When using Overseas

Use for ...

- Shopping

- ATM transactions

Shopping

Available Merchants

You can use the card for Visa merchants (stores/online shop) in over 200 countries and regions.

Settlement account and currency

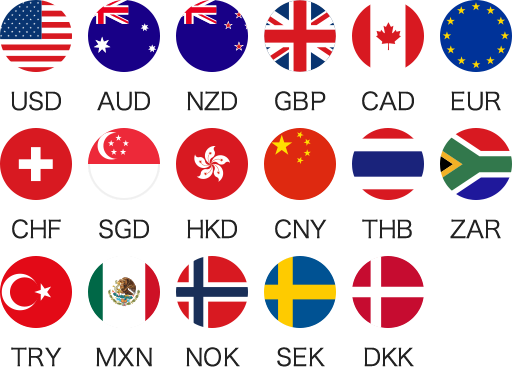

When you use 17 Applicable Currencies

If you have sufficient balance in your PRESTIA MultiMoney Foreign Currency Savings Account, the amount you use will be debited from there.

- PRESTIA MultiMoney Foreign Currency Savings Deposit handles Chinese Yuan offshore only.

- Chinese Yuan offshore deposit can be used for settlement in China.

- Fund Transfer is required from U.S. Dollar Saving Account to PRESTIA MultiMoney Account, because U.S. Dollar Saving Account cannot be used for settlement.

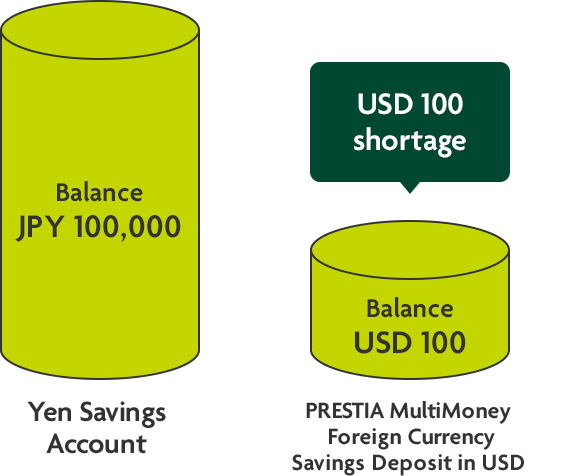

What if your account balance runs low?

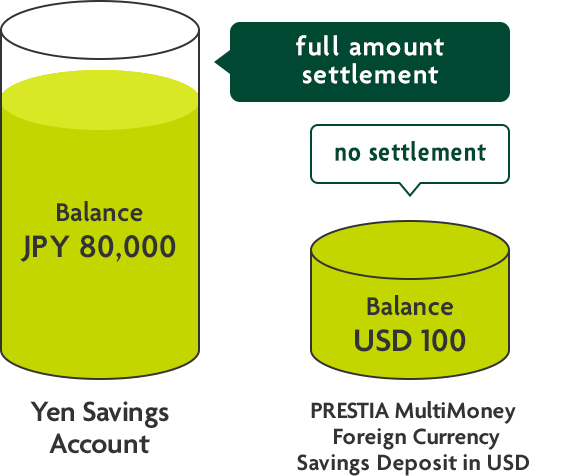

When using GAIKA FULL BACK, the full transaction amount is deducted from your Yen Savings Account when the balance in your Foreign Currency Savings Deposit is insufficient.

- This service is not available if customer set "OFF" to GAIKA FULL BACK.

- When using GAIKA FULL BACK, converted into Japanese yen at a rate obtained by adding the predefined commission fee (3%) to the exchange rate determined by VISA.

- Some merchants may convert yen amount at their own exchange rates.

When you use currencies other than 17 Applicable Currencies

Transaction amounts are withdrawn from your Yen Savings Account.

When the balance in your Yen Savings Account is insufficient, GLOBAL PASS cannot be used.

- When the transaction amount is to be deducted from your Yen Savings Account, the full amount will be converted to Japanese yen by using the exchange rate determined by Visa, with an addition of a predefined commission (3%).

- Some merchants may convert yen amount at their own exchange rates.

Tap to pay service

Merchant stores with the contactless indicator

Benefits

GLOBAL PASS

| PRESTIA GOLD PREMIUM customers |

PRESTIA DIGITAL GOLD / PRESTIA GOLD customers | Other customers |

|

|---|---|---|---|

| Cash back rate | 1.50% | 1.00% | 0.25% |

| Target period | Start of each month - end of each month | ||

| Date of deposit and deposit account |

Deposited in Japanese yen into your Yen Savings account on the 20th of the following month (or the following business day if the 20th falls on a bank holiday) | ||

ANA MILEAGE CLUB GLOBAL PASS

1 mile per 10,000 yen equivalent

(GLOBAL PASS)

- ATM usage is not eligible. When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

- The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized.

- Target period that the benefits are granted is determined based on the date when we receive the confirmation of transactions.

(ANA MILEAGE CLUB GLOBAL PASS)

- Miles benefits will be provided by the end of the second month after month of use.

- The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized.

