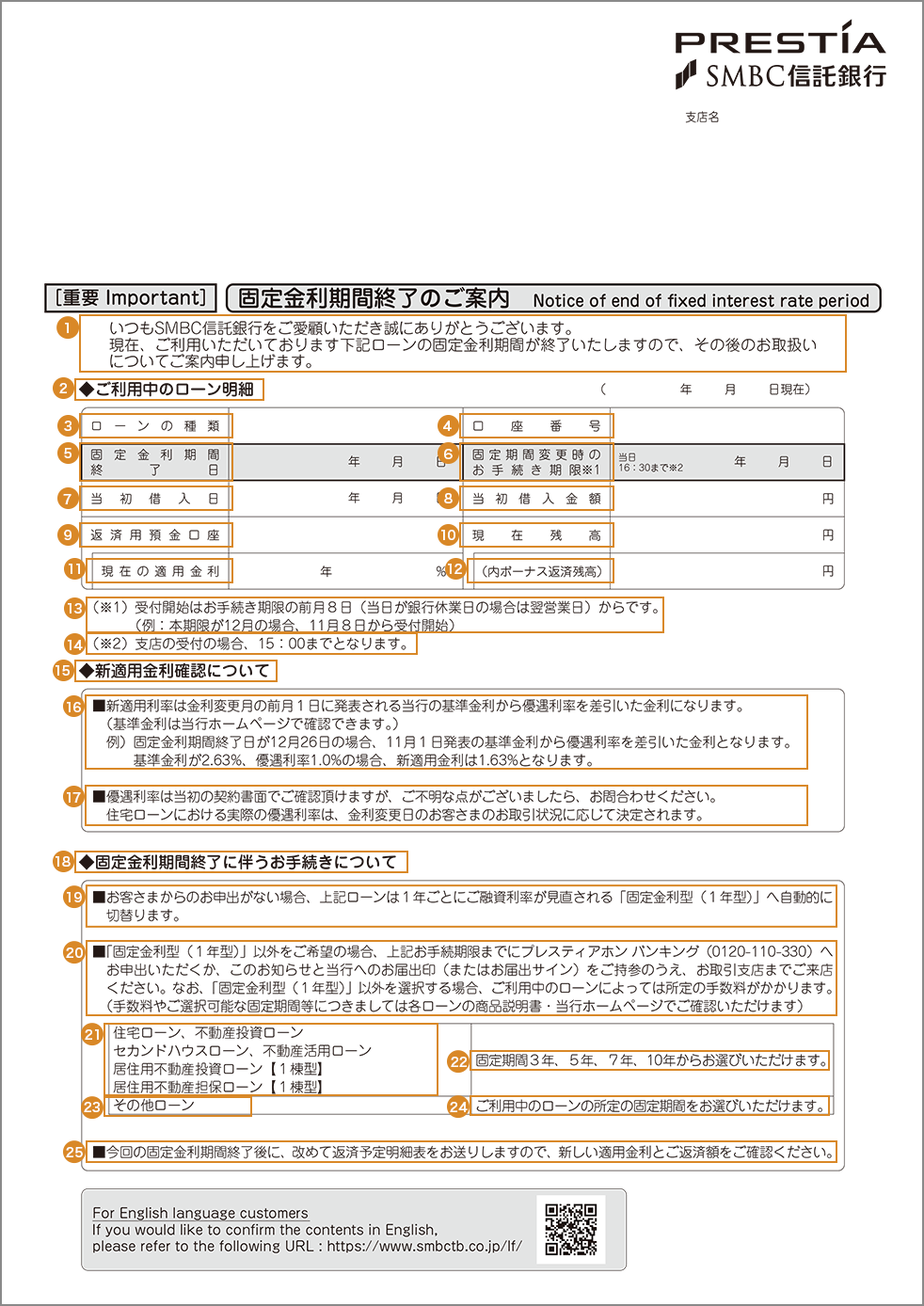

1. Notice of end of fixed interest rate period / 固定金利期間終了のご案内

For customers whose fixed interest rate period is scheduled to end, this is the information on how to confirm the new applicable interest rate and the optional procedures to follow when the fixed interest rate period ends.

- 1Thank you for banking with SMBC Trust Bank. We would like to inform you of the details on your loan transactions after the end of the fixed interest rate period for the following loans.

- 2◆ご利用中のローン明細:◆Your Loan details

- 3ローンの種類:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 4口座番号:Account number

- 5固定金利期間終了日:End date of fixed interest rate period

- 6固定期間変更時のお手続き期限:Procedural deadline for changing the fixed interest rate period

- 7当初借入日:Initial borrowing date

- 8当初借入金額:Initial borrowing amount

- 9返済用預金口座:Repayment deposit account

- 10現在残高:Current loan balance

- 11現在の適用金利:Current interest rate

- 12(内ボーナス返済残高):(Bonus repayment balance)

- 13(*1) Applications will be accepted from the 8th (the next business day when it falls on a bank holiday) of the month prior to the procedural due date.

