Order Watch

<Foreign Exchange Leave Order Service>

Automatically executes a transaction

when your target rate is reached

- *Personal foreign currency deposit balance (as of end of March 2025) based on our research.

Source: Each bank's IR materials (published basis)

You will no longer need to monitor the market,

just wait for the trade to occur.

-

Online banking ONLY

Free of exchange

commission from yen to foreign currencies -

Within the expiration date

You can change or

cancel the order -

Expiration date

Up to 180 days

Recommended for those who...

Don't want to miss any trading opportunities in the 24-hour foreign exchange market.

Too busy to check the exchange rate frequently.

Tend to over-expect the market outlook and miss the timing to trade.

How Order Watch Works

With the Order Watch service, SMBC Trust Bank will make a transaction on your behalf based on your preferred exchange rate specified in advance (Order Rate) when the Prevailing Market Rate* reaches the Order Rate.

The transaction is executed at the "Customer Rate" which includes foreign exchange commission.

- *The exchange rate determined by SMBC Trust Bank based on the exchange rate as quoted in the interbank market.

Moreover, transactions by Order Watch made via online banking are free of exchange commission* from yen to foreign currencies!

You can also easily order via SMBC Trust Bank App.

- *When the converted foreign currency by this Service is reconverted to Yen, the rate (TTB rate) is applied which includes the foreign exchange commission (up to 1 yen per foreign currency).

Create Order Watch

24h/365d via online banking

* Connecting to transaction menu from above.

Navigation Menu: Foreign Currency Savings > Buy / Sell FX, Foreign Currency Deposit Service, Order Watch

For non account holders

Available 24h/365d

This product entails some risks such as loss of principal.

Please see here for the details.

Three order types are available depending on your preferences.

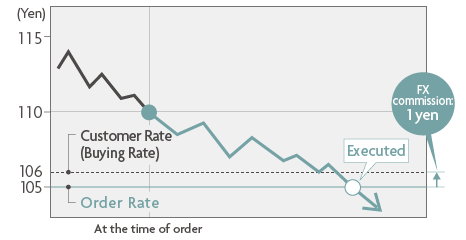

Straight Order

This is the most standard order.

A Limit Order aims to earn bigger foreign exchange gains by specifying favorable exchange rate than the present rate.

![]() When the exchange rate is 110 yen/USD at the time of order

When the exchange rate is 110 yen/USD at the time of order

Buy : Convert yen to foreign currency

E.g. : Placed a buy order at Order Rate 105 yen/USD. Later, the Prevailing Market Rate reached Order Rate 105 yen, and the order was executed at the Customer Rate (106 yen; foreign exchange commission of 1 yen added to Order Rate).

Sell : Convert foreign currency to yen

E.g. : Placed a sell order at Order Rate 115 yen/USD. Later, the Prevailing Market Rate reached Order Rate 115 yen, and the order was executed at the Customer Rate (114 yen; foreign exchange commission of 1 yen deducted from Order Rate).

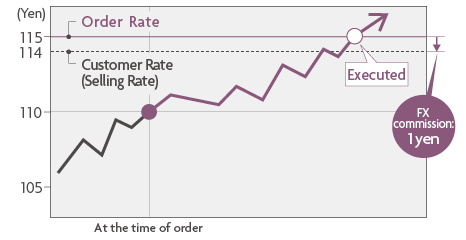

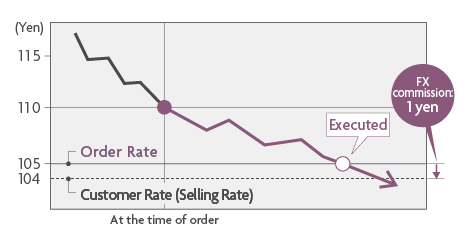

Stop Order

This is an order to prevent losses from expanding beyond a certain amount.

You designate a more unfavorable exchange rate than at present.

![]() When the exchange rate is 110 yen/USD at the time of order

When the exchange rate is 110 yen/USD at the time of order

Buy : Convert yen to foreign currency

E.g. : Expecting that the yen will depreciate further if it reaches 115 yen/USD, placed a buy order at Order Rate 115 yen/USD although the rate was unfavorable than the rate at that time. Later, the Prevailing Market Rate reached Order Rate 115 yen, and the order was executed at the Customer Rate (116 yen; foreign exchange commission of 1 yen added to Order Rate).

