PRESTIA GOLD

Opening up

a whole new world

PRESTIA GOLD is offered to customers with a Total Average Monthly Relationship

Balance equivalent to 10 million yen or more along with a Total Average Monthly

Wealth Management Balance equivalent to 3 million yen or more.

Status privileges

- Service fee discount

- Dedicated consultants

- Dedicated line for PRESTIA GOLD customers

- Other privileges

Service fee discount

PRESTIA GOLD customers can enjoy free or discounted service fees through all transaction channels (via online banking, telephone and at our branches).

-

Fees for domestic

yen fund transfers Free- Transfer funds free of charge

not only to another

SMBC Trust Bank account

but also to an account at other banks - *Not applicable to cash transfers using ATMs.

- Transfer funds free of charge

-

Fees for overseas remittances Free

- Transfer funds overseas free of charge both in foreign currency and yen

- *The payee must have been registered in advance.

-

Foreign exchange fees

for purchasing foreign currency 50% OFF- 50% discount

on foreign exchange commission

for purchasing foreign currency

(6 currencies only*) - *USD | AUD | NZD | GBP | CAD | EUR

- 50% discount

-

Foreign currency

cash handling fees Free- Foreign currency cash handling fees

when depositing/withdrawing

USD or EUR in cash

at our branch will be free up to

US$5,000 or €5,000 per day.

- Foreign currency cash handling fees

-

Foreign exchange commissions

for cross currency transactions

(converting a foreign currency

to another currency) Discount- For cross currency transactions,

foreign exchange commissions when

converting foreign currency

to yen will be free

and those

when converting yen to foreign

currency, included in the TTS rate,

will be discounted by 70%.

- For cross currency transactions,

Dedicated consultants

PRESTIA GOLD customers can talk to PRESTIA GOLD Executives, dedicated consultants for them, about their asset management and wealth management needs.

Financial consultation

We will design a tailor-made investment plan just for you. We will do a detailed analysis of your investment goals, desired investment period and risk tolerance before presenting you with a variety of possible asset management portfolios by combining various investment products SMBC Trust Bank PRESTIA offers.

You can choose a portfolio that is most satisfactory to you. Financial consultation is a service that only selected customers can use.

Financial consultation process

- Analyze needs

- Evaluate

risk tolerance - Create profile

- Create portfolio

- Determine product

Special PRESTIA GOLD booths

Branches have special booths just for PRESTIA GOLD customers.

At these booths, you can make transactions and consult about your wealth management needs.

Dedicated line for PRESTIA GOLD customers

An exclusive PRESTIA Phone Banking service for PRESTIA GOLD customers is available to respond to their requests.

Our PRESTIA GOLD customer service representatives are ready to assist you over the phone.

- Offer subject to our call center availability.

Other privileges for PRESTIA GOLD customers

-

Cashback bonus or ANA mile benefits offered (depending on the type of GLOBAL PASS held by the customer)

-

Add-on interest rate for foreign currency time deposit and discount on foreign exchange commissions for cross currency transactions (when converting a foreign currency to another currency)

-

Preferential programs available for various loan products that can also be used for high-priced properties

Timing of status change

Status reflection (upgrading)

Customers fulfilling eligibility requirements for PRESTIA GOLD status can apply at our branch or via telephone. Please inquire about the timing of status reflection.

- The timing of status reflection may be delayed. Please make sure, before making a transaction, to check your status at the time of transaction.

Termination or change of status

We may terminate or change your status if the requirements for PRESTIA GOLD status have not been met for a certain period.