(e.g., if this due date is in December, applications will be accepted from November 8th) - 14(*2) For applications at branch offices, the deadline is 15:00.

- 15◆新適用金利確認について:◆Confirmation of new applicable interest rates

- 16■The new applicable interest rate will be the Bank's base interest rate announced on the 1st of the month prior to the month of interest rate change, minus the interest rate preferential discount.

(The base interest rate is displayed on our website.)

Example: If the end date of the fixed interest rate period is December 26, the interest rate will be the base rate announced on November 1, minus the preferential discount. If the base interest rate is 2.63% and the preferential discount is 1.0%, the new applicable interest rate will be 1.63%. - 17■The preferential discount on interest rates can be confirmed in the initial contract documents, but please contact us if you have any questions. The actual preferential discount on interest rates will be determined based on the customer's transaction status on the interest rate revision date.

- 18◆固定金利期間終了に伴うお手続きについて:◆Procedures upon expiration of the fixed interest rate period

- 19■If no request is made from the customer, the loan above will automatically switch to "Fixed interest rate plan (1 year)" where the loan interest rate is reviewed every year.

- 20■If you wish to choose a loan plan other than Fixed interest rate plan (1 year), please call PRESTIA Phone Banking (0120-110-330) or visit a branch with this notice and your registered seal (or signature) by the deadline written above. If you choose a loan plan other than the "Fixed interest rate plan (1 year)," you will be charged a prescribed fee depending on your type of loan. (For more information on fees and available fixed rate plans, please refer to the product information memorandum for each loan or visit our website.)

- 21住宅ローン、不動産投資ローン、セカンドハウスローン、不動産活用ローン:Housing Loan, Investment Property Loan, Second House Loan, Home Equity Loan

居住用不動産投資ローン【1棟型】:Residential Real Estate Investment Loan (building type)

居住用不動産担保ローン【1棟型】:Residential Real Estate Secured Loan (building type) - 22Available fixed terms: 3, 5, 7, or 10 years.

- 23その他のローン:Other loans

- 24The predetermined fixed term for your current loan is available.

- 25■Following the end of the fixed interest rate period, another repayment schedule will be sent to notify you the revised interest rate and repayment amount.

