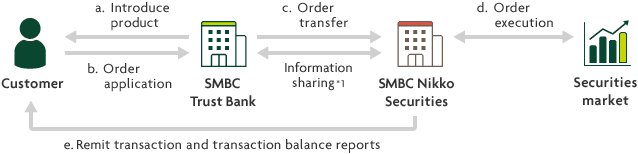

Basic transaction flow

- a.SMBC Trust Bank introduces the customer to a product.

- b.SMBC Trust Bank receives the order application from the customer.

- c.SMBC Trust Bank transfers the order received from the customer to SMBC Nikko Securities for execution.

- d.SMBC Nikko Securities executes the customer’s order.

- e.SMBC Nikko Securities remits transaction reports to the customer.

- *1Information on the customer’s securities transactions is provided/obtained/shared between the parties, with the prior consent of the customer.

Precautions with transactions made through financial instruments intermediary services

Key points relating to the financial instruments intermediary services

Please note the following points when making an application for products through financial instruments intermediary services.

- Financial instruments intermediary services refer to a financial institution being commissioned by a securities company to act as an intermediary for financial instruments, such as marketable securities trading. The trading is performed by the commissioning securities company, so SMBC Trust Bank is not the other party involved in the actual trading.

- SMBC Trust Bank has been commissioned by SMBC Nikko Securities Inc. (SMBC Nikko Securities) to open securities trading accounts for customers and to recommend and act as an intermediary for the trading of marketable securities. When providing financial instruments intermediary services, SMBC Trust Bank acts as an intermediary but SMBC Trust Bank does not act as an agent of the commissioning financial products business. SMBC Trust Bank does not have authority as an SMBC Nikko Securities agent, nor does SMBC Trust Bank have authority to execute contracts between the customer and the commissioning securities company. Therefore, the opening of securities trading accounts and the trading of marketable securities through these accounts are transactions between the customer and SMBC Nikko Securities.

- The trading products/services and conditions can differ when SMBC Trust Bank provides financial instruments intermediary services, compared to when transactions are carried out at SMBC Nikko Securities’ head or branch offices.

- The products offered when SMBC Trust Bank acts as a financial instruments intermediary are not deposits and are not subject to the deposit insurance system.

- With the products offered when SMBC Trust Bank acts as a financial instruments intermediary, loss of principal is a risk and SMBC Trust Bank makes no assurances regarding repayment of the principal or regarding yields and dividends.

- With the products offered when SMBC Trust Bank acts as a financial instruments intermediary, there is risk that the value of the assets invested fall below the invested principal, due to fluctuations in interest rates, foreign exchange markets and stock markets or changing financial circumstances at the issuing party; these risks are the burden of the customer.

- SMBC Trust Bank is commissioned by the commissioning securities company to act as an intermediary in marketable securities trading, trade transfer, application receipt, and marketing. The trade is performed by the commissioning securities company, so SMBC Trust Bank is not the other party involved in the trading.

- Different products are associated with different risks and fees, so customers must confirm the contents of pre-contract documents, the product prospectus, and other product information provided to the customer.

- SMBC Trust Bank does not hold money or marketable securities for customers under any circumstances when providing financial instruments intermediary services.

- The customer and their dealings with SMBC Trust Bank, including deposits and financing, are not affected by whether or not the customer engages SMBC Trust Bank to act as an intermediary for the trading of financial instruments. In addition, the specific dealings a customer has with SMBC Trust Bank, including deposits and financing, do not affect financial instruments intermediary transactions.

Registered Financial Institution for Financial Instruments Intermediary Services

(Trade name, etc.)

SMBC Trust Bank Ltd.

Registered Financial Institution Director of Kanto Local Finance Bureau (Registered Financial Institution) No. 653

(Association Memberships)

Japan Securities Dealers Association

Commissioning Financial Instruments Business

(Trade name, etc.)

SMBC Nikko Securities Inc.

Financial Instruments Business Director of Kanto Local Finance Bureau (Financial Instruments Business) No. 2251

(Association Memberships)

Japan Securities Dealers Association, Japan Investment Advisers Association, Financial Futures Association of Japan, Type II Financial Instruments Firms Association

Japanese

Japanese English

English