Using Overseas

Select your purpose

- Shopping

- ATM

Shopping

Accepted at

Visa merchants (stores/online shops)

Major Websites & Apps Accepting GLOBAL PASS

Tap to Pay

Merchant with a Tap to Pay logo

Settlement account and currency

When using 17 applicable currencies

The full amount will be debited from PRESTIA MultiMoney Account Foreign Currency Savings Deposit as long as the balance is sufficient.

- PRESTIA MultiMoney Account Foreign Currency Savings Deposit handles Chinese Yuan Offshore only.

- Chinese Yuan Offshore can be used for settlement in China.

- As a U.S. Dollar Savings Account cannot be used for settlement, funds must be transferred to PRESTIA MultiMoney US Dollar Savings Deposit.

What if your account balance runs low?

When GAIKA FULL BACK is "ON", the full amount will be debited from your Yen Savings Account.

- See the notes.

When using currencies other than above

The full amount will be debited from your Yen Savings Account.

- *The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa. However, some merchants may convert at their own exchange rates.

- *Note that the amount will not be debited from PRESTIA MultiMoney Yen Savings Deposit.

Benefits

GLOBAL PASS

| PRESTIA | PRESTIA GOLD/ PRESTIA DIGITAL GOLD |

PRESTIA GOLD PREMIUM |

|---|---|---|

| 0.25% | 1.00% | 1.50% |

ANA MILEAGE CLUB GLOBAL PASS

1 mile per 10,000 yen equivalent

- *The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized.

- *Ineligible Transactions are Visa debit use of Account Funding Transaction and Original Credit Transaction.

- *When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

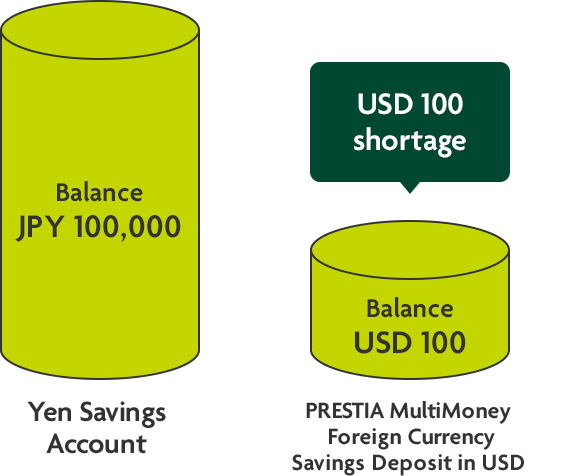

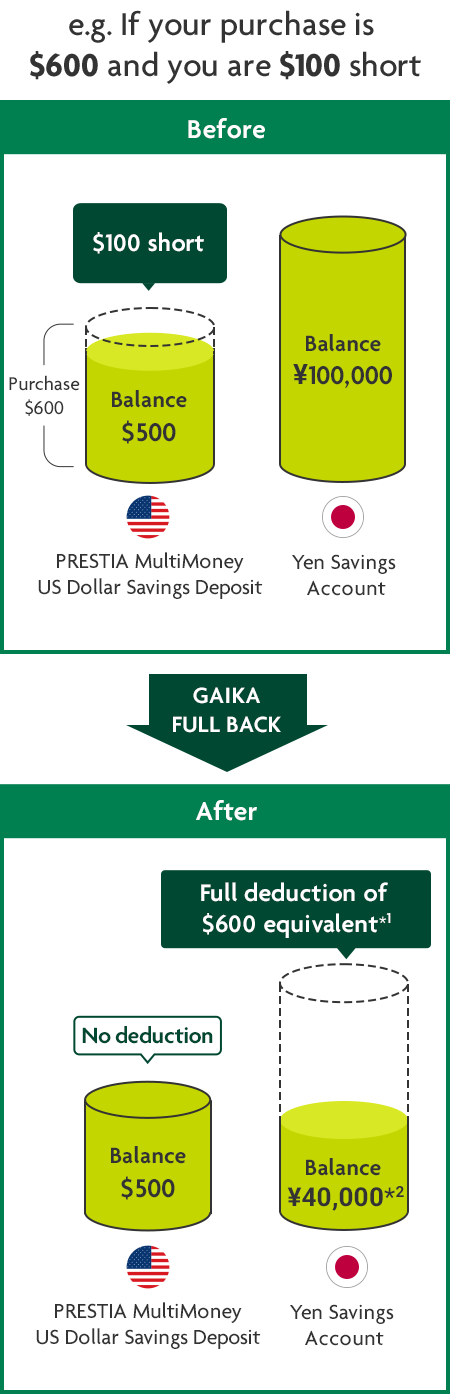

GAIKA FULL BACK

- covers when your foreign currency balance is insufficient

GAIKA FULL BACK is a service whereby the full transaction amount is deducted from your Yen Savings Account when the balance in your Foreign Currency Savings Deposit is insufficient. You will be able to use your card overseas without worrying about your foreign currency balance.

