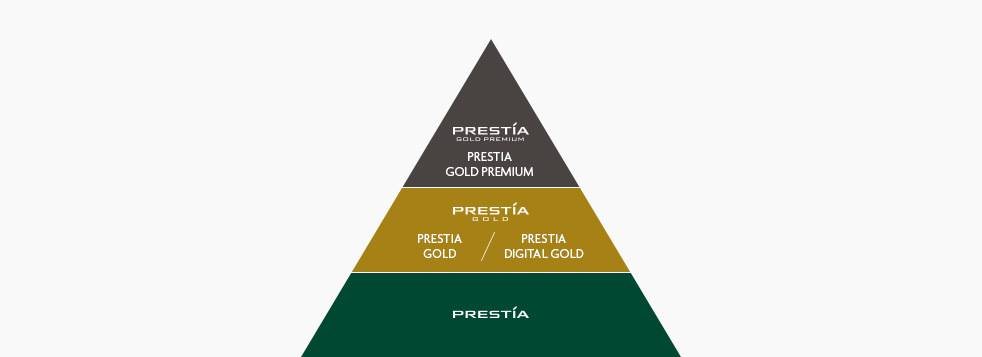

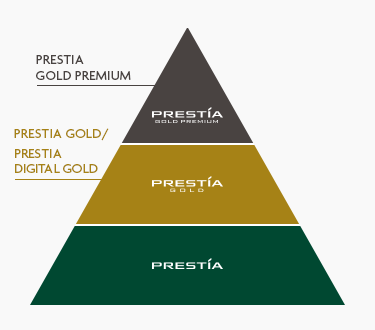

We offer special status and better privileges depending on your patronage.

◎ You must meet both requirements ① and ② in yen conversion.

Status Privileges

Service fee discount

- *1Basically applicable to transactions completed via online banking. For details, please refer to the Service Fee List.

- *2When using ATMs, transfers in cash is not applicable. In addition, certain conditions shall apply to the transfers with a cash card. For details, please refer to the Service Fee List.

- *3Certain conditions shall apply to the reimbursement. For details, please refer to the Service Fee List.

- *4Discounts on foreign exchange fees will be calculated by rounding down any numbers beyond two decimal places in fractional units of the foreign currency in question. Therefore, the final discount rate may not become 70% in some cases.

For customers with a Total Average Monthly Relationship Balance for the month before the previous month equivalent to 1 million yen or more

- Fees will be discounted for domestic yen fund transfers to other banks and overseas remittances via online banking.

For customers with a Total Average Monthly Relationship Balance of the previous month equivalent to 500,000 yen or more, or with a balance in foreign currency portion equivalent to 200,000 yen or more

- The monthly account maintenance fee (2,200 yen including tax) will be waived.

Privileges to GLOBAL PASS (Multi Currencies Visa Debit with Cash Card)

We offer cash cards according to your status. You can choose from two types; cashback bonus or mile benefits.

| PRESTIA | |

|---|---|

|

|

| GLOBAL PASS cashback bonus (for shopping at Visa merchants overseas) |

0.25% |

| ANA MILEAGE CLUB GLOBAL PASS mile benefits (based on annual increase in foreign currency deposit balance) |

5 miles per 10,000 yen equivalent |

| ATM owner charge for using overseas ATMs | - |

- *The maximum miles to be rewarded based on the annual increase in foreign currency deposit balance are 10 million miles per year.

- *When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

- *If you have a cash card other than GLOBAL PASS, you can switch to GLOBAL PASS via online banking. See here for details.

- *If you have a cash card other than GLOBAL PASS, you can switch to GLOBAL PASS via online banking. See here for details.

More details on privileges to GLOBAL PASS

Other than the above, we provide customers with a PRESTIA GOLD or higher status with various privileges including wealth management assistance by dedicated consultants. More details

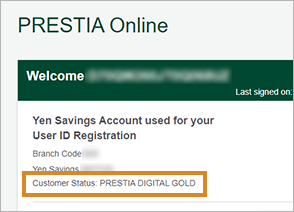

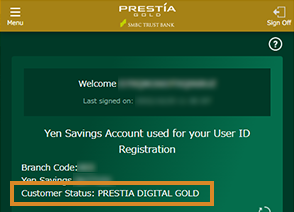

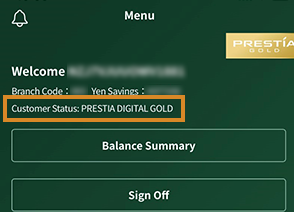

How to check your status

You can check your status via online banking.

