies

Visa Debit with Cash Card)

GLOBAL PASS is a cash card with Visa debit service that can be used in 18 currencies including Japanese yen.

You can use foreign currencies directly from your account.

- *Personal foreign currency deposit balance (as of end of March 2024) based on our research.

Source: Each bank's IR materials (published basis)

GLOBAL PASS

5 Key Features

- You can enjoy shopping at stores with Visa logo around the world.

- Easy tap to pay service by Visa and iD.

- Withdraw local currency from overseas ATMs with Visa or PLUS logo.

- Earn cashback or ANA miles by overseas usage.

- Family Cards are available.

Two types of cards are available

Free of annual fee

GLOBAL PASS®

With cashback bonus

Cashback bonus of 0.25 - 1.5%

for the amount spent at Visa merchants

overseas will be provided in Japanese yen

ANA MILEAGE CLUB

GLOBAL PASS

With ANA mile benefits

300 miles presented by opening a new account

You can earn miles not only by shopping and ATM transaction abroad, but also Yearly increase in foreign currency deposit.

More details

* Ineligible transactions are Visa debit use of Account Funding Transaction and Original Credit Transaction.

Unique benefits of ANA MILEAGE CLUB GLOBAL PASS

| Description | Number of miles | Timing*1 | |

|---|---|---|---|

| benefit 1 | Opening a new account | 300 miles | Second month after the month of opening your account |

| benefit 2 | Yearly increase in foreign currency deposit*2 | 5 miles per 10,000 yen equivalent PRESTIA DIGITAL GOLD and PRESTIA GOLD customers: 10 miles PRESTIA GOLD PREMIUM customers: 15 miles |

Every year at the end of February |

| benefit 3 | Using overseas ATMs*3 | 1 mile per 10,000 yen equivalent | End of the second month after month of use |

| benefit 4 | Shopping overseas*3, 4 | 1 mile per 10,000 yen equivalent | End of the second month after month of use |

- As a general rule, miles benefits will be provided by the above dates.

- Yearly increase in the foreign currency deposit of the Total Average Monthly Relationship Balance as of the end of December of each year. For foreign currency deposits and structured deposits in foreign currencies, this is the increase in foreign currency deposits converted to yen with the TTB rate stipulated by SMBC Trust Bank on the last business day of the previous month for each currency. The maximum miles to be rewarded are 10 million miles per year.

- The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized.

- Ineligible Transactions are Visa debit use of Account Funding Transaction and Original Credit Transaction.

For inquiries regarding the ANA MILEAGE CLUB GLOBAL PASS

PRESTIA Phone Banking

- In Japan

- 0120-110-330 (toll-free)

- From Overseas

- +81-46-401-2100 (charges apply)

For mileage inquiries

ANA MILEAGE CLUB Service Center

- In Japan

- 0570-029-709 (charges apply)

- From Overseas

- +81-3-6741-1120 (charges apply)

- ANA MILEAGE CLUB is a registered trademark of ALL NIPPON AIRWAYS CO., LTD.

- When switching between GLOBAL PASS and ANA MILEAGE CLUB GLOBAL PASS, any benefits received prior to the change will not be carried over.

- When your ANA MILEAGE CLUB GLOBAL PASS is issued, you will receive the new customer number (10 digits) for ANA MILEAGE CLUB; if you input your old ANA MILEAGE CLUB customer number (10 digits) into the application form when applying, the miles you have accumulated thus far will be transferred automatically. Contact the ANA MILEAGE CLUB Service Center on the above for more information.

- If you cancel your ANA MILEAGE CLUB GLOBAL PASS, all benefits you were scheduled to receive as of the time of cancellation will be invalidated.

Eligible customers

Individual customers who have Yen Savings Deposit account and PRESTIA MultiMoney Foreign Currency Savings Deposit account with SMBC Trust Bank. (Corporate account holders are unable to apply for a GLOBAL PASS.)

- Main card: Customers must be 18 years or older to apply.

- Family card: Customers must be 16 years of age or older to apply. (High school students can apply.)

Issuance fee

- Main Card : Free

- Family card : Free

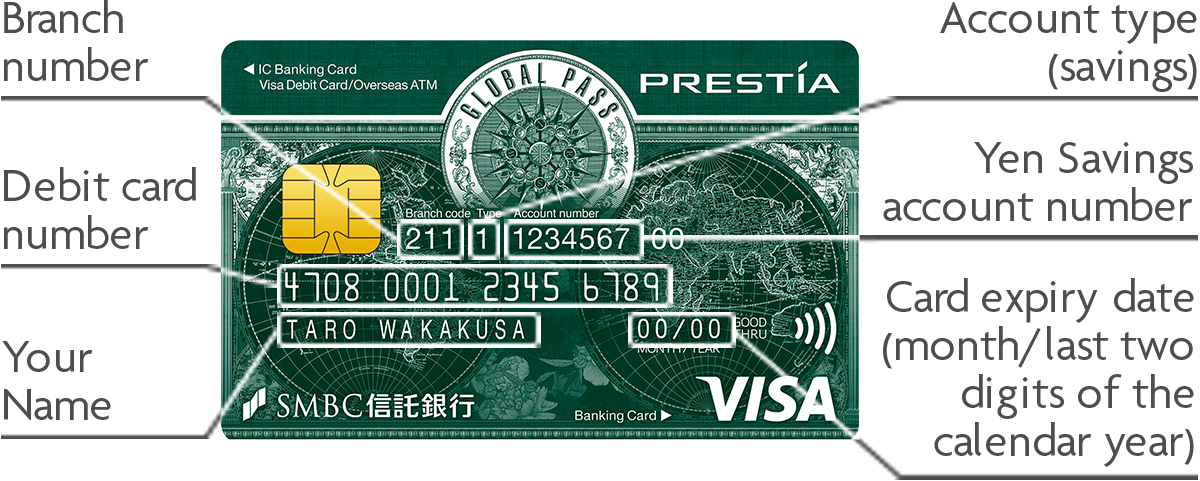

Expiration date

Printed on the card mount and on the front side of the card.