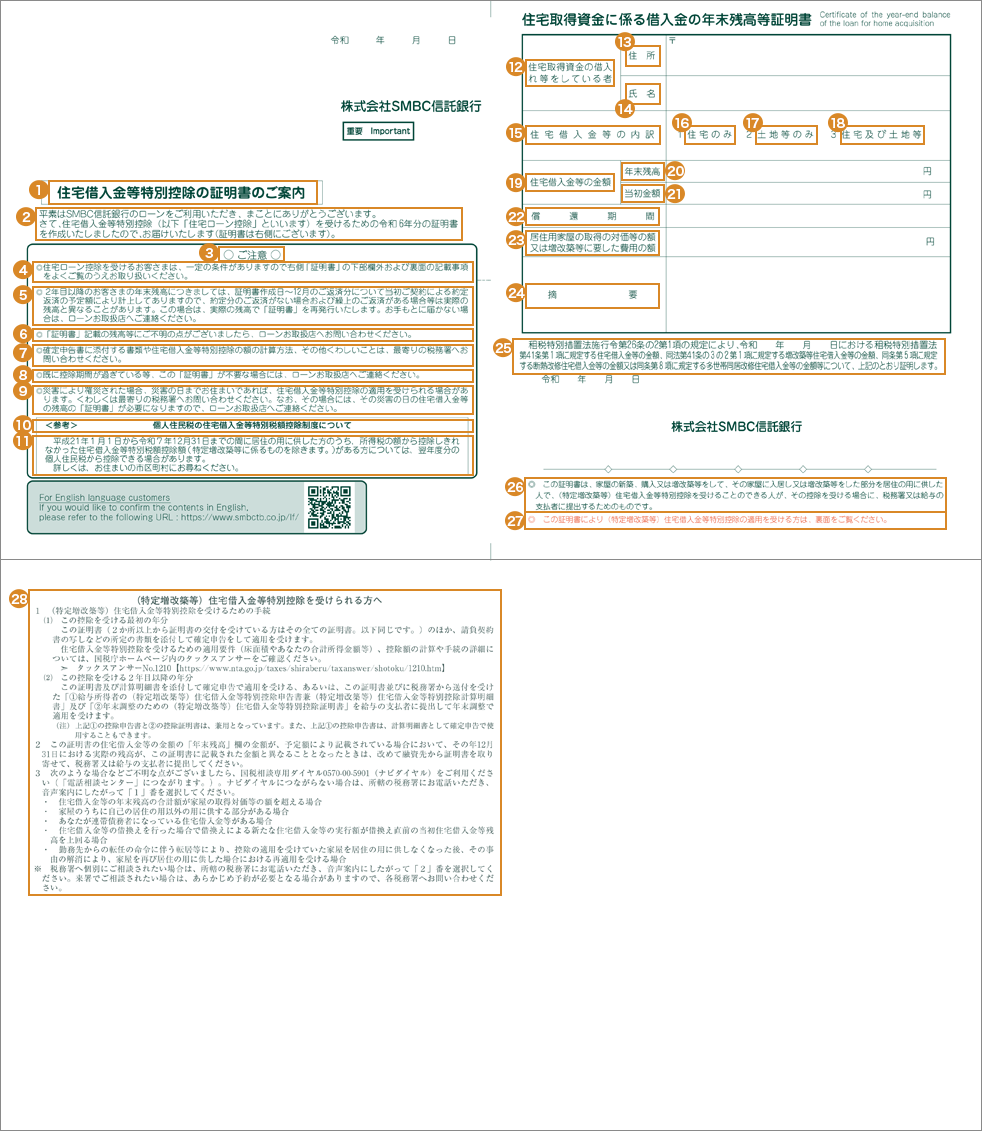

2. Certificate of the year-end balance of the loan for home acquisition / 住宅取得資金にかかる借入金の年末残高等証明書

This certificate is to be submitted to the tax office or payroll office when taking the special tax reduction for housing loan.

(Applicable to specific housing modification and/or extensions.)

- 1住宅借入金等特別控除の証明書のご案内:Certificate of Special Tax Deduction for Housing Loans, etc.

- 2Thank you very much for using SMBC Trust Bank loans. We have prepared a certificate to receive the special tax deduction for housing loans (hereinafter referred to as the "Housing Loan Tax Deduction") for the YYYY fiscal year. (Certificates are located on the right side).

- 3○ご注意○:○Please note○

- 4◎Customers who qualify for "Housing Loan Tax Deduction" are subject to certain conditions. Please carefully refer to the information at the bottom of the "Certificate" on the right side before applying for your tax deductions.

- 5◎The year-end balance for customers in the second and subsequent years is based on the scheduled repayment amount under the original contract for the repayment period from the date of the certificate until December of the same year, and may differ from the actual balance when alterations to your repayment schedule has occurred due to missed repayments and/or early repayments. In such cases, please contact your local loan office to have the "Certificate" reissued with the actual balance.

- 6◎If you have any questions about your loan balance shown on the "Certificate", please contact your local loan office.

- 7◎Please contact your local tax office for information on documents to be attached to the tax return, the calculation method for the amount of special tax deduction for housing loans, and other details.

- 8◎If you no longer require this "Certificate" due to expiration of tax deduction period or other reasons, please contact your local loan office.

- 9◎If you were affected by a disaster and lived in your home until the day of the disaster, you may be eligible for a special tax deduction for housing loans. Please contact your local tax office for details. Please note that in such case, a "Certificate" of your housing loan balance as of the date of the disaster will be required. Please contact your local loan office for details.

- 10<参考>個人住民税の住宅借入金等特別税額控除制度について:<Reference> Special tax reduction system for housing loans and etc. for individual inhabitant taxation

- 11For those who have utilized their houses for residential purposes during the period from January 1, 2009 to December 31, 2025, the amount of special tax reduction for housing loans and etc. (excluding those related to specific extension, alteration of houses and etc.) that still remains after deduction applied on income tax may be applied to the individual inhabitant tax for the next fiscal year. For details, please contact your local municipal office.

- 12住宅取得資金の借入れ等をしている者:Persons who are borrowing funds for home acquisition and etc.

- 13住所:Address

- 14氏名:Name

- 15住宅借入金等の内訳:Breakdown of Housing Loans, etc.

- 16住宅のみ:Residential Building only

- 17土地等のみ:Land and etc. only

- 18住宅及び土地等:Residential Building and Land, etc.

- 19住宅借入金等の金額:Amount of housing loans and etc.

- 20年末残高:The year-end balance

- 21当初金額:Initial loan amount

- 22償還期間:Redemption period

- 23居住用家屋の取得の対価等の額又は増改築等に要した費用の額:The cost for acquisition of residential housing and/or the cost for extension, alteration of housing.

- 24摘要:Remarks

- 25Pursuant to Article 26-2, Paragraph 1 of the Order for Enforcement of the Order for Enforcement of the Act on Special Taxation Measures Law, I hereby certify as above the amount of housing loan, etc. prescribed in Article 41, Paragraph 1 of the Special Taxation Measures Law, the amount of housing loan for house extension, alteration, etc. prescribed in Article 41-3-2, Paragraph 1 of the same law, the amount of housing loan for heat insulation repair prescribed in Paragraph 5 of the same law, or the amount of housing loan for multifamily housing repair prescribed in Paragraph 8 of the same law, as of YYYY/MM/DD.

- 26◎This certificate is to be submitted to the tax office or payroll office by a person who has newly built, purchased, or extended or reconstructed a house and occupied the house or used the extended or reconstructed part of the house as his/her residence, and who is eligible for the special credit for housing loans (specified extension, reconstruction, etc.), when he/she receives such credit.

