GLOBAL PASS® cashback bonus/ANA mile benefits

PRESTIA DIGITAL GOLD/PRESTIA GOLD/PRESTIA GOLD PREMIUM customers will receive cashback bonus or ANA mile benefits depending on their status.

- When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

Benefits of GLOBAL PASS

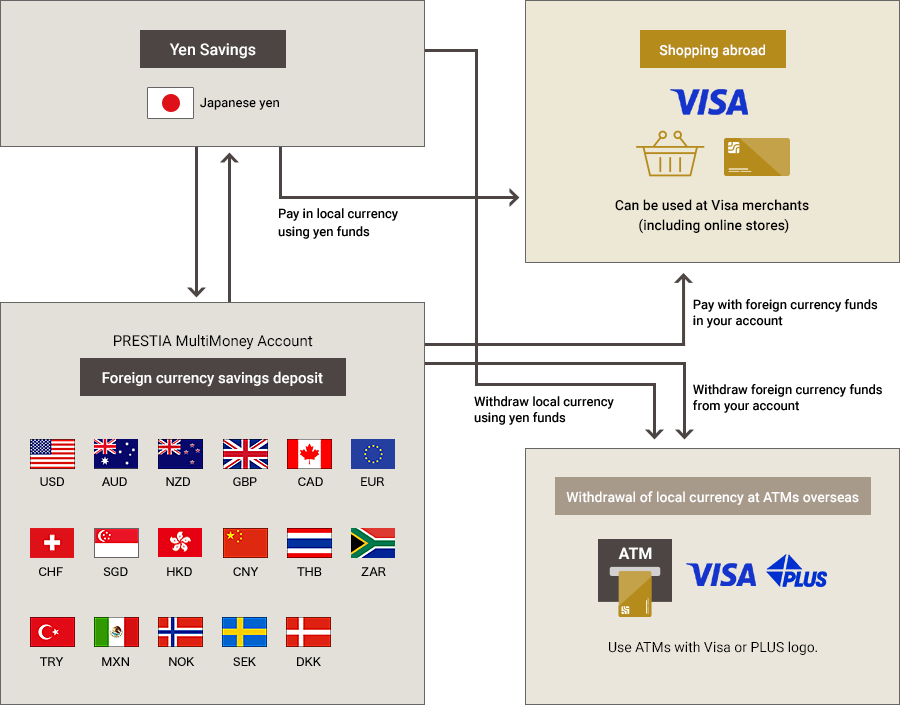

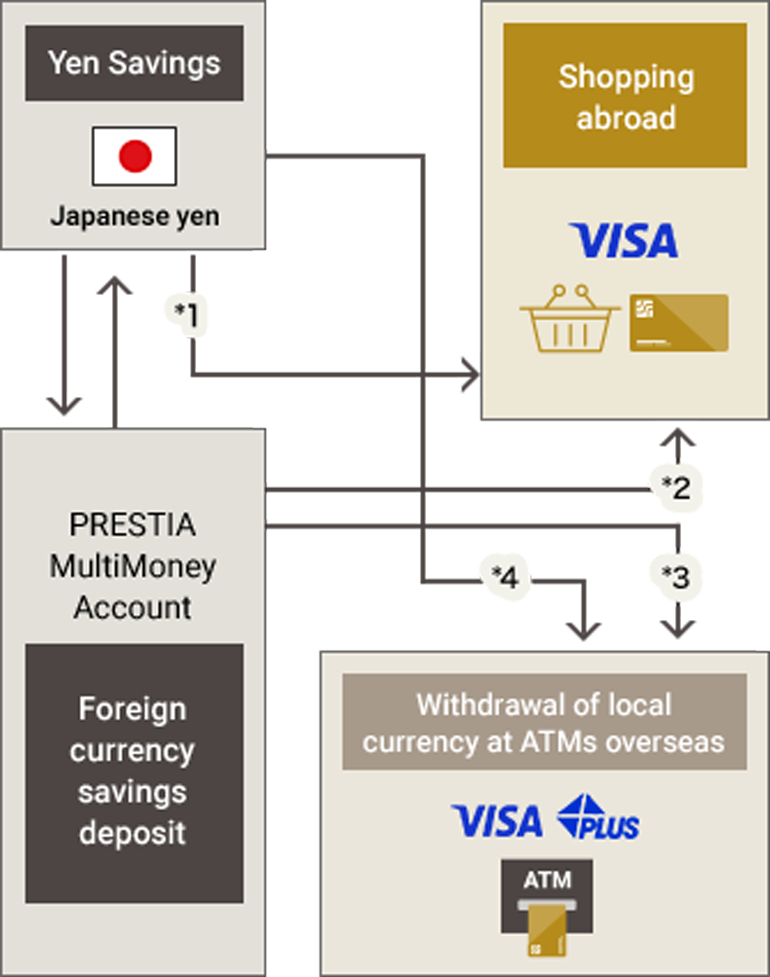

Use foreign currency directly from your account for shopping or at ATMs overseas

GLOBAL PASS is a cash card with Visa debit service that can be used in 18 currencies including Japanese yen. You can use foreign currencies directly from your account for shopping abroad or to withdraw cash using an ATM overseas.