What if my account balance runs low?"GAIKA FULL BACK" will cover

This service allows you to make settlements by covering the full amount with your Yen Savings Account if the balance of the transacting foreign currency in your PRESTIA MultiMoney Foreign Currency Savings Account is insufficient. You will be able to use your card overseas without worrying about your foreign currency balance.

For example: When you have only USD 100 in your PRESTIA MultiMoney Account for the USD 200 transaction, the full amount USD 200 (JPY 20,000*) will be deducted from your Yen Savings Account.

- Assuming that the exchange rate determined by Visa, with an addition of a predefined commission (3%): 1 USD = JPY 100

Notes

- *The total transaction amount will be converted into Japanese yen at a rate obtained by adding the predefined commission fee (3%) to the exchange rate determined by Visa. However, when a Visa merchant store or a company that owns an overseas ATM determines the charge amount by converting the transaction amount into Japanese yen using its own exchange rate, then the total transaction amount will be deducted from your Yen Savings Deposit account whether or not you have chosen to use the GAIKA FULL BACK service.

- *You can set "On" or "Off" to GAIKA FULL BACK via online banking.

- *If GAIKA FULL BACK status is "Off" and your balance of the relevant currency is insufficient, or if GAIKA FULL BACK status is "On" but the balance of your Yen Savings Account is insufficient, you will not be able to shop at Visa merchant stores overseas or withdraw from overseas ATMs.

- *When an additional withdrawal is made at a merchant due to rebill after cancellation, split charges or the difference in bills, or when only final value ("Fixed") was charged without a confirmation of the validity of your debit card when used, the amount may be withdrawn from the corresponding foreign currency deposit regardless of the GAIKA FULL BACK setting. When the balance is short in the account, we will exchange the equivalent amount of the insufficient funds into the foreign currency from Japanese Yen and debit it if your balance of your Yen Savings Deposit account is enough, or please deposit into your debit card settlement account if you do not have enough balance.

- *GAIKA FULL BACK may not be applicable to certain transactions depending on the processing systems used at Visa merchants.

Method of use for shopping

When shopping at Visa merchants

-

Present your GLOBAL PASS at the time of payment

Ask to pay "with a Visa card". When asked your desired number of payments, answer "one".

- Visa debit purchases cannot be paid in installments.

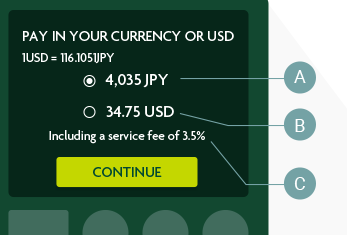

When you need to choose the currency for payment

Specific selection of your preferred currency may slightly vary by terminal.

- Aamount to be withdrawn from Yen Savings account

- Bamount to be withdrawn from PRESTIA MultiMoney Foreign Currency Savings Deposit

- Cservice fee for A (included in the exchange rate) *1

- *1The exchange rate is determined by the merchant and is different from that of SMBC Trust Bank.

- JPY

- Withdrawn from Yen Savings account. The transaction amount is calculated based on the exchange rate determined by the local merchant (i.e. not by SMBC Trust Bank) even if GAIKA FULL BACK option is OFF.

- USD

- Withdrawn from PRESTIA MultiMoney US Dollar Savings Deposit.

If you prefer to pay in the local currency, please confirm with the merchant that the payment is settled in the local currency.

-

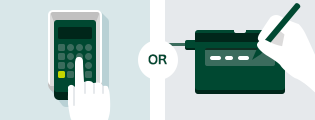

Input your debit PIN or sign.

At merchant stores displaying this logo, you can simply tap your card to complete payment.

- You may be asked to sign or enter PIN even when you tap to pay, depending on the transaction amount and/or conditions.

-

View Usage Statements

An alert e-mail will be sent to your registered e-mail address each time you use your card. You can also check your Usage statements on the Member's Website.

As a general rule, payment amounts will be deducted from your deposit account on the same day.

Payment methods for online shopping

-

Select a payment method

On the shopping site, select "Credit Card" for your payment method and "Visa" for your settlement brand.

-

Enter the required information

Enter the required information following directions on the shopping site. In case of shopping at the merchant stores participating in Visa Secure, you will proceed to the authentication screen. See here about Visa Secure.

-

View Usage Statements

An alert e-mail will be sent to your registered e-mail address each time you use your card. You can also check your Usage statements on the Member's Website.

As a general rule, payment amounts will be deducted from your deposit account on the same day.

About Visa Secure

"Visa secure" is a secured service to confirm the identity of the card holder by verification code, when you use GLOBAL PASS on applicable online shopping sites. When additional verification is required, the verification screen appears in order to send a verification code to your e-mail address registered on GLOBAL PASS Member's Website.

- Visa Secure becomes active after registration for GLOBAL PASS Member's Website is complete.

Unavailable transactions

GLOBAL PASS cannot be used for:

- Transactions which the settlement amount is determined after the card is presented.

e.g. highway tolls, gas stations, etc. - Offline transactions

e.g. in-flight sales, some taxis and vending machines, etc. - Online casino transactions

- Transactions at overseas crypto-assets merchants

- In addition to the above, you may be unable to use GLOBAL PASS due to circumstances of individual merchants.

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQs about switching to GLOBAL PASS

Japanese

Japanese English

English