I want to purchase foreign currency when the yen reaches my desired level.

I want to receive favorable interest while waiting for the yen to appreciate.

If so, choose "Deposit in Japanese Yen".

This product entails some risks such as loss of principal. Please see here for the details.

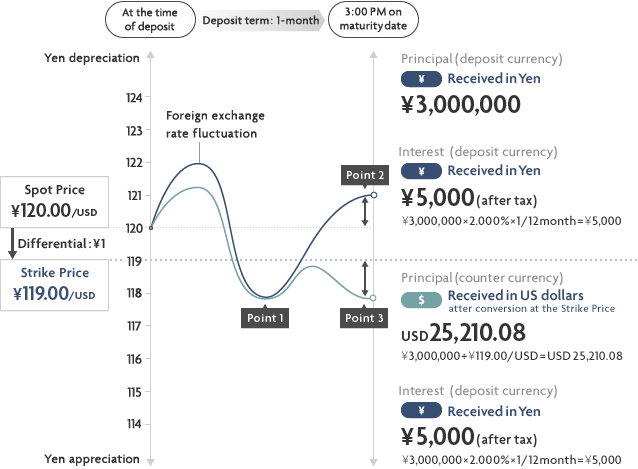

Example

Steps

STEP

1

Determine your deposit amount.

Minimum deposit amount is 1,000,000 yen or more (500,000 yen or more for transactions via online banking).

STEP

2

Select your counter currency:

USD, EUR, GBP, AUD, NZD, CAD, CHF

STEP

3

Determine your deposit term:

1 week*, 2 weeks, 1 month, and 3 months; and other terms as determined by SMBC Trust Bank.

- *For transaction via online banking

STEP

4

Determine your Strike Price by setting your differential.*

The Strike Price is calculated by subtracting your selected differential from the Spot Price.

- *Selectable differential is within the range set by SMBC Trust Bank and subject to market conditions and may change without prior notice.

STEP

5

Your interest rate is now set.

For example,

- Principal amount: ¥3 million

- Deposit term: 1-month

- Counter currency: US dollar

- Differential: ¥1

- Annual interest rate after tax: 2.000%

- The Spot Price equals the exchange rate determined by SMBC Trust Bank based on the exchange rate as quoted on the interbank market.

- The Strike Price is calculated by subtracting your selected differential from the Spot Price. If the exchange rate of Yen against your selected counter currency at 3:00 P.M. on your maturity date indicates yen appreciation equal to or beyond the Strike Price, your principal will be converted into your selected foreign currency (counter currency) at your selected Strike Price when paid.

- The differential is the rate range to be used to set your Strike Price from the Spot Price. Selectable differential is within the range set by SMBC Trust Bank and subject to market conditions and may change without prior notice.

- Counter currency : USD, EUR, GBP, AUD, NZD, CAD, CHF

Point 1

Whether the currency conversion occurs or not depends on the spot rate at 3:00 P.M. on the maturity day. Even if the market exchange rate exceeds the strike price during the deposit period, funds will neither be exchanged for the counter currency, nor will a decision be made to exchange for the counter currency, at that time.

Point 2

When the exchange rate of Yen against the counter currency indicates Yen depreciation beyond the Strike Price, and you are to receive your principal in Yen, you lose the opportunity for a foreign exchange profit that you could have enjoyed had you made a foreign currency deposit at the time of deposit.

Point 3

- Please note that your principal will be converted into your selected counter currency at the Strike Price preset by you at the time of deposit, not at the exchange rate prevailing on the maturity date. Since the Strike Price is usually more unfavorable than the foreign exchange rate prevailing in the market at maturity, a loss of principal may occur when you convert your received foreign currency funds back into Yen on the maturity date.

- When you convert your received foreign currency funds back into Yen, the TTB rate specified by SMBC Trust Bank will be applied to the conversion. The TTB rate includes the foreign exchange commission prescribed by SMBC Trust Bank.

- *Please note that the foreign exchange rates and interest rates shown above are used as examples. Actual foreign exchange rates and interest rates that will be applied to your transactions will differ from these examples.

- *In principle, interest is subject to a 20.315% withholding tax (National tax 15.315% and Local tax 5%) for individual customers. Comprehensive income taxation applies to corporate customers. The tax rate etc. may change in the future due to reasons such as the revision of tax laws.

Past Performance of Premium Deposit

Product description

- Available Deposit Currency

- JPY

- Available Counter Currencies

- USD, EUR, GBP, AUD, NZD, CAD, CHF

- Term of Availability

-

1 week *, 2 weeks, 1 month, and 3 months; and other terms as determined by SMBC Trust Bank.