- 27Please see reverse page if you are eligible for Special Tax Deduction for Housing Loans, etc.

- 28For those who are eligible for Special Tax Deduction for Housing Loans, etc.

- 1 Procedures for Special Tax Deduction for Housing Loans, etc.

- (1)For the first year for which this deduction is claimed

This certificate (If you have received certificates from two or more places, all of them. The same applies hereinafter.) and other prescribed documents such as a copy of the contract agreement must be attached when you file your tax return.

Please refer to the Tax Answer on the National Tax Agency's website for details on the applicable requirements, the calculation of the deduction amount and procedures.

➣ Tax Answer No. 1210 [https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/1210.htm] - (2)For the second and subsequent years for which this deduction is claimed

The taxpayer can either file a final tax return with this certificate and calculation statement, or submit this certificate and the "①Application for Special Tax Deduction for Housing Loans, etc. of Employment Income Earner and Calculation Statement for Special Tax Deduction for Housing Loans, etc." and "② Certificate of Special Tax Deduction for Housing Loans, etc. for Year end Adjustment" sent by the tax office to the payer to apply for the deduction in the year-end tax adjustment.

(Note) The deduction declaration form in ① above and the deduction certificate in ② above are dual-use. The deduction form ① above can also be used as a statement of calculation in the tax return.

- (1)For the first year for which this deduction is claimed

- 2 If the amount in the "Year-end Balance" column of the amount of housing loan, etc. on this certificate is based on an estimated amount, and the actual balance as of December 31 of the year is different from the amount shown on this certificate, please request a new certificate from the lender and submit it to the tax office or payroll office.

- 3 If you have any questions such as the following, please contact the National Tax Consultation Dial 0570-00-5901 (Navigation Dial will connect you to the Telephone Assistance Center). If you cannot connect to Navigation Dial, call your local tax office and follow the automated voice guidance and select the number "1".

- When the total amount of the year-end balance of housing loans, etc. exceeds the amount of the acquisition price of the house, etc.

- In the case where there is a part of the house that is used for purposes other than your own residence.

- If you are a co-debtor on a home loan, etc.

- In the case of refinancing of housing loans, etc., where the amount of new housing loans, etc. due to refinancing exceeds the balance of the initial housing loans, etc. immediately prior to the refinancing.

- In the case of reapplying the credit when the house to which the credit is applied is used for residential purpose again after the house is no longer used for residential purpose due to the relocation of the employee as a result of the transfer order from the employer, etc., and the house is used for residential purpose again due to the resolution of such reason.

- *If you wish to consult with the tax office by phone, please call the nearest tax office and select the number "2" following the automated voice guidance. If you wish to consult with the tax office in person, an appointment may be required in advance, so please contact the tax office.

- 1 Procedures for Special Tax Deduction for Housing Loans, etc.

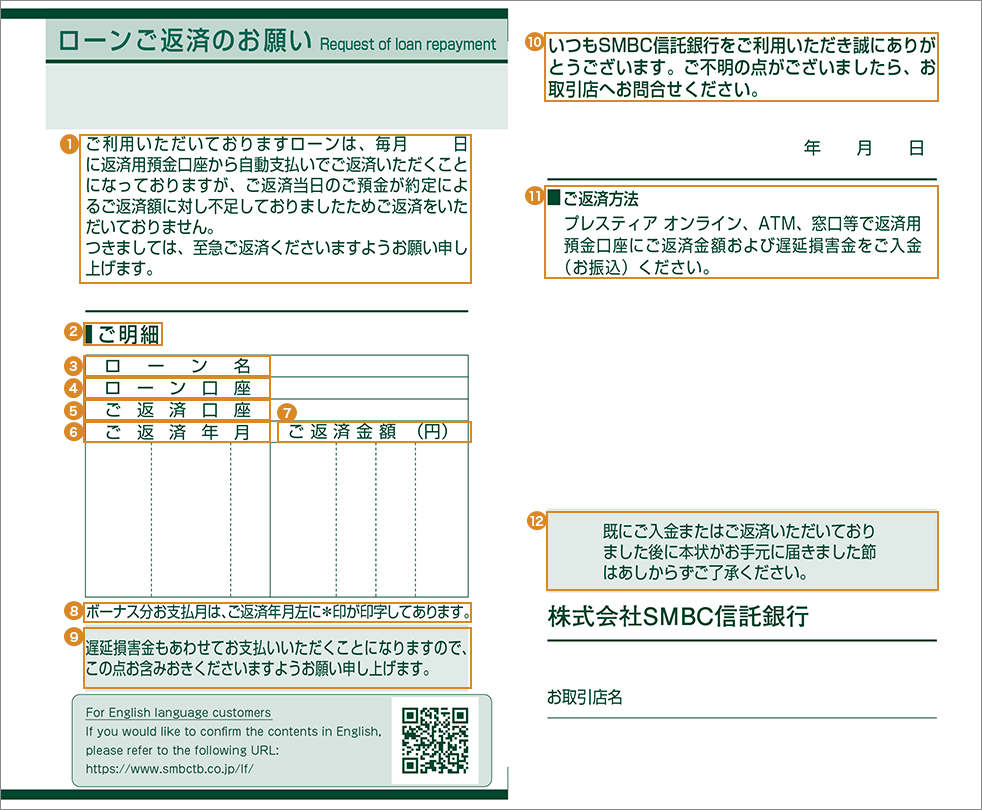

3. Request of loan repayment / ローンご返済のお願い

This document is a request for depositing sufficient funds in the loan repayment account.