- We will send a new card to your registered address approximately 2 months before your card expiration date.

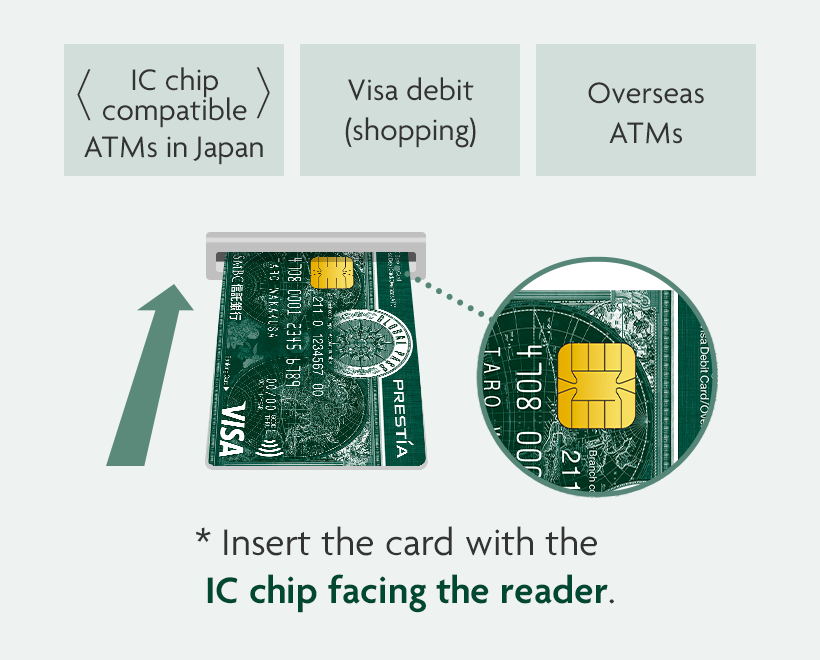

Usage

-

Overseas

- Shopping at Visa merchants (including online stores).

- Withdrawal of local currency at ATMs with Visa or PLUS logo.

-

In Japan

- Shopping at Visa/iD/J-Debit merchants (including online stores).

- Use ATMs at affiliated financial institutions.

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQs about switching to GLOBAL PASS

Using your card

Check the customer information and insertion direction.

4 digit PINs

There are three types of PINs for different purposes. Please note that if you enter a PIN incorrectly for more than the predetermined number of times, the services associated with that PIN will become unavailable.

Domestic Cash Card PIN

Domestic ATMs

Shopping with J-Debit

Debit PIN*

Shopping with Visa/iD

Overseas ATMs

T-PIN

Online banking

(Required for user registration and when you forget your User ID/password)

PRESTIA Phone Banking

- *You may be asked to sign or enter PIN even when you tap to pay with Visa or iD, depending on the transaction amount and/or conditions.

- *To change the Debit PIN, your card must be reissued.

- *The "iD" logo is a registered trademark of NTT DOCOMO, INC.

Various services

Family card

PRESTIA Alert Services

Compensation for fraud

Shopping Insurance

Notes

- You will not be able to change the settlement account you choose when applying. If you wish to do so, you will have to cancel your existing GLOBAL PASS and apply for a new card.

- Any discrepancies between the spending information received from the merchant store where the card was used and the sales confirmation notice sent at a later date by the merchant due to foreign exchange rate differences, etc. will be adjusted through either a deposit or a deduction. In some cases, billing and payment may take place at a later date for the store's reasons.

- In the event of cancellation or return, a refund will be provided with the designated method after the spent amount has been deducted from your settlement account. Note that refunds may require some time.

- At some merchant stores, transactions in amounts exceeding the settlement account balance may be processed. In such cases, your transaction will be completed, but SMBC Trust Bank will make the payment on your behalf due to insufficient balance in your settlement account, and you will be requested to make a deposit into your settlement account as soon as possible. Please understand in advance that your membership qualification may be cancelled if we are unable to debit for a certain period after the occurrence of insufficient funds.

- SMBC Trust Bank may block your card if your GLOBAL PASS is used or may be used illicitly.

- Service contents may change without notice.

- GLOBAL PASS and Foreign Currency Full Back are registered trademarks of SMBC Trust Bank Ltd.

To avoid the card malfunction

Avoid magnetic items

Contact with a magnetic object, even just for a second, may result in a severe damage of the card's magnetic strip.

Water/Dirt

Magnetic stripes and IC chips are precision components, so damaging them may cause malfunctions.

Bending

Forcing the card into a wallet or sitting with the card in the back pocket of pants can cause distortion of the card.

- *Magnetic strip recovery requests accepted at our branches.

GLOBAL PASS User's Guide (PDF)

English follows Japanese.

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQs about switching to GLOBAL PASS

Japanese

Japanese English

English