Deposit 3M yen or more per transaction

into a USD time deposit

(3-month / 6-month) from Yen funds during the period and

receive the special interest rates!

Note that the benefits of this campaign are not applied if you transfer yen funds to your US dollar Savings Account first.

- *1As of October 24, 2025

Plus, FX commission FREE (YEN→USD)

The permanent program "Free FX Commission Program" will be automatically applied, so there will be no foreign exchange fees when purchasing US dollars.

FX commission

from YEN to USD

per USD (one way)

Normally

Account holders

1 yen

PRESTIA DIGITAL GOLD*2

/ PRESTIA GOLD

0.5 yen

PRESTIA GOLD PREMIUM

0.3 yen

After program implementation

FREE

- *2For PRESTIA DIGITAL GOLD customers, the 0.5 yen FX commission only applies to online banking and Automated Voice Guidance transactions.

< Interest Simulation >

(e.g.) Depositing 10M yen into a 3-month Time Deposit

(Assuming 1 USD = 150 yen)

| Deposit amount | 10 million yen/150 = | 66,666.66 USD |

|---|---|---|

| Interest before tax | 66,666.66 USD × 5.1% p.a. × 3/12 months = | 849.999 USD |

| Interest after tax | 849.999 USD − Tax 172.677 USD = | 677.32 USD |

- *We calculate the annual after-tax interest rate by deducting a tax rate of 20.315% from the annual pre-tax interest rate and truncate the numbers beyond the third decimal point. Interest will be calculated on the basis of a 365 day year.

This product entails some risks such as loss of principal. Please see here for the details.

About Campaign

- Campaign Period

- November 10, 2025 (Mon) to January 30,2026 (Fri)

- Eligible Customers

- Individual customers of SMBC Trust Bank PRESTIA

- Eligible Products

- USD Time Deposit (Deposit terms: 3-month / 6-month)

- Source Funds

- Japanese Yen

Please make a time deposit directly from your Yen Savings Account or PRESTIA MultiMoney Yen Savings Account. Please note that the benefits of this campaign are not applied if you transfer yen funds to your US dollar Savings Account first.