Sell : Convert foreign currency to yen

E.g. : Want to sell US dollar that you hold (convert them to yen) when the exchange rate reaches 105 yen/USD to cut losses once, preventing the losses from expanding further. You plan to wait for another opportunity to buy US dollar. So, you placed a sell order at Order Rate 105 yen/USD. Later, the Prevailing Market Rate reached Order Rate 105 yen, and the order was executed at the Customer Rate (104 yen; foreign exchange commission of 1 yen deducted from Order Rate).

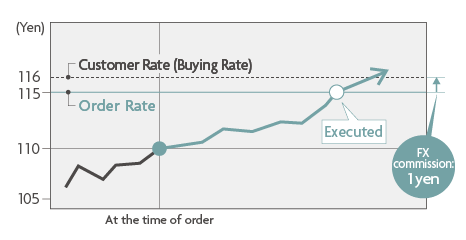

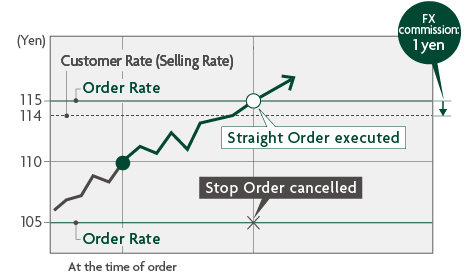

OCO (One Cancel the Other)

OCO is the combination of Straight Order and Stop Order so that you will not miss the opportunity to convert foreign currency to yen or vice versa when the yen appreciates or depreciates.

Execution on either one of the instructions will automatically cancel the other.

![]() When the exchange rate is 110 yen/USD at the time of order

When the exchange rate is 110 yen/USD at the time of order

E.g. : Want to fix foreign exchange gains by selling US dollar when the exchange rate reaches 115 yen/USD. However, if the yen appreciates on the contrary before reaching 115 yen, you want to prevent losses from expanding by converting US dollar to yen when the rate reaches 105 yen/USD. So, you placed a sell order at Order Rate 115 yen/USD (Straight Order) and the other sell order at Order Rate 105 yen/USD (Stop Order). Later, the Prevailing Market Rate reached Order Rate 115 yen, the Straight Order was executed at the Customer Rate (114 yen; foreign exchange commission of 1 yen deducted from Order Rate), and the Stop Order was automatically cancelled.

- *OCO enables you to place a Straight Order and a Stop Order in different amounts.

(E.g. : Placing a Straight Order to sell 20,000 US dollars when the exchange rate reaches 115 yen/USD, as well as a Stop Order to sell 15,000 US dollars when the rate reaches 105 yen/USD.)

[What is the difference between the Order Rate and the Customer Rate?]

The Order Rate is the exchange rate at which you wish to make a transaction (your target Prevailing Market Rate on the exchange market).

When your order is executed, currency conversion will happen at "Customer Rate" which includes foreign exchange commission, not at "Order Rate".

E.g. :

For an order to buy US dollar: when an order is executed at the Order Rate of 105 yen/USD, the Customer Rate is 106 yen.

For an order to sell US dollar: when an order is executed at the Order Rate of 115 yen/USD, the Customer Rate is 114 yen.

- *From online banking, foreign exchange commission from yen to foreign currency is free for Order Watch. (Maximum foreign exchange commission from foreign currency to yen is 1 yen per 1 foreign currency.)

Receive notification by registering to PRESTIA Alert Service!

Order statuses below will be notified to your registered e-mail address if you register to PRESTIA Alert Service.

- Execution

- Expiry (Sent 3 days before expiry date)

> Register / Update (PRESTIA Alert Service / PRESTIA Insight)

> Register / Update (PRESTIA Alert Service / PRESTIA Insight)

Create Order Watch

24h/365d via online banking

* Connecting to transaction menu from above.

Navigation Menu: Foreign Currency Savings > Buy / Sell FX, Foreign Currency Deposit Service, Order Watch

For non account holders

Available 24h/365d

Orders can also be placed at our branches.

Brief Description of Product

With the Order Watch service, if you are not willing to make a transaction at the current exchange rate, SMBC Trust Bank will make a transaction on your behalf based on your preferred exchange rate specified in advance (Order Rate) when the Prevailing Market Rate*1 reaches the Order Rate. The transaction is executed at the "Customer Rate" which includes foreign exchange commission*2.