- 1Although the loan(s) that you have taken is to be repaid automatically from your deposit account on of each month, unfortunately you have not repaid the loan as your deposit on the day of repayment was insufficient to cover the scheduled repayment amount. Therefore, we request your loan repayment to be made as soon as possible.

- 2■ご明細:■Details

- 3ローン名:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 4ローン口座:Loan Account

- 5ご返済口座:Repayment Deposit Account

- 6ご返済年月:Repayment month

- 7ご返済金額(円):Repayment amount (yen)

- 8Bonus payment months are marked with an asterisk (*) to the left of the month and year of repayment.

- 9Please note that you will also be required to pay a late payment fee.

- 10Thank you for banking with SMBC Trust Bank. If you have any questions, please contact your local branch.

- 11■How to repay

Please deposit (transfer) the repayment amount and the late payment fee to your repayment deposit account via online banking, at an ATM, or over the counter. - 12If you have already made a payment or repayment and this letter arrives after your payment has been made, please kindly disregard this letter.

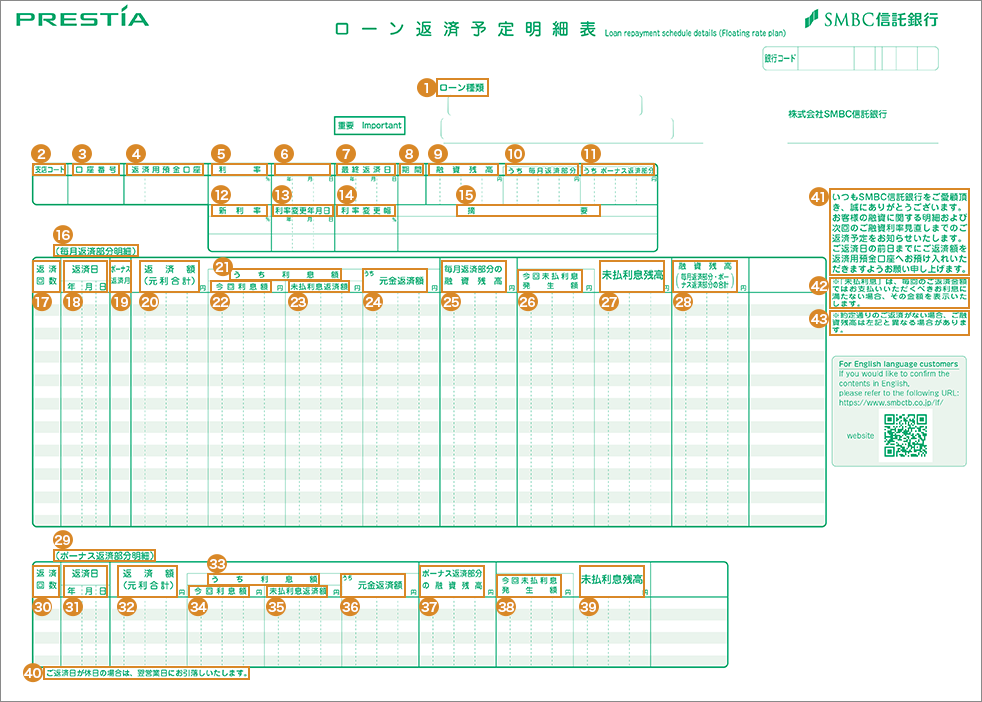

4. Loan repayment schedule details (Floating rate plan) / ローン返済予定明細表

For customers who selected floating rate plan when signing the loan contract, this information provides details of the scheduled repayment amounts until the next loan interest rate revision.

