Start Guide and Procedure

4 steps to use GLOBAL PASS

Please follow the steps below for the safe and secure use of your card.

STEP 1Sign the back of GLOBAL PASS

Check your name on the front and sign the back of GLOBAL PASS in the signature box.

STEP 2Register for GLOBAL PASS Member's Website.

You can view your shopping history and manage settings such as the transaction limits.

- *To avoid any inconvenience (e.g. not being able to shop online), please make sure to complete the registration.

How to Register

Visit GLOBAL PASS Member's Website and register User ID and Password from "Create your User ID".

Visa Secure automatically becomes active after the registration.

More details on the Visa Secure.

- *The User ID and Password should be created separately from your online banking's User ID and Password.

Convenient features on Member's Website

Viewing Usage Statements

You can view Usage Statements for Visa debit card transactions (shopping/overseas ATM use) with GLOBAL PASS for the past 15 months (date, time, store, amount, etc.).

- No printed Usage Statements will be mailed.

- You can also view Statements for your family cards. Family card users, however, can only view Usage Statements for their own family card.

Notification e-mails

If a payment cannot be deducted from your settlement account due to insufficient funds when adjusting for differences in the usage amount, an e-mail titled "Deposit Request Due to insufficient Balance" will be sent to the e-mail address you have registered on the website. And also an email will be sent to the registered email address when a setting is changed on the GLOBAL PASS Member's Website.

Change the transaction limits

You will be able to set your transaction limit for per transaction, per day and per month for shopping/overseas ATM use by yourself (Visa debit card function).

Suspension / cancellation of Visa debit card function

You will be able to suspend or cancel use of GLOBAL PASS (shopping/overseas ATMs).

Other changes

You will be able to change user ID/ Password, e-mail address and notification e-mail settings for the Member's Website.

STEP 3Check and Modify the Transaction Limit

You can change the transaction limits for shopping and withdrawals from overseas ATMs on GLOBAL PASS Member's Website.

Keeping the transaction limit to a minimum helps minimize the damage in the worst case scenario.

- *For security reasons, selectable range is partially restricted.

How to Check and Modify

Sign on to GLOBAL PASS Member's Website > Manage Services > Change Limit Control > Modify Limits

- *If you switched Banking Card (and PRESTIA Gaika Cash Card) to GLOBAL PASS, Overseas ATM withdrawal transaction limit is RESET to the GLOBAL PASS default setting regardless of your previous setting(s).

STEP 4Register for PRESTIA Alert Service

PRESTIA Alert Service sends a notification e-mail when GLOBAL PASS is used.

More details on the service.

How to Register

Sign on to online banking > Services > E-mail Registration / Maintenance > Register / Update (PRESTIA Alert Service / PRESTIA Insight)

Sign on to online banking > Services > E-mail Registration / Maintenance > Register / Update (PRESTIA Alert Service / PRESTIA Insight)

* If your registered address is overseas:

Your card will be sent in a blocked status for security reasons. Please follow the procedures below to activate the card, depending on your card usage.

- Overseas ATMs and shopping at Visa / iD merchants

Sign on to GLOBAL PASS Member's Website > Manage Services > Change Card Status

then activate your card. - ATMs in Japan and shopping with J-Debit

Please have your card and T-PIN ready and call PRESTIA Phone Banking from an account holder or visit our branch after you return to Japan.

Contact Us

- PRESTIA Phone Banking

Within Japan/Automated Voice Guidance Service

0120-110-330(toll-free)

Service hours: 8:00 - 22:00

If the above phone number is not available.

046-401-2100(charges apply)

Service hours: 8:00 - 22:00

From overseas/Automated Voice Guidance Service

81-46-401-2100(charges apply)

Service hours: 8:00 - 22:00

Others

Change your transaction limit

Transaction limits for shopping at Visa / iD merchants and withdrawals from overseas ATMs

You can change your transaction limits on the GLOBAL PASS Member's Website.

- *For security reasons, selectable range is partially restricted.

- Default setting and Selectable range increments

- The amount transacted with the family card is included in the transaction limit of your main card.

- When being deducted from PRESTIA MultiMoney Foreign Currency Savings Account, total cumulative use will be calculated based on the amount converted into Japanese yen at a rate obtained by adding the predefined commission fee (3%) to the exchange rate determined by Visa.

Transaction limits for withdrawals / transfers at domestic ATMs and shopping at J-Debit merchants

You can apply at a branch or via telephone.

- Default setting and Selectable range increments

- The above is the daily transaction limit.

- The withdrawal limit for ATMs other than Sumitomo Mitsui Banking Corporation and Seven Bank ATMs (including Japan Post Bank ATMs) is 2 million yen/day (fixed).

- The transaction limit for J-Debit can be set between 1-500,000 yen/day. The default setting is 500,000 yen/day.

- To use biometric authentication, you must register your finger vein authentication information at a branch. Please do not forget to bring your card with you.

