-

-

-

- *Unavailable via PRESTIA Mobile, App

-

Fund Transfers:

Domestic Fund Transfer Acceptance History

Overseas Remittance History

Registered Payee List

Transfers Within My Accounts (Same Currencies)

-

Buy / Sell FX, Foreign Currency Deposit Service, Order Watch:

Application for PRESTIA MultiMoney Foreign Currency Savings Deposit

Archive of Product Information Memorandum, etc.

-

Time Deposits:

Premium Deposit (Structured Deposit)

Personal Profiling

Archive of Product Information Memorandum, etc.

-

PRESTIA MultiMoney Credit:

-

E-mail Registration / Maintenance:

Manage Information and Services:

One Time Password (OTP):

GLOBAL PASS (Multi Currencies Visa Debit with Cash Card)

Unsubscribe Statement via Post

-

-

-

Overseas Remittance

- STEP1: Notes

- STEP2: Input Transaction Details

- STEP3: Review Transaction Details

- STEP4: Confirm Your Completed Transaction

- Notices

STEP 1Notes

Please check the box after reading and having understood the Notes, and then press "Next".

STEP 2Input Transaction Details

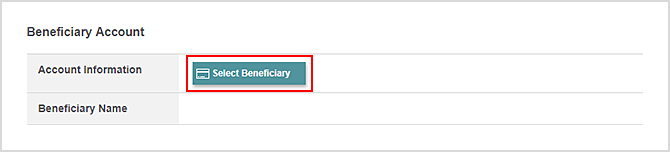

- 1.Please press "Select Beneficiary" and select the beneficiary (recipient).

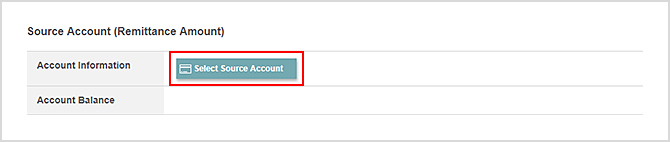

- 2.Please press "Select Source Account" and select the account that you want the funds to be taken from.

- *When you make a foreign currency remittance from your Yen Savings account, below two transactions will occur.

> The first transaction: Buy Foreign Currency from Yen Savings account and transfer to your PRESTIA MultiMoney Foreign Currency Savings Deposit.

> The second transaction: Make Overseas Remittance from your PRESTIA MultiMoney Foreign Currency Savings Deposit which you have bought the foreign currency in the first transaction. - *You cannot choose U.S. Dollar Savings Deposit Account as the source account.

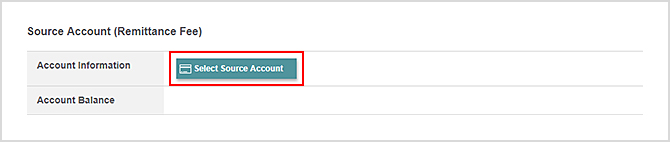

- 3.Please press "Select Source Account" and select the account that you want the fees to be taken from.

- *You can choose either PRESTIA MultiMoney Yen Savings Deposit or Yen Savings Account only.

- *You need to select Source Account (Remittance Fee) even when the fee is free. Press "Next" to proceed and confirm Remittance Fee on "Overseas Remittance: Review Transaction Details". When there is no fee, Remittance Fee will be 0 JPY.

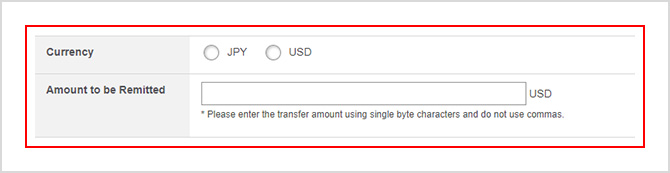

- 4.Please input the amount you wish to remit.

- *If you are remitting foreign currency and selected Yen Savings Account as the Source Account (Remittance Amount), You can specify the remittance amount in yen equivalent or foreign currency. Please select your preferred currency.

- *Please input the amount of remittance using single-byte numbers.

- *Please do not include symbols such as commas and the dollar mark ($).

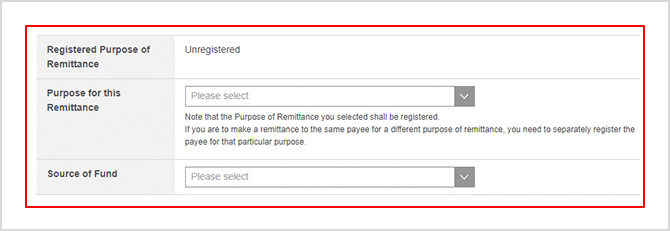

- 5.Please confirm "Registered Purpose of Remittance", select "Source of Fund", and press "Next".

