Using Overseas

Select your purpose

- Shopping

- ATM

ATM transactions

Available ATMs

ATMs with a Visa or PLUS logo

Settlement account and currency

When using 17 applicable currencies

The full amount will be debited from PRESTIA MultiMoney Account Foreign Currency Savings Deposit as long as the balance is sufficient.

- PRESTIA MultiMoney Account Foreign Currency Savings Deposit handles Chinese Yuan Offshore only.

- Chinese Yuan Offshore can be used for settlement in China.

- As a U.S. Dollar Savings Account cannot be used for settlement, funds must be transferred to PRESTIA MultiMoney US Dollar Savings Deposit.

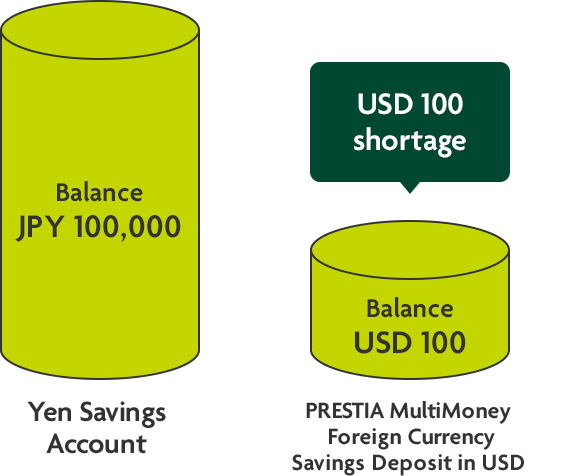

What if your account balance runs low?

When GAIKA FULL BACK is "ON", the full amount will be debited from your Yen Savings Account.

- See the notes.

When using currencies other than above

The full amount will be debited from your Yen Savings Account.

- *The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa. However, some merchants may convert at their own exchange rates.

- *Note that the amount will not be debited from PRESTIA MultiMoney Yen Savings Deposit.

ATM service fees

Free

- *The owners of ATMs may charge an additional fee separately. However if you meet all of the conditions, the fee will be reimbursed.

Benefit

1 mile per 10,000 yen equivalent for ANA MILEAGE CLUB GLOBAL PASS

- *The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized.

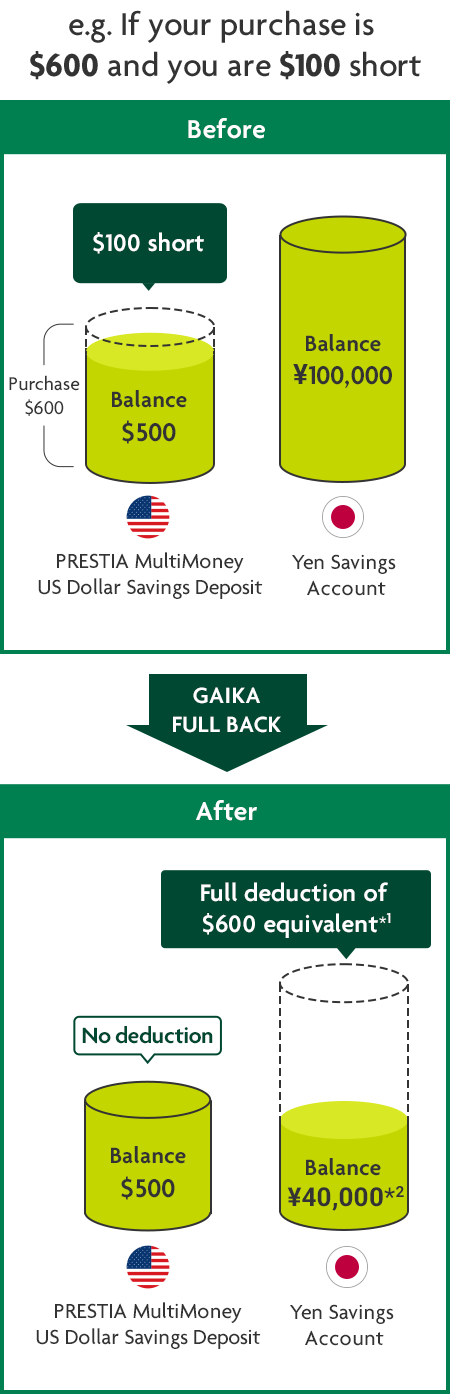

GAIKA FULL BACK

- covers when your foreign currency balance is insufficient

GAIKA FULL BACK is a service whereby the full transaction amount is deducted from your Yen Savings Account when the balance in your Foreign Currency Savings Deposit is insufficient. You will be able to use your card overseas without worrying about your foreign currency balance.

*1 The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa.

*2 Estimated based on a Visa exchange rate of $1 = ¥100, including a 3% commission fee.

How to change

You can set GAIKA FULL BACK "On" or "Off" via online banking.

- PRESTIA Online / Mobile

Menu > Services > GLOBAL PASS (Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

Menu > Services > GLOBAL PASS (Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

- App

Menu > Products/Service > Debit Card > GLOBAL PASS(Multi Currencies Visa Debit with Cash Card) > GAIKA FULL BACK

Notes

How to Use

Basic Operating Procedures

-

Insert card

* Insert your card in the direction of IC chip

- Balance inquiry is not available.