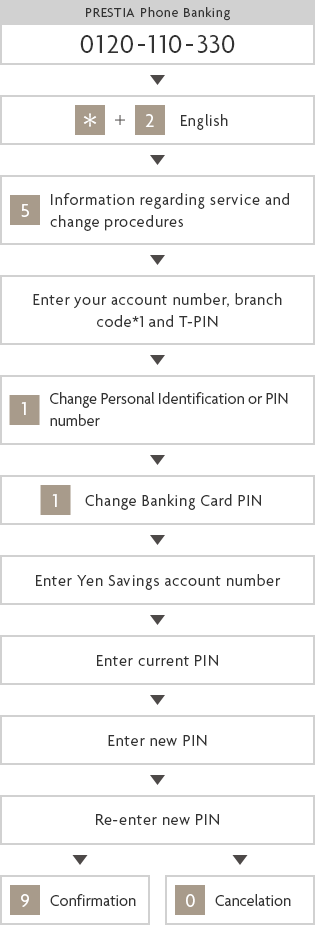

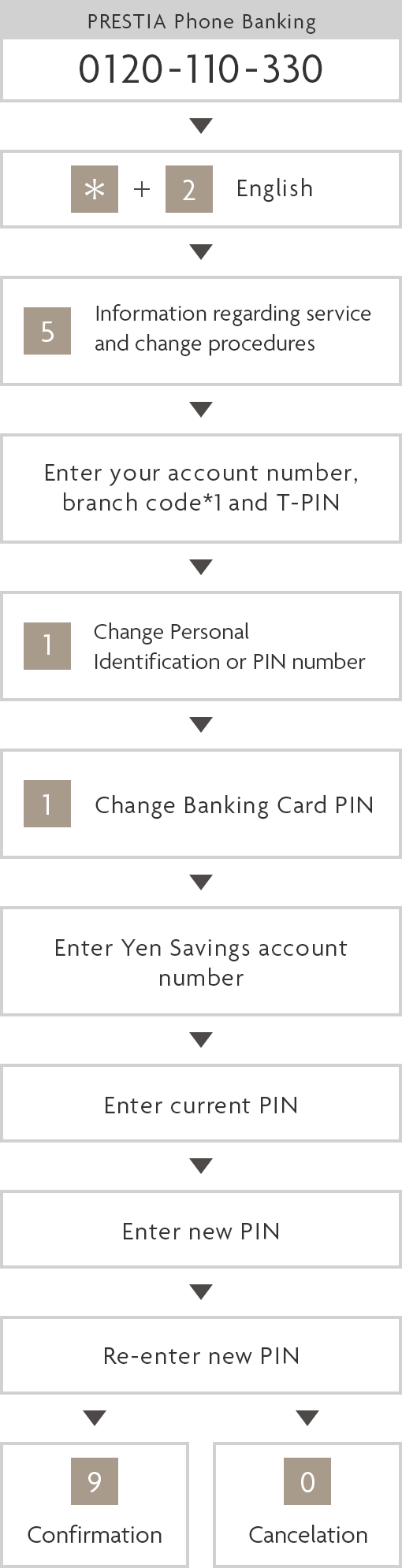

How to change your Domestic Cash Card PIN

Domestic Cash Card PIN is required to use Domestic ATMs and J-Debit.

You can make changes with PRESTIA Phone Banking's automated voice guidance service.

- Customers who opened an account on or before July 13, 2018 do not need to input a branch code.

- This service may be unavailable at certain times.

- Note that menu numbers may change. Please listen to the voice guidance before making selections.

Incorrect PIN entry

Use of your account will be temporarily suspended in order to ensure its safety if a certain number of incorrect PIN entry is attempted. When you wish to reactivate the use of your card, call PRESTIA Phone Banking and press "0" in the main menu to speak to a customer service representative following the voice guidance.

Debit PIN

Debit PIN is required for transactions other than the above, e.g. shopping at Visa merchants and transactions at overseas ATMs.

- You may be asked to sign or enter PIN even when you tap to pay with Visa or iD, depending on the transaction amount and/or conditions.

- You will not be able to change your debit card PIN. If incorrect entry attempts exceed the certain number of limit, you will no longer be able to use your current GLOBAL PASS. If you want to use your GLOBAL PASS again, you will need to issue another card.

For overseas ATM transactions, you can Release block on PRESTIA Phone Banking, if you have Debit PIN and T-PIN.

Card reissue

For details on how to card reissue, please refer to Various Procedures page.

- The new card will be sent to your registered address about 10 days after we receive the documents

Cancelling your card

Visit our branches or inquire with PRESTIA Phone Banking. We accept requests for GLOBAL PASS cancellations and change to a domestic use-only card.

- If you cancel your GLOBAL PASS, accumulated cashback amount at the time of cancellation (deposited amount or scheduled mile rewards) will be completely invalidated.

- Your family card will also be cancelled when you cancel your main card.

Card lost or stolen

If your card is lost or stolen, please call the police and us immediately at the numbers below.

You will be able to suspend use of GLOBAL PASS (shopping/overseas ATMs) on the Member's Website.

From overseas

(toll-free) 24 hours a day, 365 days a year

- Ireland, U.K., Israel, Italy, Austria, the Netherlands, Switzerland, Sweden, Spain, Taiwan, China (major cities), Denmark, Germany, New Zealand, Norway, Hungary, Philippines, France, Belgium, Portugal, Macao, Malaysia, Luxembourg

- 00-800-81-110-330

- South Korea, Singapore, Thailand, Hong Kong

- 001-800-81-110-330

- Mainland US, Canada, Hawaii

- *Calls from the United States are limited to Verizon (landline only).

- 011-800-81-110-330

- Australia

- 0011-800-81-110-330

- Finland

- 990-800-81-110-330

- Other than the above(charges apply)

- 81-46-401-2126

- Depending on region or location, you may be unable to use your mobile phone, or may be charged service fees and / or local call charges even if able to use it. You may also be unable to use the phone from certain hotels or public telephones. If you call from a hotel, etc., you may be billed separate service fees and/or telephone charges, etc.

- Note that this service may be changed or discontinued at any time without prior notice.

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQs about switching to GLOBAL PASS

Japanese

Japanese English

English