- *1The exchange rate determined by SMBC Trust Bank based on the exchange rate as quoted in the interbank market.

- *2Foreign exchange commission from yen to foreign currency is free for Order Watch on online banking. (When the converted foreign currency by this Service is reconverted to Yen, the rate (TTB rate) is applied which includes the foreign exchange commission (up to 1 yen per foreign currency).)

Order type

Straight Order, Stop Order, OCO

Available currencies

(only against yen)

USD, AUD, NZD, GBP, CAD, CHF, EUR, HKD, NOK, ZAR, SGD

Transaction amount

From 500,000 yen equivalent up to 500 million yen equivalent

Order Rate

In increments of 0.1 yen

Order Expiry Date

Order expiry date can be set from next calendar day to a maximum of 180 days of the order date, except Sundays and New Year's Day. Order is valid until 7 a.m. of the order expiry date. The order becomes invalid automatically after the Order Expiry Date.

Changing/Cancelling the order

Changing the Order Expiry Date or Canceling the order is accepted prior to execution.

*Orders may not be canceled or changed once executed.

*SMBC Trust Bank may not be able to accept requests to change/cancel an order depending on the market conditions.

Transaction channels

PRESTIA branches, PRESTIA Phone Banking, Online banking

Service hours

24h/365 days in principle.

*Transaction may be unavailable on overseas holidays due to market condition.

*You can make transactions at our branches during the branch's business hours.

Order monitoring hours

(Transactions will be monitored to see whether the Order Rate is reached.)

7 a.m. on Monday -5 a.m. on Saturday in principle.

*Transactions will not be monitored to see whether they reached the order rate when Prevailing Market Rate is not available.

Available channels to check order status

PRESTIA branches, PRESTIA Phone Banking, Online banking

Create Order Watch

24h/365d via online banking

* Connecting to transaction menu from above.

Navigation Menu: Foreign Currency Savings > Buy / Sell FX, Foreign Currency Deposit Service, Order Watch

For non account holders

Available 24h/365d

Notes About Order Rate / Exchange Rate

- Following orders cannot be accepted for administrative reasons;

- when order rate is too close to prevailing market rate as designated by SMBC Trust Bank.

- when order rate deviates (both sides) more than 10% of Prevailing Market Rate.

Please note that this range may be changed without notice due to market trends and other reasons. - The bid and offer prices quoted by various information providers are only indicative prices and do not necessarily reflect actual deals transacted in the market.

Therefore, depending on the FX market status, orders may not be executed at the Order Rate, such as when the indicative price momentarily reaches the Order Rate and then bounces back quickly.

Cautions to be observed when using Order Watch service

<Notes about placing an Order>

- During the effective period of the order, the order amount can be used for other transactions. However, please note that even though the market rate matches your Order Rate, the order will not be executed and it will be expired in case of insufficient amount.

- The interest rate for PRESTIA MultiMoney Savings Deposit will be applied to funds used for active orders.

- Orders from one foreign currency to another are not accepted.

- Funds in a fixed-term deposit that just matured may not be used as funds for an Order until the next business day after the maturity date.

<Notes about the execution of an Order>

- Converted funds will be deposited to PRESTIA MultiMoney Foreign Currency Savings Deposit in the case of foreign currency and to PRESTIA MultiMoney Yen Savings Deposit in the case of yen.

<Other notes>

- Order statuses below will be notified to your registered email address if you register to PRESTIA Alert Service.

①Execution ②Expiry- *Email notifications will not be sent if you have not signed up for, or suspended the use of, PRESTIA Alert Service. Please check your Consolidated Bank Statement in this case.

- Your bank statement includes details about 1) Order Rates of currently valid orders and 2) Order Rates of executed orders. However, information about orders that became invalid or cancelled will not be included.

- The Terms and Conditions for Order Watch Service in the SMBC Trust Bank Customer Agreements stipulates important matters that you should be aware of when using the Order Watch service. Please read them carefully before using the service.

Please note

This product entails some risks such as loss of principal in Japanese yen. Please read "Information Memorandum and Pre-Contract Document" carefully and make sure you have full understanding of the product, associated risks, and commissions before making a transaction.

Please see here for the details of Risk of loss of principal, Commissions, Other considerations and available currencies, etc.

Japanese

Japanese English

English