*1 The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa.

*2 Estimated based on a Visa exchange rate of $1 = ¥100, including a 3% commission fee.

How to change

You can set GAIKA FULL BACK "On" or "Off" via online banking.

- PRESTIA Online / Mobile

Menu > Services > GLOBAL PASS (Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

Menu > Services > GLOBAL PASS (Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

- App

Menu > Products/Service > Debit Card > GLOBAL PASS(Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

Notes

How to Use

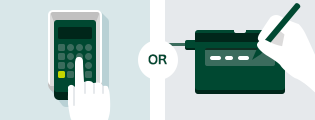

When shopping with Visa

-

Present your GLOBAL PASS

Tell them you will pay with Visa. If they ask you about the number of payments, tell them "one-time".

- Installment payments are not available.

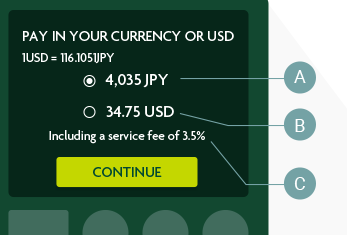

When you need to choose the currency for payment

Currency selection varies by terminal.

- AJPY to be withdrawn from Yen Savings Account

The transaction amount is calculated based on the exchange rate determined by the local merchant and is withdrawn from Yen Savings Account even if GAIKA FULL BACK is OFF.

- BUSD to be withdrawn from PRESTIA MultiMoney US Dollar Savings Deposit

If you prefer to pay in the local currency, please confirm with the merchant that the payment is settled in the local currency.

- *IF GAIKA FULL BACK is ON and the balance of the PRESTIA MultiMoney Account is insufficient, the amount will be withdrawn from Yen Savings Account.

- CService fee included in A

-

Input your debit PIN

At stores displaying this logo, just tap to pay!

- You may be asked to enter PIN even when you tap to pay, depending on the transaction amount and/or conditions.

-

View Usage Statements

The transaction details can be viewed on the GLOBAL PASS Member's Website.

We also recommend registering for PRESTIA Alert Service in advance to receive email notifications for each transaction.

When shopping online

Notes

Unavailable transactions

GLOBAL PASS cannot be used for:

- Transactions which the settlement amount is determined after the card is presented.

e.g. highway tolls, gas stations, etc. - Offline transactions

e.g. in-flight sales, some taxis and vending machines, etc. - Online casino transactions

- Transactions at overseas crypto-assets merchants

- *In addition to the above, you may be unable to use GLOBAL PASS due to circumstances of individual merchants.

Additional charges may occur separately from accommodation fees and deposits

At hotel check-in, additional charges may occur due to card validity checks or credit limit verifications, separate from accommodation fees and deposits.

Refunds may take up to 20 days. If you need an immediate refund, please contact the hotel.

Deposits cannot be used until refunded to your account

At hotel check-in or when using rental cars, a full or partial amount of the fee may be charged as a deposit, which will be deducted from your account balance. The charged deposit amount cannot be used until it is refunded to your account. More details

A small amount may be deducted for card verification

When registering or using your card for online shopping, a small amount may be charged to verify card validity. Refunds may take up to 20 days.

- At some merchants, transactions in amounts exceeding the settlement account balance may be processed. In such cases, your transaction will be completed, but SMBC Trust Bank will make the payment on your behalf due to insufficient balance in your settlement account, and you will be requested to make a deposit into your settlement account as soon as possible. Please understand in advance that your membership qualification may be cancelled if we are unable to debit for a certain period after the occurrence of insufficient funds.

- Any discrepancies between the spending information received from the merchant store where the card was used and the sales confirmation notice sent at a later date by the merchant due to foreign exchange rate differences, etc. will be adjusted through either a deposit or a deduction. In some cases, billing and payment may take place at a later date for the store's reasons.

- In the event of cancellation or return, a refund will be provided with the designated method after the spent amount has been deducted from your settlement account. Note that refunds may require some time.

Related Information

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQ about switching to GLOBAL PASS

Japanese

Japanese English

English