GLOBAL PASS®

GLOBAL PASS(Multi Currencies Visa Debit with Cash Card)

GLOBAL PASS is a cash card with Visa debit service that can be used in 18 currencies including Japanese yen.

You can use foreign currencies directly from your account.

- You can enjoy shopping at stores with Visa logo around the world.

- Easy tap to pay service by Visa and iD.

- Withdraw local currency from overseas ATMs with Visa or PLUS logo.

- Earn cashback or ANA miles by overseas usage.

- Family Cards are available.

Two types of cards are available

Free of annual fee.

Expiration date : Printed on the card mount and on the front side of the card.

- *We will send a new card to your registered address approximately 2 months before your card expiration date.

GLOBAL PASS

With cashback bonus

Cashback bonus of 0.25 - 1.5% for the amount spent at Visa merchants overseas will be provided in Japanese yen

ANA MILEAGE CLUB GLOBAL PASS

With ANA mile benefits

300 miles presented by opening a new account

You can earn miles not only by shopping and ATM transaction abroad but also Yearly increase in foreign currency deposit.

* Ineligible Transactions are Visa debit use of Account Funding Transaction and Original Credit Transaction.

Issuance fee

Main Card : Free

Family Card : Free

Personal Identification Number (PIN)

There are three types of PINs used for different purposes.

- Domestic Cash Card PIN

- Used at domestic ATMs or to shop at J-Debit merchants.

- Debit PIN*

- Used to shop at Visa/iD merchants and at overseas ATMs

- T-PIN

- Used for PRESTIA Phone Banking.

- *Please note that your card must be reissued to set a new Debit PIN if you change your Debit PIN, forget your Debit PIN or enter incorrect Debit PIN multiple times.

In case of switching over the phone

- Both PINs are same since the same PIN as "Domestic Cash Card PIN" is set for the "Debit PIN".

- Your Debit PIN is not automatically changed even when you change the Domestic Cash Card PIN afterwards.

- If you change your Debit PIN after issuance, you will need to reissue it.

- Once the switching procedure is completed over the phone, it will be issued and delivered accordingly.

- We will send you a card with the User's Guide enclosed. Please read it carefully.

- Please register for the GLOBAL PASS Member Website instructed in the User's Guide.

- If you do not plan to use the card, you can lower the usage limit after the registration.

- If you select ANA Mileage Club GLOBAL PASS:

If the ANA Mileage Club number you provided was incorrect or if you did not tell us the number at the switching, please link your existing ANA Mileage Club number with the ANA Mileage Club number printed on the card on the ANA website by yourself.

GAIKA FULL BACK

This service allows you to make settlements by covering the full amount with your Yen Savings Account if the balance of the transacting foreign currency in your PRESTIA MultiMoney Account is insufficient.

- The total transaction amount will be converted into Japanese yen at a rate obtained by adding the predefined commission fee (3%) to the exchange rate determined by Visa. However, when a Visa merchant store or a company that owns an overseas ATM determines the charge amount by converting the transaction amount into Japanese yen using its own exchange rate, then the total transaction amount will be deducted from your Yen Savings Deposit account whether or not you have chosen to use the GAIKA FULL BACK service.

- You can set "On" or "Off" to GAIKA FULL BACK.

- If GAIKA FULL BACK status is "Off" and your balance of the relevant currency is insufficient, or if GAIKA FULL BACK status is "On" but the balance of your Yen Savings Account is insufficient, you will not be able to shop at Visa merchant stores overseas or withdraw from overseas ATMs.

- When an additional withdrawal is made at a merchant due to rebill after cancellation, split charges or the difference in bills, or when only final value ("Fixed") was charged without a confirmation of the validity of your debit card when used, the amount may be withdrawn from the corresponding foreign currency deposit regardless of the GAIKA FULL BACK setting. When the balance is short in the account, we will exchange the equivalent amount of the insufficient funds into the foreign currency from Japanese Yen and debit it if your balance of your Yen Savings Deposit account is enough, or please deposit into your debit card settlement account if you do not have enough balance.

- GAIKA FULL BACK may not be applicable to certain transactions depending on the processing systems used at Visa merchants.