When the balance in your Foreign Currency Savings Deposit is insufficient* or when you use currencies not handled by the PRESTIA MultiMoney Account, the full transaction amount will be deducted from your Yen Savings Account.

- Customers not using GAIKA FULL BACK cannot make payments from their Yen Savings Accounts.

- Pay in local currency using yen funds

- Pay with foreign currency funds in your account

- Withdraw foreign currency funds from your account

- Withdraw local currency using yen funds

The monthly transaction limit for shopping is maximum 10 million yen

The monthly transaction limit applied to shopping at Visa merchants (including online stores) in Japan or abroad is maximum 10 million yen each.

| Default setting | Selectable range(in increments of 10,000 yen) |

||

|---|---|---|---|

| Shopping in Japan/abroad |

Per transaction |

500,000 yen | 0 - 5 million yen |

| Per day | 500,000 yen | 0 - 5 million yen |

|

| Per month | 500,000 yen | 0 - 10 million yen |

|

- The amount transacted with the family card is included in the transaction limit of your main card.

Up to two family cards available

Offering the same functions and services with your GLOBAL PASS to your family members.

- Only available for family members aged 12 and above.

Reimbursement of overseas ATM owner fees

The owner of an ATM may charge an additional fee separately. In that case, the fee amount (as in local currency or equivalent in yen) will be reimbursed to the executed account up to 100 times per month.

- You must meet the following conditions to be eligible for reimbursement.

- When withdrawing local currency using funds in your Yen Savings Account, the balance over 5,000 yen is necessary in the account.

- When withdrawing local currency using funds in your MultiMoney Foreign Savings Account, the balance equivalent to 5,000 yen or more in withdrawn currency is necessary in the account.

Overseas ATM owner fees will be reimbursed up to 100 times for ① and ② above respectively.

- The conversion to yen will be calculated with the TTB rate specified by SMBC Trust Bank as of the reimbursement date.

Which do you prefer,

cashback or ANA miles?

GLOBAL PASS

Customers with GLOBAL PASS will receive cashback bonus of 0.25 - 1.5% for the amount spent at Visa merchants overseas in Japanese yen.

- Shopping abroad

- PRESTIA DIGITAL GOLD

- PRESTIA GOLD

- PRESTIA GOLD PREMIUM

- Regular customers

- Cash back rate

- Cash back rate1.00%

- Cash back rate1.00%

- Cash back rate1.50%

- Cash back rate0.25%

- When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

- ATM usage is not eligible for cashback bonus.

- The transaction amount will be converted into Japanese yen at a rate obtained by adding 3% to the exchange rate determined by Visa as of the date the transaction is finalized. Account Funding Transaction (AFT) and Original Credit Transaction (OCT) using Visa debit are not eligible.

ANA MILEAGE CLUB GLOBAL PASS

Customers with ANA MILEAGE CLUB GLOBAL PASS will receive 5-15 miles per 10,000 yen equivalent for yearly increase in their foreign currency deposit balance, in addition to miles obtained when they newly open an account, withdraw at ATMs overseas and make payments at Visa merchants abroad.

- Yearly increase in foreign

currency deposit - PRESTIA DIGITAL GOLD

- PRESTIA GOLD

- PRESTIA GOLD PREMIUM

- Regular customers

- Mile (per 10,000 yen equivalent)

- Mile (per 10,000 yen equivalent)10 miles

- Mile (per 10,000 yen equivalent)10 miles

- Mile (per 10,000 yen equivalent)15 miles

- Mile (per 10,000 yen equivalent)5 miles

- When your status changes, you will automatically receive the benefits and privileges of your new status, regardless of the type of card you have.

- "Yearly increase in foreign currency deposit" refers to the increase in foreign currency deposits of the Total Average Monthly Relationship Balance as of the end of December of each year. For foreign currency deposits and structured deposits in foreign currencies, this is the increase in foreign currency deposits converted to yen with the TTB rate stipulated by SMBC Trust Bank on the last business day of the previous month for each currency. The maximum miles to be rewarded are 10 million miles per year.