- *If the "Registered Purpose of Remittance" is Unregistered, select "Purpose for this Remittance".

- *The remittance purpose selected in "Purpose for this Remittance" will be registered, and "Purpose for this Remittance" will not be displayed from next time onwards.

STEP 3Review Transaction Details

If there are no errors in the information you have input, please check the checkbox after reading and fully understanding the Notice, and then press "Submit."

If you select a Yen Savings Account as Source Account (Remittance Amount) to remit foreign currency

- *"Discount for foreign exchange commission will be applied to this transaction." will be displayed on the screen when discount is applied to the commission.

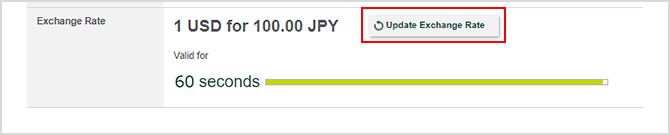

When the Market Rate is applied:

- In principle, exchange rates applied on online banking are the Market Rates, which include foreign exchange commissions.

- The displayed foreign exchange rate is valid for 60 seconds.

- If you exceed the time limit, please press the "Update Exchange Rate" button.

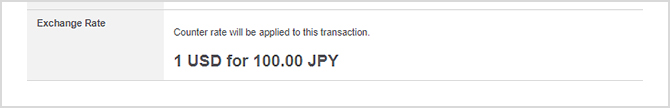

When the Counter Rate is applied:

On weekends and holidays or when the Market Rates are not available, the Counter Rates(TTS) will be applied.

- *When selecting a Yen Saving account as the "Source Account" and remitting foreign currency, the conversion from yen will occur immediately.

If the foreign currency balance becomes insufficient due to other transactions in between the order and the execution of the remittance, it will not be executed.

In the case above, the balance will remain in the foreign currency account.

STEP 4Confirm Your Completed Transaction

- *Please note that once this screen is closed, it cannot be re-displayed.

The following details will be displayed when your Yen Savings Account is selected as the source account of remittance to remit foreign currency.

> The first transaction: Buy Foreign Currency from Yen Savings account and transfer to your PRESTIA MultiMoney Foreign Currency Savings Deposit.

> The second transaction: Make Overseas Remittance from your PRESTIA MultiMoney Foreign Currency Savings Deposit which you have bought the foreign currency in the first transaction Above two transactions will be displayed on "Account Activities" and the Statement.

Notices

| Service Hours |

For details, please refer to "Hours of Service for Overseas Remittance." |

|---|---|

| Daily Limit (Number of Transactions) | Daily limit of transactions (overseas remittance and domestic fund transfers in foreign currency) using the overseas remittance service is 2 transactions per day (from 0:00 to 23:59 JST) for both PRESTIA Online and PRESTIA Mobile combined. |

| Daily Limit (Total Remittance Amount) |

|

| Fees |

|

| Others |

|

Hours of Service for Overseas Remittance

After transaction is completed, it takes time for the transfer amount to be withdrawn.

Please be careful not to transfer twice.

- *Some transfers may not be reflected until the following business day or after to confirm the details. We may contact you to confirm the details of your purpose of remittance. If we cannot confirm the details, your remittance may be canceled.

- *For any inquiries, please contact PRESTIA Online Helpdesk.

Remittance Order History for the overseas remittance transactions made via online banking

The list of last 10 overseas remittance orders placed within the past month is available on Overseas Remittance Input screen for the overseas remittance transactions made via online banking.

- *Result of the transaction is not reflected to the order history. Even though your transaction has not been executed due to insufficient balance etc., the transaction is displayed as the order history.

- *Overseas remittance transactions made via PRESTIA Phone Banking or at the branch are never been displayed.

- *For any inquiries, please contact PRESTIA Online Helpdesk.

About details and history of executed overseas remittance across all channels

From the menu below, you can check the details of remittance history executed via internet banking, telephone, branch and mail after March 2021 for approximately 6 years from the next business day of remittance execution date (remittance execution date is different from remittance acceptance date).

Transfers > Overseas Remittance History

Please press here for more information on "Overseas Remittance History".