- 1ローン種類:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 2支店コード:Branch code

- 3口座番号:Account number

- 4返済用預金口座:Deposit account for repayment

- 5利率:Interest rate

- 6融資年月日:Date of loan execution

利率変更年月日:Date of interest rate change - 7最終返済日:Final repayment date

- 8期間:Loan period

- 9融資残高:Loan balance

- 10うち 毎月返済部分:Monthly repayment portion

- 11うち ボーナス返済部分:Bonus repayment portion

- 12新利率:Revised Interest Rate

- 13利率変更年月日:Date of interest rate revision

- 14利率変更幅:Difference from last interest rate

- 15摘要:Remarks

- 16(毎月返済部分明細):(Details of monthly repayment portion)

- 17返済回数:Number of repayments

- 18返済日(年月日):Repayment dates

- 19ボーナス返済月:Bonus repayment months

- 20返済額(元利合計):Repayment amount (sum of principal and interest)

- 21うち利息額:Interest amount portion

- 22今回利息額:Interest amount of this repayment

- 23未払利息返済額:Accrued interest amount

- 24うち元金返済額:Principal repayment amount portion

- 25毎月返済部分の融資残高:Loan balance of monthly repayment portion

- 26今回未払利息発生額:Amount of interest accrued from this repayment

- 27未払利息残高:Accrued Interest Balance

- 28融資残高:Loan balance

毎月返済部分・ボーナス返済部分の合計:Sum of monthly and bonus repayment - 29(ボーナス返済部分明細):(Details of bonus repayment portion)

- 30返済回数:Number of repayments

- 31返済日(年月日):Repayment dates

- 32返済額(元利合計):Repayment amount (sum of principal and interest)

- 33うち利息額:Interest amount portion

- 34今回利息額:Interest amount of this repayment

- 35未払利息返済額:Accrued interest amount

- 36うち元金返済額:Principal repayment amount portion

- 37ボーナス返済部分の融資残高:Loan balance of bonus repayment portion

- 38今回未払利息発生額:Amount of interest accrued from this repayment

- 39未払利息残高:Accrued Interest Balance

- 40If the repayment date is a holiday, the amount will be debited on the next business day.

- 41Thank you for banking with SMBC Trust Bank. We would like to inform you of the details of your loan and the repayment schedule until the next loan interest rate revision. Please deposit the repayment amount into your repayment deposit account by the day before the repayment date.

- 42*"Accrued Interest" shows the interest amount if the amount of each repayment is less than the amount of interest to be paid.

- 43*If you do not repay the loan as scheduled, the loan balance may differ from that shown on the left.

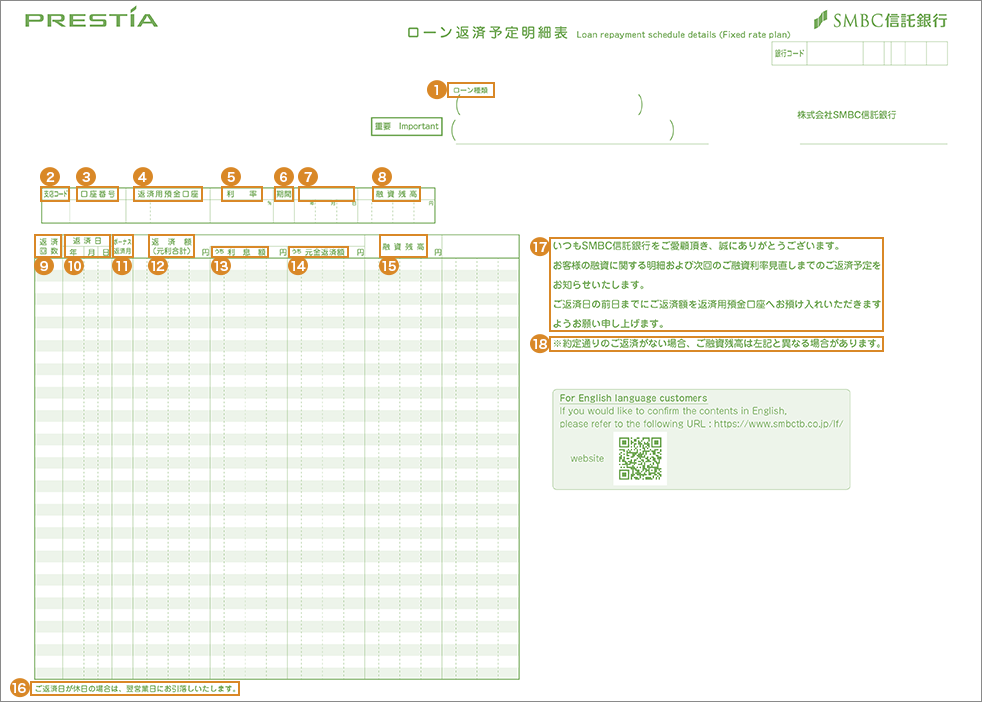

5. Loan repayment schedule details (Fixed rate plan) / ローン返済予定明細表

For customers who selected fixed rate plan when signing the loan contract, this information provides details of the scheduled repayment amounts until the next loan interest rate revision.

- 1ローン種類:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 2支店コード:Branch code

- 3口座番号:Account number

- 4返済用預金口座:Deposit account for repayment

- 5利率:Interest rate

- 6期間:Loan period

- 7融資年月日:Date of loan execution

利率変更年月日:Date of interest rate change - 8融資残高:Loan balance

- 9返済回数:Number of repayments

- 10返済日(年月日):Repayment dates

- 11ボーナス返済月:Bonus repayment months

- 12返済額(元利合計):Repayment amount (sum of principal and interest)

- 13うち利息額:Interest amount portion

- 14うち元金返済額:Principal repayment amount portion

- 15融資残高:Loan balance

- 16If the repayment date is a holiday, the amount will be debited on the next business day.