-

Input your 4-digit Debit PIN and press ENTER to confirm

- The confirmation button may be YES OK or CORRECT.

- If you are asked to input a 6-digit PIN, use a different ATM.

-

Press WITHDRAWAL or GET CASH

- CASH ADVANCE is not available with GLOBAL PASS.

-

Press SAVINGS ACCOUNT

- You can also make a withdrawal by selecting CURRENT ACCOUNT or CHECKING ACCOUNT.

-

Enter the amount and press the confirmation button

When entering the amount yourself

$20.00

When selecting the fixed amounts

20 200 50 500 100 Other

Some ATMs may offer the option for a DCC (Dynamic Currency Conversion) transaction.

If you accept the DCC transaction, the amount will be converted using the terminal's exchange rate instead of our predetermined exchange rate and withdrawn from your Yen Savings Account.

![[Sample] YOU MAY SELECT TO PERFORM THIS TRANSACTION IN YOUR HOME CURRENCY (A) CASH WITHDRAWAL 20 EUR (B) ATM ACCESS FEE 4.95 EUR (C) TOTAL AMOUNT 24.95 EUR (D) TERMINAL EXCHANGE RATE 0.0054 EUR = 1.0000 JPY (E) INCLUDES 14.95% MARKUP (F) YOUR ACCOUNT CHARGE WITH CONVERSION 4,589 JPY (G) DECLINE CONVERSION (H) ACCEPT CONVERSION flag image](/en/product/globalpass/overseas/atm/images/img_10.png)

![[Sample] YOU MAY SELECT TO PERFORM THIS TRANSACTION IN YOUR HOME CURRENCY (A) CASH WITHDRAWAL 20 EUR (B) ATM ACCESS FEE 4.95 EUR (C) TOTAL AMOUNT 24.95 EUR (D) TERMINAL EXCHANGE RATE 0.0054 EUR = 1.0000 JPY (E) INCLUDES 14.95% MARKUP (F) YOUR ACCOUNT CHARGE WITH CONVERSION 4,589 JPY (G) DECLINE CONVERSION (H) ACCEPT CONVERSION flag image](/en/product/globalpass/overseas/atm/images/img_10_sp@2x.png)

- ACASH WITHDRAWAL :

Cash out amount - BATM ACCESS FEE :

ATM's owner fee*1 - CTOTAL AMOUNT :

A+B - DTERMINAL EXCHANGE RATE :

Exchange rate - EMARKUP :

Fee rate - FYOUR ACCOUNT CHARGE WITH CONVERSION :

Amount withdrawn from your Yen Savings Account with commission - GDECLINE CONVERSION :

Select this option if you want to withdraw from a foreign currency savings deposit or Yen Savings account at our predetermined exchange rate. The DCC transaction will be canceled. After that, some ATMs may proceed with the transaction in the local currency while others may terminate your transaction.

- *If the amount was deducted from Yen Savings Account while declining the transaction, the same amount will be refunded to your account.

- HACCEPT CONVERSION :

Withdrawn from Yen Savings Account at the terminal's exchange rate even if GAIKA FULL BACK is OFF.

- *1The fee amount (as in local currency or equivalent in yen) will be reimbursed to the executed account when the conditions below are met for PRESTIA DIGITAL GOLD, PRESTIA GOLD or PRESTIA GOLD PREMIUM customers.

- If the transaction was made from Yen Savings Account, the balance over 5,000 yen is necessary in the same account.

- If the transaction was made from PRESTIA MultiMoney Foreign Savings Account, the balance equivalent to 5,000 yen or more in withdrawn currency is necessary in the account. (The conversion to yen will be calculated with the TTB rate specified by SMBC Trust Bank as of the reimburse date.)

The DCC transaction cannot be canceled later. If you are unsure how to proceed, terminate the transaction by pressing cancel button. Make sure that the transaction is completely canceled on the screen before trying a different ATM.

- ACASH WITHDRAWAL :

-

Be sure to take your cash, card, and receipt

- If you have the option to print a receipt, always select YES and keep it.

-

Make sure that the transaction is completed on the screen before you leave

Some overseas ATMs allow multiple transactions even after you removed your card. For security, double check on the screen that the transaction is completed.

-

Check Statements

The transaction details can be viewed on the GLOBAL PASS Member's Website.

We also recommend registering for PRESTIA Alert Service in advance to receive email notifications for each transaction.

If your card was swallowed by the ATM or your cash did not come out, contact the ATM owner immediately to request a return/refund.

The negotiation will be difficult after returning to Japan.

- GLOBAL PASS use is limited to individuals. The purpose of use of funds withdrawn overseas will be limited to expenses for the overseas stay (charges and expenses for accommodation, transportation, meal or other expenses relating to basic necessities, costs of personal items and gifts, tuition fees and medical expenses, etc.)

Related Information

For customers with a cash card issued by September 2019

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

You can easily switch to GLOBAL PASS via online banking for free.

If you have not yet registered for online banking, please register here in advance.

FAQ about switching to GLOBAL PASS

Japanese

Japanese English

English