- Transaction Amount

- Minimum of 3 million yen per transaction

- Benefits

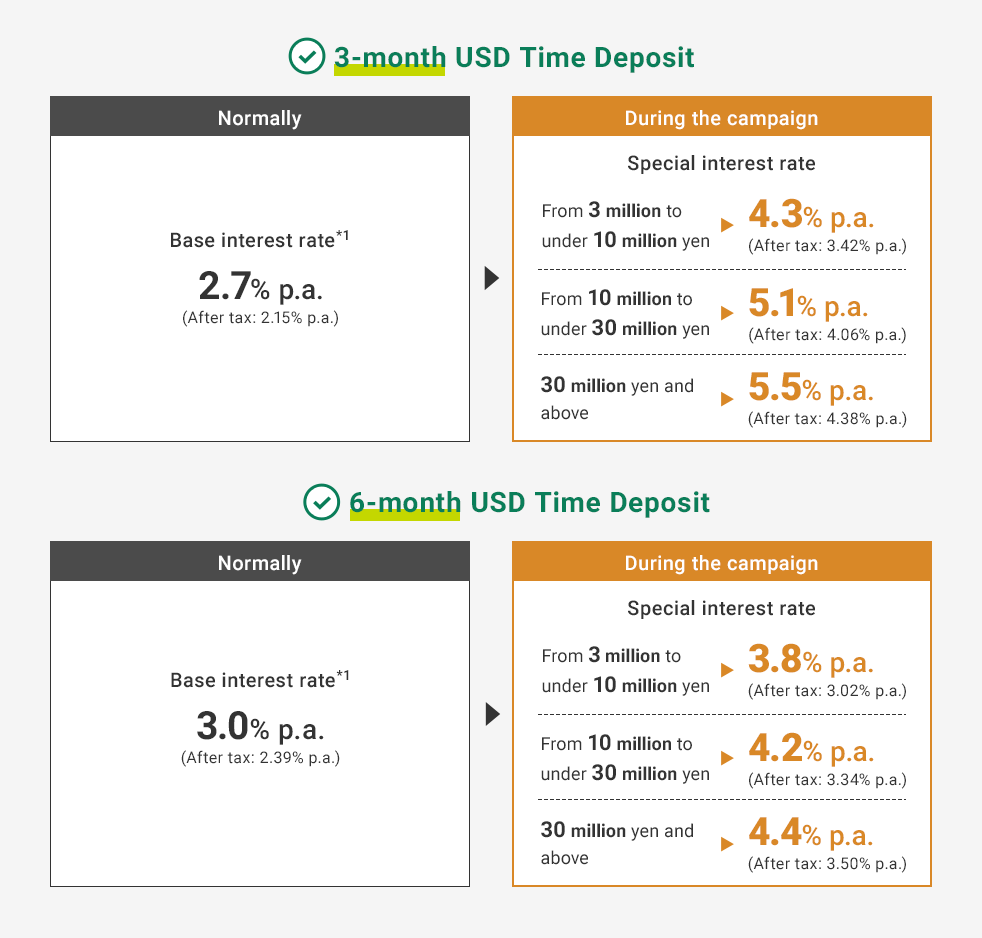

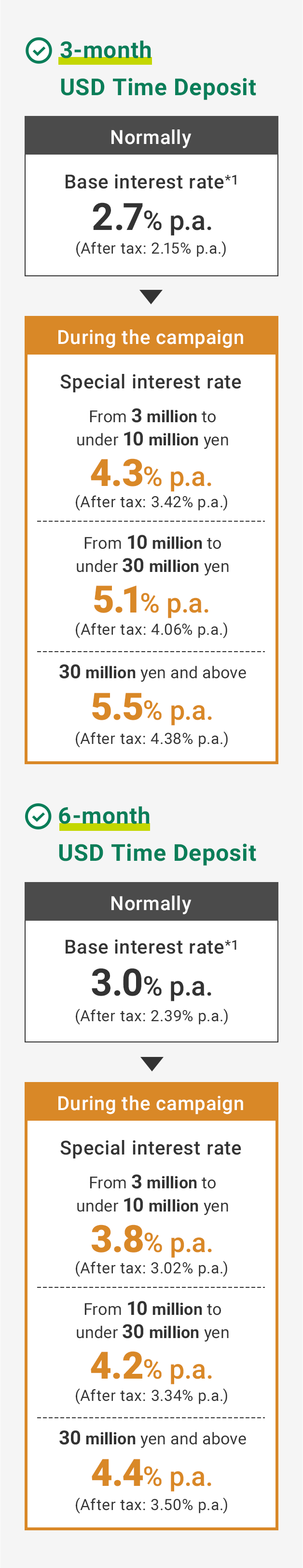

-

Deposit per transaction Deposit terms From 3 million to

under 10 million yenFrom 10 million to

under 30 million yen30 million yen and above 3-month 4.3% p.a.

(After tax: 3.42% p.a.)5.1% p.a.

(After tax: 4.06% p.a.)5.5% p.a.

(After tax: 4.38% p.a.)6-month 3.8% p.a.

(After tax: 3.02% p.a.)4.2% p.a.

(After tax: 3.34% p.a.)4.4% p.a.

(After tax: 3.50% p.a.)- ◎The permanent program "Free FX Commission Program" will be automatically applied, so there will be no foreign exchange fees when purchasing US dollars.

- Above interest rates are annual pretax interest rates. In principle, interest is subject to a 20.315% withholding tax (National tax 15.315% and Local tax 5%) for individual customers. The tax rate etc. may change in the future due to reasons such as revision of tax laws.

- Interest rates and exchange rates may fluctuate due to market conditions. Please check the latest information at our branches or via the bank's Website, etc.

- Transaction Channels /

Deadlines -

- Branches: Until the end of business hours on January 30,2026 (Fri)

- PRESTIA Phone Banking : Transactions completed by 21:59 on January 30,2026 (Fri)

- Online banking : Transactions completed by 23:59 on January 30,2026 (Fri)

PRESTIA DIGITAL GOLD status

PRESTIA DIGITAL GOLD is offered to customers with a Total Average Monthly Wealth Management Balance for the previous month equivalent to 3 million yen or more.