- 17Thank you for banking with SMBC Trust Bank. We would like to inform you of the details of your loan and the repayment schedule until the next loan interest rate revision. Please deposit the repayment amount into your repayment deposit account by the day before the repayment date.

- 18*If you do not repay the loan as scheduled, the loan balance may differ from that shown on the left.

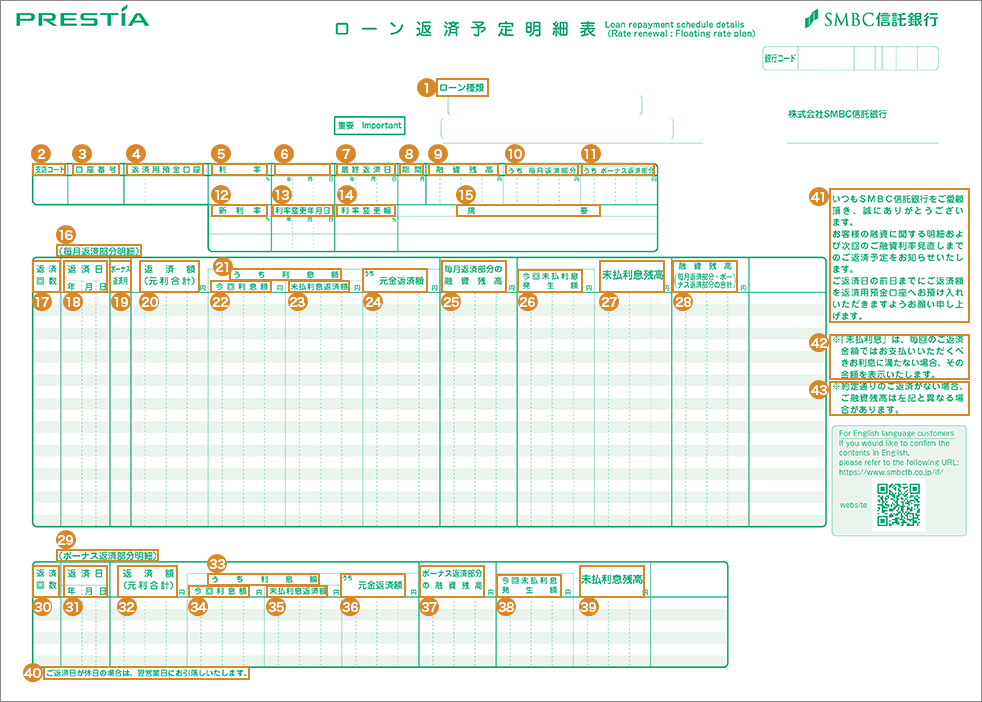

6. Loan repayment schedule details (Rate renewal: Floating rate plan) / ローン返済予定明細表

For customers who select floating rate plan, this information provides details of the scheduled repayment amounts until the next loan interest rate revision.

- 1ローン種類:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 2支店コード:Branch code

- 3口座番号:Account number

- 4返済用預金口座:Deposit account for repayment

- 5利率:Interest rate

- 6融資年月日:Date of loan execution

利率変更年月日:Date of interest rate change - 7最終返済日:Final repayment date

- 8期間:Loan period

- 9融資残高:Loan balance

- 10うち 毎月返済部分:Monthly repayment portion

- 11うち ボーナス返済部分:Bonus repayment portion

- 12新利率:Revised Interest Rate

- 13利率変更年月日:Date of interest rate revision

- 14利率変更幅:Difference from last interest rate

- 15摘要:Remarks

- 16(毎月返済部分明細):(Details of monthly repayment portion)

- 17返済回数:Number of repayments

- 18返済日(年月日):Repayment dates

- 19ボーナス返済月:Bonus repayment months

- 20返済額(元利合計):Repayment amount (sum of principal and interest)

- 21うち利息額:Interest amount portion

- 22今回利息額:Interest amount of this repayment

- 23未払利息返済額:Accrued interest amount

- 24うち元金返済額:Principal repayment amount portion

- 25毎月返済部分の融資残高:Loan balance of monthly repayment portion

- 26今回未払利息発生額:Amount of interest accrued from this repayment

- 27未払利息残高:Accrued Interest Balance

- 28融資残高:Loan balance

毎月返済部分・ボーナス返済部分の合計:Sum of monthly and bonus repayment - 29(ボーナス返済部分明細):(Details of bonus repayment portion)

- 30返済回数:Number of repayments

- 31返済日(年月日):Repayment dates

- 32返済額(元利合計):Repayment amount (total of principal and interest)

- 33うち利息額:Interest amount portion

- 34今回利息額:Interest amount of this repayment

- 35未払利息返済額:Accrued interest amount

- 36うち元金返済額:Principal repayment amount portion

- 37ボーナス返済部分の融資残高:Loan balance of bonus repayment portion

- 38今回未払利息発生額:Amount of interest accrued from this repayment

- 39未払利息残高:Accrued Interest Balance

- 40If the repayment date is a holiday, the amount will be debited on the next business day.

