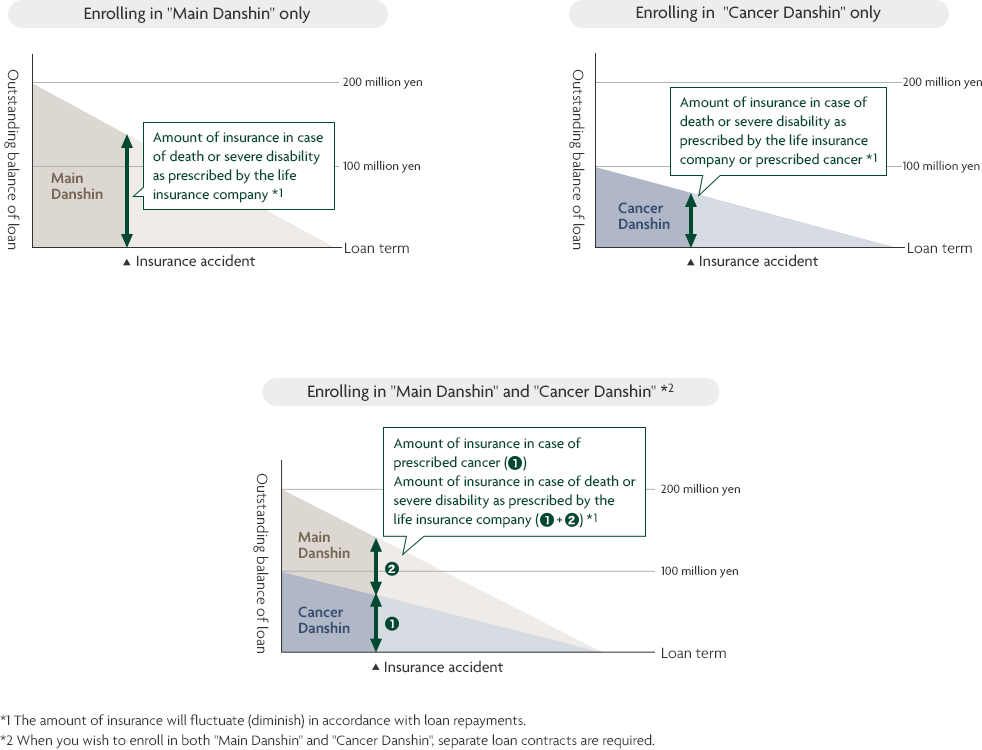

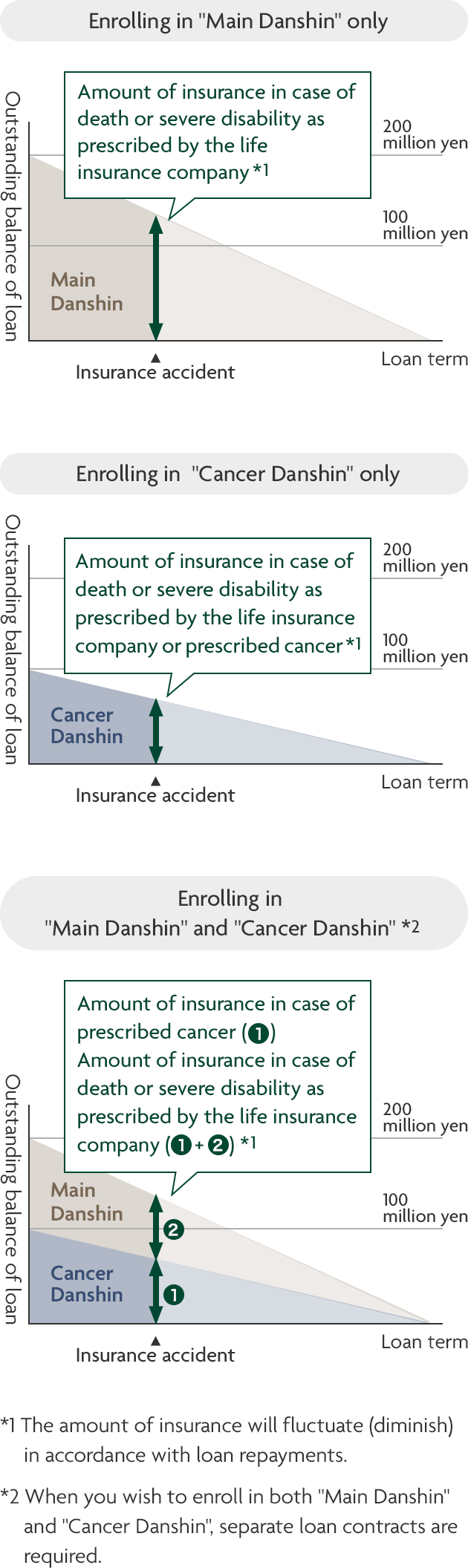

Group Credit Life Insurance insures up to 200 million yen ("Main Danshin")

SMBC Trust Bank's "Danshin (main contract)" covers the loan balance up to 200 million yen* and provides coverage for the purchases of high-end properties.