Privileges of PRESTIA DIGITAL GOLD

PRESTIA DIGITAL GOLD customers can enjoy free or discounted service fees for online banking transactions.

-

Fees for domestic yen fund transfers Free

- Transfer funds free

of charge not only to another

SMBC Trust Bank account but also

to an account at other banks - *ATM (using a cash card) transactions are also eligible.

- Transfer funds free

-

Fees for overseas remittances Free

- Transfer funds overseas free of charge

both in foreign currency and yen - *The payee must have been registered in advance.

- Transfer funds overseas free of charge

Requirements and Timing of status change of PRESTIA DIGITAL GOLD

<Requirements>

Total Average Monthly Wealth Management Balance for the previous month equivalent to 3 million yen or more

- *Total Average Monthly Wealth Management Balance is the sum of the average monthly balances of each asset management product, including foreign currency deposit, in your SMBC Trust Bank PRESTIA accounts.

<Timing of status change>

PRESTIA DIGITAL GOLD status will be applied automatically by the 20th of each month when their Total Average Monthly Wealth Management Balance for the previous month is equivalent to 3 million yen or more.

- *Depending on the timing of campaign application, the status may not be applied until the following month or later.

Please note : Read the following guidelines before you join the campaign.

Notes about this campaign

- Please make a time deposit directly from your Yen Savings Account or PRESTIA MultiMoney Yen Savings Account. Please note that the benefits of this campaign are not applied if you transfer yen funds to your US dollar Savings Account first.

- Cancellation of Foreign Currency Time Deposit is not allowed before maturity, including those that have rolled over automatically, except that SMBC Trust Bank determines cancellation is unavoidable. In the event that cancellation is determined unavoidable, depositor may be required to pay settlement fee due to changes in financial circumstances, etc.

- In order to receive the stated benefits, transactions must be completed by the deadline. The process may take a while. Please plan your transaction well in advance.

- This campaign might not be combined with other programs or campaigns.

- Note that this campaign may be discontinued or changed (including its content or duration) at any time without prior notice. Also note that similar campaigns may be held after this one has ended.

- Please note that cancellations are not accepted after transactions have been completed.

Notes about the special interest rate

- The Time Deposit that is cancelled before maturity will not be eligible for this campaign.

- The special interest rate will be applied until the first maturity date. In the case of auto-renewal, the interest rate for the same Foreign Currency Time Deposit term and the currency on offer on each maturity date shall apply.

- When auto-renewal does not apply, the principal and interests accumulated will be deposited to PRESTIA MultiMoney Foreign Currency Savings Deposit and the applicable interest rate for the currency in the account will apply after the maturity date.

- Please contact your nearest tax office for details about how the interest earned should be handled in terms of taxations.

Notes about Foreign Currency Deposits

- This product entails some risks such as loss of principal in Japanese yen. Please read "Information Memorandum and Pre-Contract Document" carefully and make sure you have full understanding of the product, associated risks, and commissions before making a transaction.

- Please see here for the details of Risk of loss of principal, Commissions, Other considerations and available currencies, etc.

- Please receive and read the latest "Information Memorandum" (Pre-Contract Document) within one year before investing in Foreign Currency Time Deposit.

Other considerations

- At SMBC Trust Bank PRESTIA, we use profiling (a series of questions related to asset management) to understand the amount of risk you are able to accept. The answers received in profiling, and the risk acceptable to the customer, are expressed numerically as a "customer risk tolerance (risk score)". Please be aware that investment in a product is not possible if the customer risk score is below the product risk level. It's required that you conduct Personal Profiling and have the Risk Score 1 or higher within one year before investing in this product.

- SMBC Trust Bank PRESTIA charges a monthly account maintenance fee to your account on the second business day of each month. Please note, however, that no such fee will be charged for the month in question if your Total Average Monthly Relationship Balance or other conditions satisfy specific requirements.

As of November, 2025

Contact Us

For account holders

Telephone

0120-110-330Within Japan (toll-free)

81-46-401-2100From overseas (charges apply)

Service hours: 8:00 - 22:00 (JST)

BranchFind a branch

For non-account holders

Telephone

0120-504-189(toll-free)

Service hours: 8:00 - 22:00 (JST)

Japanese

Japanese English

English