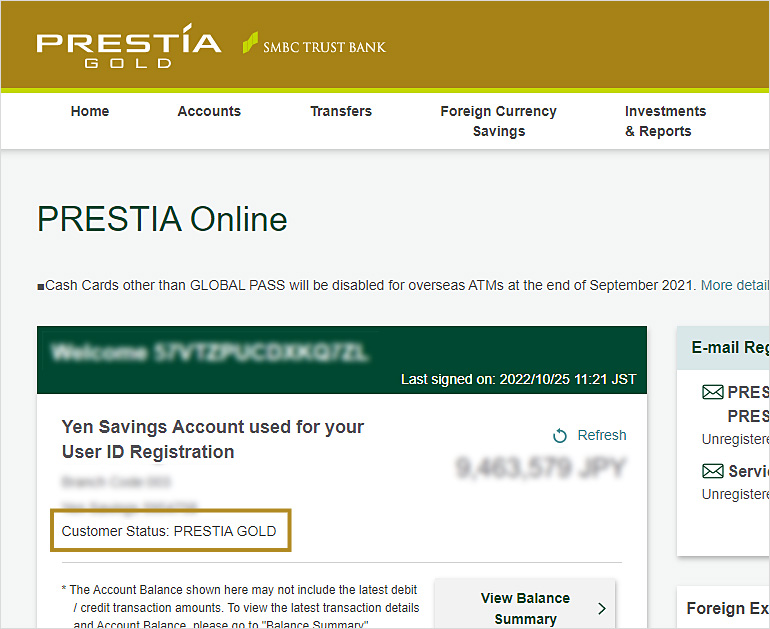

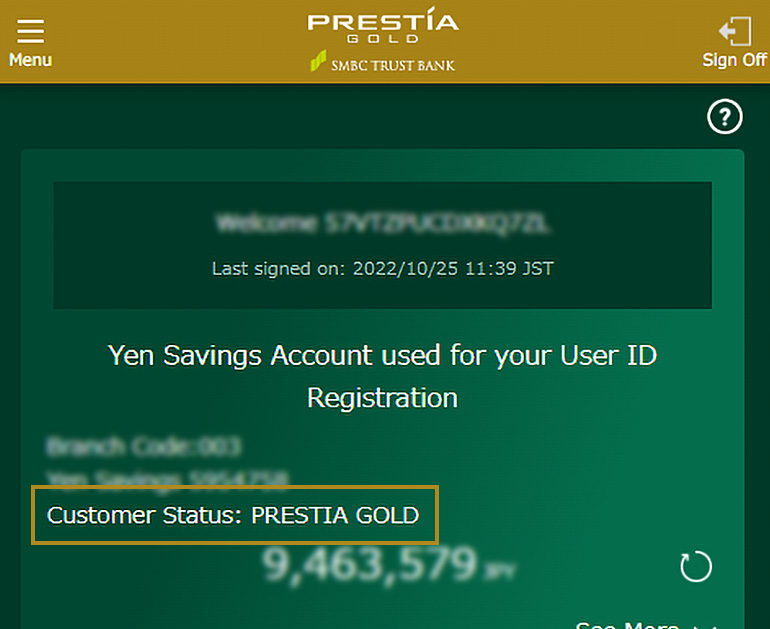

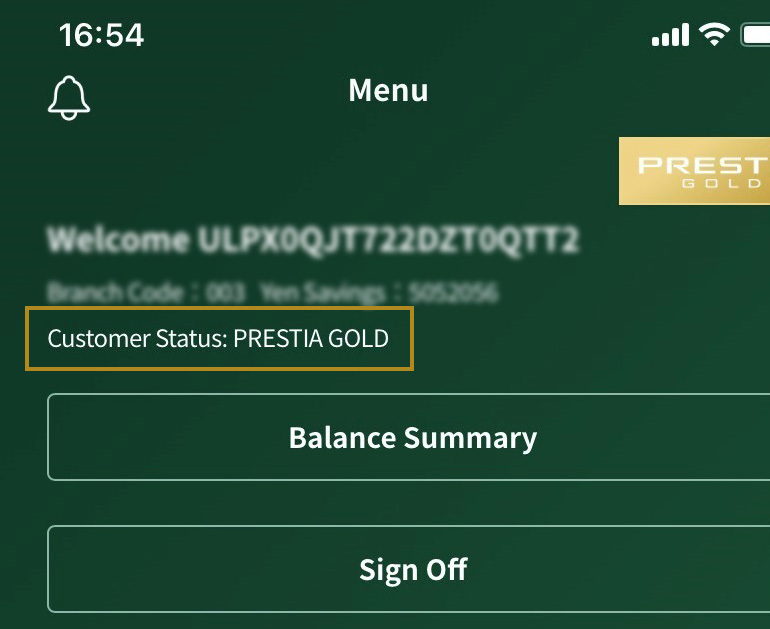

How to check your status

You can check your status via online banking.

- Regardless of the account balance, the bank may be unable to provide a customer with a special status based on comprehensive judgment.

- The bank may, without any prior notice, terminate the provision of a status to a customer based on comprehensive judgment, if it judges that the customer is taking advantage of status privileges through transactions with wrongful or unreasonable methods/contents as compared to regular, reasonable transaction methods/contents.