- *Applied to those insurance applications with notification date on or after April 1, 2024.

Coverage of up to 100 million yen for prescribed cancer ("Cancer Danshin" *1)

By adding the rider of cancer coverage with living needs rider appended to "Danshin (main contract)", the coverage would be not only in the event of death or prescribed severe disability but also in the event that a doctor diagnoses a prescribed cancer*2 or a life expectancy is judged to be within 6 months*3.

- *1Applied to those insurance applications with notification date on or after April 1, 2024. The living needs rider is appended with the rider of cancer coverage. Only one of these cannot be added to "Danshin (main contract)". When the rider of cancer coverage is added, 0.1% will be added on the applicable interest rate for the entire loan term (discount on the base interest rate will be adjusted).

- *2The cancer insurance coverage is not payable in the following cases.

- In the event that the diagnosis of malignant neoplasm is confirmed by the doctor prior to the liability start date of the "Cancer Danshin" policy.

- In the event that the diagnosis of malignant neoplasm is confirmed within 90 days including the liability start date.

- In the case of intraepithelial cancer and skin cancer other than malignant melanoma of the skin.

- *3The determination of life expectancy is made by the life insurance company based on the diagnosis of a doctor designated by the life insurance company.

About Group Credit Life Insurance

Images of insurance coverage

About enrollment in "Danshin"

The age for joining "Danshin" is from 18 to 72 years old (from 18 to 50 years old for "Cancer Danshin"), and continuation age of insurance is up until birthday of 80 years old.

In principle, all customers who take out a loan are required to subscribe to "Danshin". When the rider of cancer coverage is added, 0.1% will be added on the applicable interest rate for the entire loan term (discount on the base interest rate will be adjusted).

Please note that you may not be able to enroll in the "Danshin" policy depending on your health conditions or with any other factors.

About notification of your health conditions

You will be asked to notify of your health condition, etc. in advance. "Notify" means to tell the bare fact. Please note that the insurance money may not be paid (= the debt may not be covered) if there is any willful misconduct or gross negligence and the fact was not notified or incorrectly notified for insurance contract will be invalidated as "violation of obligation to notify".

"Danshin" can be applied for via "Net De Danshin"*, a group credit life insurance internet service.

- *This service is available only to those who have a user ID and password provided by SMBC Trust Bank.

About insurance premiums

SMBC Trust Bank will cover premiums for "Main Danshin".

The liability start date

The liability start date is the date of SMBC Trust Bank loan disbursement (borrowing date) or the date on which the life insurance company accepts the customer's insurance enrollment, whichever is later.

Situations in which insurance money will be paid

The requirements prescribed by the life insurance company for payment of severe disability claims are different from the official disability certification standards, etc.

Below are the situations in which the insurance money may not be paid.

- When the prescribed requirements are not met during the insurance period

- If the insured person commits suicide within 1 year from the liability start date

- If the insurance contract is invalidated because of the violation of obligation to notify

- If the insured person receives a prescribed disability on purpose

- If the insured person gets injured or becomes ill and falls into the situation of prescribed disability before the liability start date

- If the insured person is killed or gets disabled (as prescribed) by an act of war or other disturbance

- If the insurance contract is invalidated because of fraud from the insurance policy holder or the insured person

- If there is an objective to receive insurance money illegally by himself/herself or from others

- If all or part of the insurance contract is invalidated because the insurance policyholder, the insured person, or the insurance money recipient has the objective to exploit the insurance money and make an insurance accident(s) intentionally, or they come out to fall under Anti Social Force, or any other significant reasons

Underwriting Life Insurance Company (Organizer)

The Dai-ichi Life Insurance Company, Limited

- *For borrowers who already have a loan with SMBC Trust Bank and are covered by group credit insurance from Mitsui Sumitomo Aioi Life Insurance Campany, there will be no change in coverage.

This page provides an overview of the insurance program "Danshin" for our customers who use our loans with SMBC Trust Bank as the policyholder. This description is not an insurance solicitation.

To enroll in the insurance, please be sure to read "Group Credit Life Insurance Document for Insured Person (Summary of Contract and Information for Attention)" and confirm about insurance accident definition and situations in which insurance money may not be paid.

Application for "Danshin"

Flow of procedures

STEP

Apply for loan

Complete your loan application on the dedicated loan web page.

STEP

Access "Net De Danshin"

Receive user ID and initial password from the bank staff to access "Net De Danshin".