- *In principle, 1 week is available only on online banking. For details of available terms at each channel, inquire at our branches or PRESTIA Phone Banking.

- Automatic Renewal

- Automatic renewal is not available.

- Deposit Amount

-

Minimum amount of 1,000,000 yen

For transaction via online banking, the minimum amount is 500,000 yen.- *SMBC Trust Bank may change the minimum deposit amount without prior notice.

- *There may be a restriction on the maximum deposit amount depending on the deposit timing and/or transaction channel.

- Payment at Maturity

-

The Deposit is processed as follows on the maturity date.

Principal

- If the Spot Price of Yen against the Counter Currency which is determined by SMBC Trust Bank based on the exchange rate as quoted in the interbank market at 3:00 p.m. on the maturity date indicates Yen appreciation equal to or beyond the Strike Price:

The principal shall be converted into the Counter Currency at the Strike Price, and then credited to the PRESTIA MultiMoney Foreign Currency Savings Account in the Counter Currency. - If the Spot Price of Yen against the Counter Currency which is determined by SMBC Trust Bank based on the exchange rate as quoted in the interbank market at 3:00 p.m. on the maturity date indicates Yen depreciation beyond the Strike Price:

The principal shall be credited into the PRESTIA MultiMoney Yen Savings account.

Interest

Interest after deduction of taxes shall be credited into the PRESTIA MultiMoney Yen Savings account.

Note

The principal and interest will be credited into the PRESTIA MultiMoney Savings Account on the business day following the maturity date (with the credit dated as of the maturity date). Therefore, the funds in PRESTIA MultiMoney Savings can be withdrawn/used from the business day following the maturity date.

- If the Spot Price of Yen against the Counter Currency which is determined by SMBC Trust Bank based on the exchange rate as quoted in the interbank market at 3:00 p.m. on the maturity date indicates Yen appreciation equal to or beyond the Strike Price:

- Applicable Interest Rates

- The applicable rate from the date of deposit until maturity shall be the rate as published by SMBC Trust Bank at the time of making the deposit.

Interest rates will change according to market conditions; thus interest rates may vary depending on the timing even when the same Counter Currency, Tenor, Strike Price, and Differential are specified. The savings interest rate of the account to which the maturity funds are credited will apply on and after the maturity date. For the latest rates, please inquire at our branches, PRESTIA Phone Banking or online banking. - Payment Method

- Interest is paid in a lump sum at maturity.

- Transaction Channels and Contact Number

- Branches of SMBC Trust Bank Ltd. that are set up to handle said transactions.

Certain transactions may not be available via online banking and PRESTIA Phone Banking.

For details, please inquire at our branches or via PRESTIA Phone Banking (Domestic (toll-free) 0120-110-330; From overseas (charges apply): 81-46-401-2100.)

You can make transactions in several different ways

Three advantages of transactions at online banking

1

Add-on interest rates regardless of the deposit amount.

(Base interest rate x 5% add-on)*1

2

Deposit term includes 1-week

3

Real time transaction in 24 hours a day*2

- *Connecting to transaction menu from above.

Navigation Menu: Investment & Reports > Premium Deposit (Structured Deposits)

- *1Excludes cases where a campaign for add-on interest rate, etc. is being conducted. Please make sure to check the applicable interest rate in the confirmation screen.

-

e.g.)If the base interest rate is 4.000% (pre-tax annual interest rate), applicable interest rate shall be 4.200% (pre-tax annual interest rate)

Calculation: 4.000+4.000x0.05=4.200% (pre-tax annual interest rate)

-

e.g.)If the base interest rate is 4.000% (pre-tax annual interest rate), applicable interest rate shall be 4.200% (pre-tax annual interest rate)

- *2You can make transactions anytime from Monday morning at 8:00 A.M. until Saturday morning at 5:00 A.M. in principle. Excluding certain time periods, Japanese national holidays and December 31 through January 3. Transaction may be unavailable on overseas holidays due to market condition.

Customers who would like to consult with a consultant

Branch

Telephone

0120-110-330

Within Japan (toll-free)

Service hours: 8:00 - 22:00

81-46-401-2100

From overseas (toll-charge)

Service hours: 8:00 - 22:00

Please note

This product entails some risks such as loss of principal in the original deposit currency and/or Japanese yen. Please read the "Information Memorandum and Pre-Contract Document" carefully, and make sure you fully understand the product before making the transaction.

Please see here for the details of Risk of loss of principal, Commissions, Other considerations and available currencies, etc.

Japanese

Japanese English

English