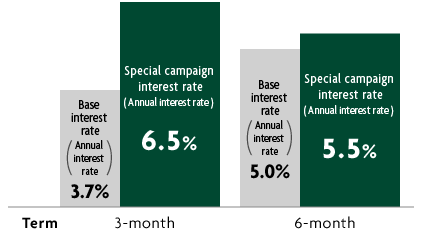

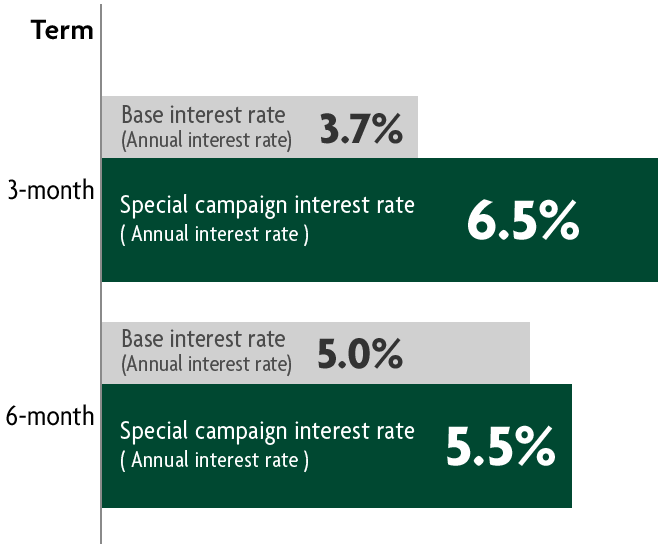

As an initial special interest rate,

3-month: 6.5% / 6-month: 5.5%

● Applicable only 3-month and 6-month USD Time Deposits.

● Only available for foreign currency funds newly transferred from other financial institutions in Japan.

● Transaction channels are limited to our branches or PRESTIA Phone Banking (operator transaction).

Special campaign interest rate

As of April 1, 2024

- *Interest rates and exchange rates may fluctuate due to market conditions. Please check the latest information at our branches or via the bank's Website, etc.

- *Above interest rates are annual pretax interest rates. In principle, interest is subject to a 20.315% withholding tax (National tax 15.315% and Local tax 5%) for individual customers. The tax rate etc. may change in the future due to reasons such as revision of tax laws.

About Campaign

- Period

- April 1, 2024 (Mon.) to June 28, 2024 (Fri.)

- Eligible customers

- Individual customers with SMBC Trust Bank PRESTIA accounts

- Eligible products

- USD Time Deposits with a deposit term of 3-month and 6-month

- Source funds

-

Foreign currency funds newly transferred from other financial institutions in Japan (Funds that were transferred within 3 months before you start a USD Time Deposit are eligible.)

- *Starting a USD Time Deposit using another foreign currency under cross currency transaction is also eligible for this campaign.

- *In case your funds are converted to yen at an intermediary bank, this campaign may be applicable. For details, please ask our staff.

- Minimum transaction amount

- Minimum of 30,000 USD equivalent per transaction

- Benefits

-

An initial special interest rate will be applied when you start a USD Time Deposit.

Term Base interest rate

(Annual interest rate)Special campaign interest rate

(Annual interest rate)3-month 3.7% 6.5% 6-month 5.0% 5.5% As of April 1, 2024

- *Interest rates may be revised without prior notice due to changes in the market environment, among other reasons.

- *Interest rates and exchange rates may fluctuate due to market conditions. Please check the latest information at our branches or via the bank's Website, etc.

- *Above interest rates are annual pretax interest rates. In principle, interest is subject to a 20.315% withholding tax (National tax 15.315% and Local tax 5%) for individual customers. The tax rate etc. may change in the future due to reasons such as revision of tax laws.

- Ineligible transactions

-

- Foreign currency funds deposited from Sumitomo Mitsui Banking Corporation and SMBC Nikko Securities

- Step Up Time Deposit

- Online banking transactions

- Funds transferred from overseas financial institutions

- Transaction channels and deadline for each channel

-

- Branches: Until the end of business hours on April 1, 2024 (Mon.) to June 28, 2024 (Fri.)

- PRESTIA Phone Banking(0120-110-330): Transactions completed by 20:00 on June 28, 2024 (Fri.)

- *Transaction channels are limited to our branches or PRESTIA Phone Banking (operator transaction).

- *The transaction time of this campaign by PRESTIA Phone Banking: 8:00 to 20:00 (Weekdays)

- *When you transfer funds from other financial institutions, please specify PRESTIA MultiMoney Foreign Currency Savings Deposit Account (8-digits).

PRESTIA DIGITAL GOLD status

PRESTIA DIGITAL GOLD is offered to customers with a Total Average Monthly Wealth Management Balance for the previous month equivalent to 3 million yen or more.

If you apply for this campaign and create USD Time Deposit, you can meet the requirements for PRESTIA DIGITAL GOLD. When you retain the requirements and be applied PRESTIA DIGITAL GOLD status, you can enjoy free or discounted service fees for online banking transactions.