STEP

Apply for group credit life insurance

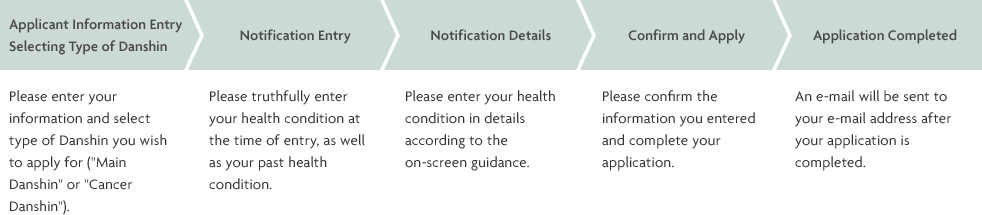

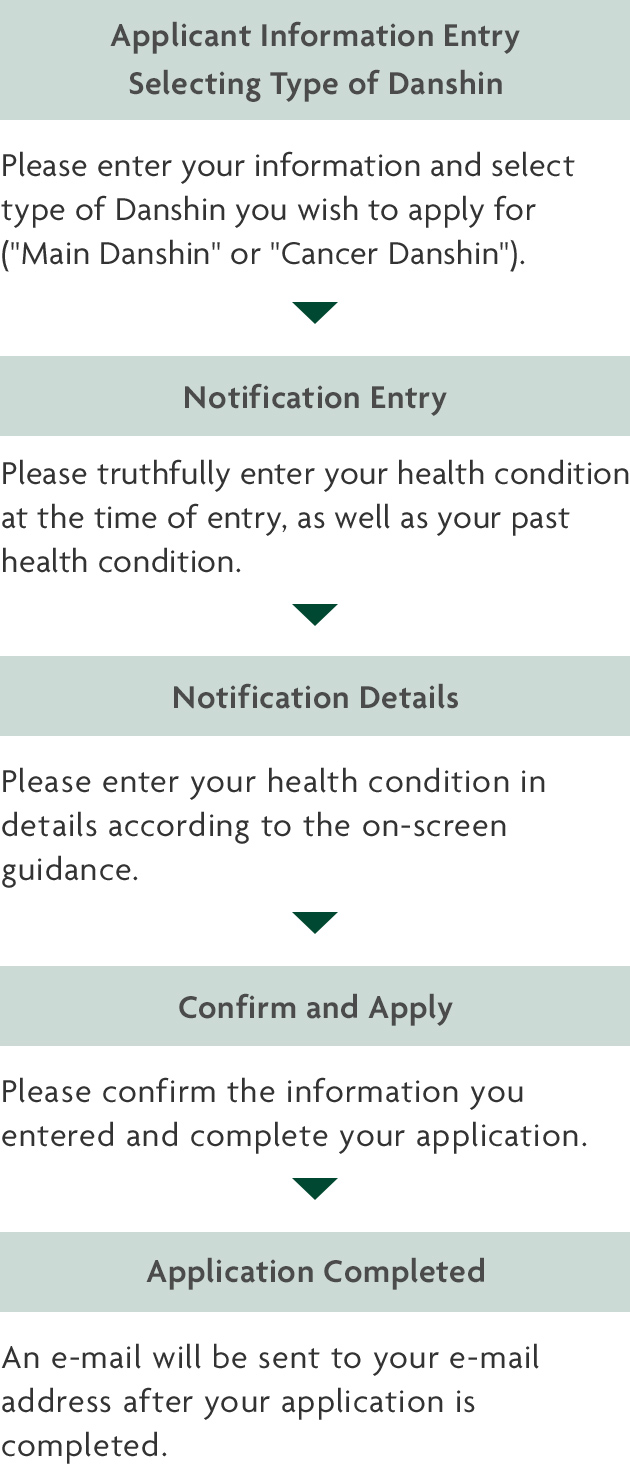

Determine which type of group credit life insurance you wish to apply for in advance ("Main Danshin" or "Cancer Danshin") and apply through "Net De Danshin".

- When you log in to "Net De Danshin" for the first time, please log in with your user ID and initial password. Then please change your password to any other password you like.

- Please read and agree to "Summary of Contract and Information for Attention" and the on-screen notes to proceed to the notification procedure.

Flow of notification procedures

Please read the on-screen notes carefully and follow the instructions to inform your health condition.

- "Net De Danshin" is a Japanese website. Please ask the bank staff if you would like to refer to the English language supplementary materials.

- The Danshin application procedure must be completed by the individual who will be taking out the loan.

- Please enter the user ID and initial password provided by the bank staff when logging in to "Net De Danshin" for the first time.

- When you change your initial password to any password, we recommend that you use a password of sufficient length, such as 12 digits or more, to enhance the security of your account. Please avoid passwords that are simple and easy to guess, contain personal information, or are identical to other services.

- If the same password is set for other services, we recommend that you change it to a different password.

- If the loan amount exceeds 50 million yen, health certificate prescribed by the life insurance company is required. Health certificate form can be downloaded from the screen after the notification is completed.

- Please submit health certificate to the life insurance company by uploading it from the URL provided in the e-mail sent from the company or by sending it by postal mail to the address specified by the company.

Japanese

Japanese English

English