*A status is shown only for PRESTIA DIGITAL GOLD/PRESTIA GOLD/PRESTIA GOLD PREMIUM customers.

PRESTIA Online > Home

PRESTIA Mobile > Home

App > Menu

(Sample images: PRESTIA DIGITAL GOLD)

Timing of status change

Status reflection (upgrading)

- *Please note that the bank may be unable to provide you with the status based on comprehensive judgment. We kindly ask for your understanding.

- *The timing of status reflection may be delayed. Please make sure, before making a transaction, to check your status at the time of transaction.

Termination or change of status

The bank may terminate or change your status if the requirements for each status have not been met for a certain period of time.

About the Monthly Account Maintenance Fee

SMBC Trust Bank PRESTIA automatically withdraws a monthly account maintenance fee of 2,200 yen (including tax) from your account on the second business day of each month.

However, this fee is waived if any one of the conditions below is satisfied.

Conditions for a waiver of the monthly account maintenance fee

| Transactions eligible for a fee waiver | Conditions | |

|---|---|---|

| 1 | Total Average Monthly Relationship Balance | The balance for the previous month is equivalent to 500,000 yen or more. |

| 2 | Total Average Monthly Relationship Balance (foreign currency portion) | The balance in foreign currency for the previous month is equivalent to 200,000 yen or more. |

| 3 | Loans | Having a loan balance as of the end of the previous month (excluding PRESTIA MultiMoney Credit). |

| 4 | PRESTIA MultiMoney Credit | Having a PRESTIA MultiMoney Credit loan balance as of the specific time on the final business day of the previous month designated by SMBC Trust Bank. |

| 5 | Affiliated credit card of SMBC Trust Bank | Being the credit card holder as of the 25th of the previous month (or if the 25th falls on Sat/Sun/national holiday, as of the previous business day). |

| 6 | Foreign Currency Deposit Service | Having applied for Foreign Currency Deposit Service and deposited certain times after the initial withdrawal. |

◎Different conditions are applied to customers eligible for various other preferential programs. Please contact us for more details.

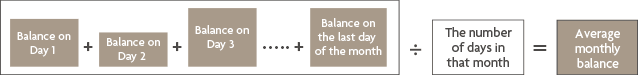

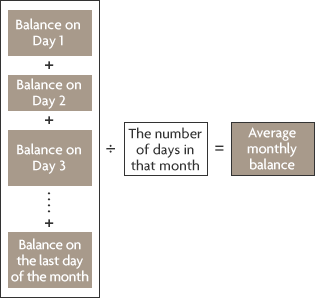

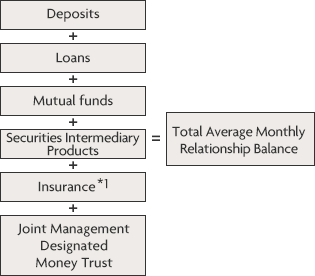

What is the Total Average Monthly Relationship Balance?

"Total Average Monthly Relationship Balance" is the sum of the average monthly balances of each product in your SMBC Trust Bank PRESTIA accounts. Your Total Average Monthly Relationship Balance is written in your bank statement.

Note: This is not the same as the balance as of the end of the month.

① Add up the end-of-day balances for each product and divide by the number of days in that month to calculate the 'average monthly balance'.

② Add up the 'Average Monthly Balance' for each product to calculate the Total Average Monthly Relationship Balance.

- *1For insurance products, the Total Average Monthly Relationship Balance is calculated based on the balance as of the last business day of every month. The balance of insurance product will not be reflected in your Total Average Monthly Relationship Balance within about a year after the end of the contract.

What is the Total Average Monthly Wealth Management Balance?

Total Average Monthly Wealth Management Balance is the sum of the average monthly balances of each asset management product in your SMBC Trust Bank PRESTIA accounts. (Your Total Average Monthly Wealth Management Balance is not written in your bank statement.)

<Products included>

■ Foreign Currency Deposit

■ 25% of loan balance

■ Mutual Funds

■ Securities Intermediary Products

■ Insurance products (differences may arise for certain products or some may not be included in the calculation)

■ Joint Management Designated Money Trust

- *Structured Deposit in Japanese yen is not included.

First month of monthly account maintenance fee withdrawal < quick reference table >

Monthly account maintenance fees are waived for the first three months for all customers, including the month in which the account was opened*1.

- *1Please note if you put in an application for account opening at the end of a month, your account opening month may become the following month.

- *2A monthly account maintenance fee is withdrawn on the second business day of each month.

Japanese

Japanese English

English