Regarding to requirements and timing of status change, please see below.

Privileges of PRESTIA DIGITAL GOLD

PRESTIA DIGITAL GOLD customers can enjoy free or discounted service fees for online banking transactions.

-

Fees for domestic yen fund transfers Free

- Transfer funds free

of charge not only to another

SMBC Trust Bank account but also

to an account at other banks - *ATM (using a cash card) transactions are also eligible.

- Transfer funds free

-

Fees for overseas remittances Free

- Transfer funds overseas free of charge

both in foreign currency and yen - *The payee must have been registered in advance.

- Transfer funds overseas free of charge

-

Foreign exchange fees

for purchasing foreign currency 50% OFF- 50% discount on foreign exchange commission

for purchasing foreign currency

(6 currencies only*) - *USD | AUD | NZD | GBP | CAD | EUR

- 50% discount on foreign exchange commission

Requirements and Timing of status change of PRESTIA DIGITAL GOLD

<Requirements>

Total Average Monthly Wealth Management Balance for the previous month equivalent to 3 million yen or more

Total Average Monthly Wealth Management Balance is the sum of the average monthly balances of each asset management product, including foreign currency deposit, in your SMBC Trust Bank PRESTIA accounts.

<Timing of status change>

PRESTIA DIGITAL GOLD status will be applied automatically by the 20th of each month when their Total Average Monthly Wealth Management Balance for the previous month is equivalent to 3 million yen or more.

- *Depending on the timing of campaign application, the status may not be applied until the following month or later.

Why Customers Choose PRESTIA's Foreign Currency Deposit

| Merit 1A variety of currencies to choose from PRESTIA handles 17 currencies, from major currencies to emerging-market countries |

|

USD, AUD, NZD, GBP, CAD, EUR, CHF, SGD, HKD, CNY, THB, ZAR, TRY, MXN, NOK, SEK, DKK |

|---|---|---|

| Merit 2Global settlement service |

|

You can withdraw local currency or use the funds in your account to shop in more than 200 countries and regions around the world. You can also receive overseas remittance to Japan without a lifting fee. |

| Merit 3Make transactions 24 hours a day, 365 days a year. Professional advice is also available! |

|

PRESTIA provides asset management consultation service at some branches. Moreover, you can make transactions anytime, any day in a year, via online banking. |

Please note : Read the following guidelines before you join the campaign.

Notes regarding this campaign

- Cancellation of Foreign Currency Time Deposit is not allowed before maturity, including those that have rolled over automatically, except that SMBC Trust Bank determines cancellation is unavoidable. In the event that cancellation is determined unavoidable, depositor may be required to pay settlement fee due to changes in financial circumstances, etc.

- Intermediary banks that process your transfer may charge a separate fee. If the amount received is less than the eligible amount, this campaign cannot be applied.

- A USD Time Deposit that is cancelled before maturity will not be eligible for this campaign.

- Please contact your nearest tax office for details about how the awards should be handled in terms of taxations.

- In order to receive the stated benefits, transactions must be completed by the deadline. The process may take a while. Please plan your transaction well in advance.

- Note that this campaign may be discontinued or changed (including its content or duration) at any time without prior notice.

Also note that similar campaigns may be held after this one has ended. - This campaign might not be combined with other programs or campaigns.

- Please note that cancellations are not accepted in principle after transactions have been completed.

Notes about the special interest rate

- Special interest rates will apply until the first maturity date. In the case of auto-renewal, the interest rate for the same Foreign Currency Time Deposit term and the currency on offer on each maturity date shall apply. When auto-renewal does not apply, the principal and interests accumulated will be deposited to PRESTIA MultiMoney Foreign Currency Savings Deposit and the applicable interest rate for the currency in the account will apply after the maturity date.

Notes about Foreign Currency Deposits

This product entails some risks such as loss of principal in Japanese yen. Please read "Information Memorandum and Pre-Contract Document" carefully and make sure you have full understanding of the product, associated risks, and commissions before making a transaction.

Please see here for the details of Risk of loss of principal, Commissions, Other considerations and available currencies, etc.

Other considerations

- Please receive and read the latest "Information Memorandum" (Pre-Contract Document) within one year before investing in Foreign Currency Time Deposit.

- At SMBC Trust Bank PRESTIA, we use profiling (a series of questions related to asset management) to understand the amount of risk you are able to accept. The answers received in profiling, and the risk acceptable to the customer, are expressed numerically as a "customer risk tolerance (risk score)". Please be aware that investment in a product is not possible if the customer risk score is below the product risk level. It's required that you conduct Personal Profiling and have the Risk Score 1 or higher within one year before investing in this product.

Contact Us

For account holders

Telephone

The transaction time: 8:00 to 20:00 on weekdays (JST)

0120-110-330Within Japan (toll-free)

81-46-401-2100From overseas (charges apply)

For non-account holders

Telephone

0120-504-189(toll-free)

Japanese

Japanese English

English