- 41Thank you for banking with SMBC Trust Bank. We would like to inform you of the details of your loan and the repayment schedule until the next loan interest rate revision. Please deposit the repayment amount into your repayment deposit account by the day before the repayment date.

- 42*"Accrued Interest" shows the interest amount if the amount of each repayment is less than the amount of interest to be paid.

- 43*If you do not repay the loan as scheduled, the loan balance may differ from that shown on the left.

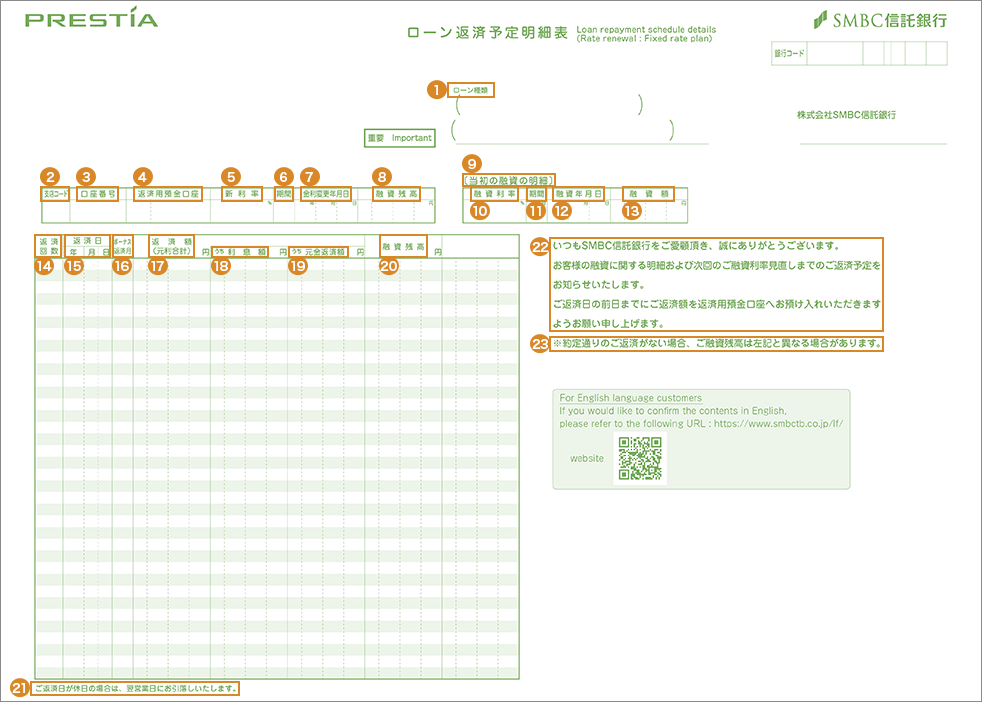

7. Loan repayment schedule details (Rate renewal: Fixed rate plan) / ローン返済予定明細表

For customers who select fixed rate plan, this information provides details of the scheduled repayment amounts until the next loan interest rate revision.

- 1ローン種類:Loan Type

住宅ローン:Housing Loan

不動産担保ローン:Real-estate secured loan - 2支店コード:Branch code

- 3口座番号:Account number

- 4返済用預金口座:Deposit account for repayment

- 5新利率:Revised Interest Rate

- 6期間:Loan period

- 7金利変更年月日:Date of interest rate revision

- 8融資残高:Loan balance

- 9(当初の融資の明細):(Details of the original loan)

- 10融資利率:Interest rate

- 11期間:Loan period

- 12融資年月日:Date of loan execution

- 13融資額:Loan amount

- 14返済回数:Number of repayments

- 15返済日(年月日):Repayment dates

- 16ボーナス返済月:Bonus repayment months

- 17返済額(元利合計):Repayment amount (total of principal and interest)

- 18うち利息額:Interest amount portion

- 19うち元金返済額:Principle repayment amount portion

- 20融資残高:Loan balance

- 21If the repayment date is a holiday, the amount will be debited on the next business day.

- 22Thank you for banking with SMBC Trust Bank. We would like to inform you of the details of your loan and the repayment schedule until the next loan interest rate revision. Please deposit the repayment amount into your repayment deposit account by the day before the repayment date.

- 23*If you do not repay the loan as scheduled, the loan balance may differ from that shown on the left.

If you have any questions about the documents, please contact us at:

PRESTIA Phone Banking

0120-110-330Available from mobile (Toll-Free)

In Japan

046-401-2100(charges apply)

From overseas

81-46-401-2100(charges apply)

Service hours: 8:00 - 22:00

Japanese

Japanese English

English