Cannot use foreign currency intended or make a transaction overseas

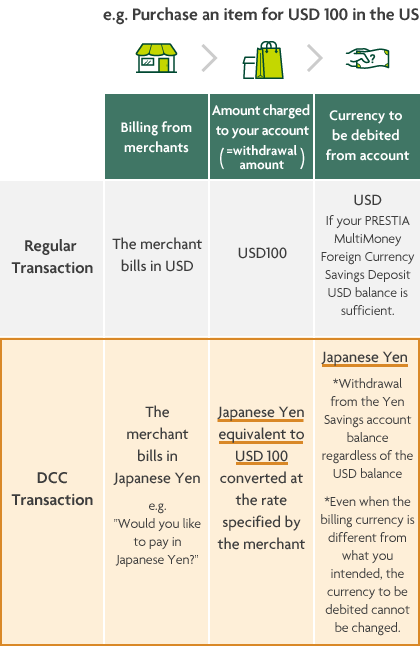

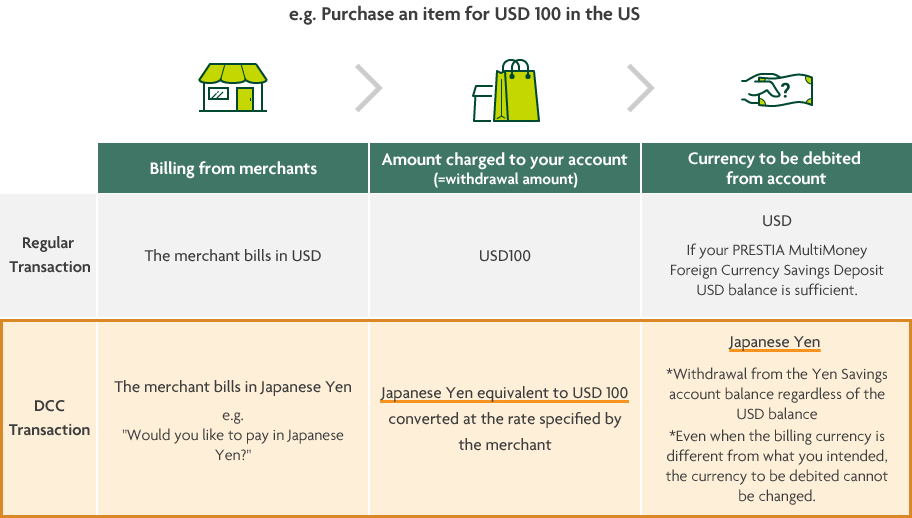

- 1Dynamic Currency Conversion (DCC)*1

Dynamic Currency Conversion (DCC) provided by merchants is a different service from GAIKA FULL BACK, provided by SMBC Trust Bank.

When you select DCC, the transaction amount is converted to Japanese Yen by the merchant and deducted from Yen Savings Account even if your GAIKA FULL BACK setting is OFF.

- *1DCC service, which gives you an option to choose the settlement currency from local currency, Japanese Yen or other currency (e.g. Euro in UK), may be provided when shopping and withdrawing cash overseas as well as shopping online at overseas sites.

If you choose a currency other than local currency, the transaction may be deducted in Japanese Yen from your account. SMBC Trust Bank does not have the authority to change DCC transactions into foreign currency transactions or GAIKA FULL BACK transactions, so please pay close attention to the display on ATMs or payment terminals when making transactions.

- *Some merchants and ATMs may charge in Japanese Yen without displaying the screen to select the currency.

(Examples to be shown on the screen)- "DCC" "CONVERSION" "Exchange Rate" "Wholesale Rate" "MARKUP"

- "JPY" "Home Currency"

- *The foreign exchange rate applied in DCC transactions for Japanese Yen or other currency is set by the merchant and is often unfavorable compared to the rate offered by banks or credit card companies.

- 2Merchants not accepting debit cards

Some overseas merchants (e.g. gas stations, in-flight sales) may impose restrictions on the use of debit cards. We are not able to investigate or negotiate which merchants have restrictions on card usage.

- 3Card settings, account status, etc.

GLOBAL PASS may not be used for the following reasons:

- Your payment exceeding your Shopping Limit

- Your payment exceeding the balance of your settlement account

- Visa Secure has not been activated yet.

Please see here for details.

- 4Security restrictions

To prevent card frauds by third parties, ensuring that customers feel safe using their cards, SMBC Trust Bank may temporarily suspend the use of the card at its discretion. We ask the account holder to call PRESTIA Phone Banking.

- 0120-110-330 Within Japan (toll-free)

- 81-46-401-2100 From overseas (charges apply)

Unavailable transactions

GLOBAL PASS cannot be used for:

- Transactions which the settlement amount is determined after the card is presented.

e.g. highway tolls, gas stations, etc. - Offline transactions

e.g. in-flight sales, some taxis and vending machines, etc. - Online casino transactions

- Transactions at overseas crypto-assets merchants

- *In addition to the above, you may be unable to use GLOBAL PASS due to circumstances of individual merchants.

Notes

- Any discrepancies between the spending information received from the merchant store where the card was used and the sales confirmation notice sent at a later date by the merchant due to foreign exchange rate differences, etc. will be adjusted through either a deposit or a deduction. In some cases, billing and payment may take place at a later date for the store's reasons.

- In the event of cancellation or return, a refund will be provided with the designated method after the spent amount has been deducted from your settlement account. Note that refunds may require some time.

- At some merchant stores, transactions in amounts exceeding the settlement account balance may be processed. In such cases, your transaction will be completed, but SMBC Trust Bank will make the payment on your behalf due to insufficient balance in your settlement account, and you will be requested to make a deposit into your settlement account as soon as possible. Please understand in advance that your membership qualification may be cancelled if we are unable to debit for a certain period after the occurrence of insufficient funds.

- Make sure to go through your Bank Statements and Usage Statements, and contact PRESTIA Phone Banking if you find any suspicious transactions. You can view your Bank Statements on online banking and your Usage Statements on the GLOBAL PASS Member Website.

- By using the card after receiving the card, you agree to the GLOBAL PASS membership agreement spontaneously.

Japanese

Japanese English

English